Q. Report on the management of foreign trade risks?

Your company is probable to face three types of risk in connection with its foreign trade. These are as:

(1) Foreign exchange risk

(2) Commercial risk

(3) Political risk

(i) Management of the foreign exchange risk

If you wish to guard against the risk of the deal with Werland you may use a money market hedge or the currency options market. These are shows below. A lead payment is a additionally alternative but this will be more expensive than the money market hedge unless a discount for early payment can be negotiated with the company's supplier in Werland. In prospect deals foreign exchange risk may be avoided by trading only in sterling but this may put you at a competitive disadvantage in attracting export orders as the foreign exchange risk will be shifted to your customer.

A money market hedge would engage borrowing in sterling now if this is possible given the current attitude of the bank converting the proceeds at spot into Werland francs investing the francs for three months and using the proceeds to make payment for the goods.

The process is as follows

Borrow £10031.35 at 10% per year for three months

Convert at spot Wf290/£ to Wf2909091

Invest in Werland 2909091 francs at 12.5% per year that is 3.125% for three months to yield

3000000 francs (2909091*1.03125)

Use the total profits from the investment to make the payment of 3000000 Werland francs.

The total cost is £10031×1.025 = £10282 comprises interest on the sterling three month loan.

Ignoring transactions costs this is less than the current spot price of

3000000/290= £10344.83

A foreign currency alternative contract offers you protection against unfavourable currency movements whilst giving you the opportunity to benefit from favourable movements. The price of this elasticity is the payment of an upfront premium for the option.

In these circumstances the option will only be exercised (used) if the spot price of Werland francs in three months time is less than the exercise price. For illustration a spot price of Wf295/£ would lead to the option being exercised. With a spot price of Wf330/£ the option wouldn't be exercised and the 3 million Werland francs would be purchased in the spot market.

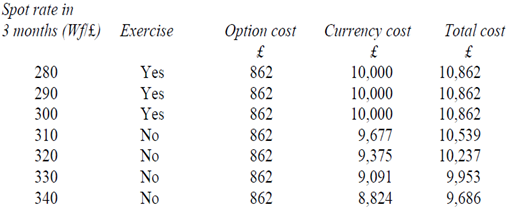

The use of foreign currency alternative appears expensive as is illustrated below for a number of possible spot rates in three months time.

Call alternatives on Wf 3000000 with a 300 exercise price

Notes

(1) The alternative cost is payable upfront and is 10000 × Wf25 = Wf 250000. Sterling cost is 250000/290 = £862.

(2) At a spot rate of 300 the contract is probable to be exercised as this would save transactions costs in the spot market. Except the spot price in three months time moves to almost Wf320/£ foreign currency options will be more expensive than a money market hedge. An estimation of the exchange rate in three months time using the purchasing power parity theory suggests that the spot rate in three months is expected to be less than Wf300/£.

It might be probable to arrange an OTC option at a lower exercise price and with a lower premium that would be more attractive to your company.

On the basis of information provided no available hedge would totally remove the foreign exchange risk of the Thodian deal. There is no forward market as well as Vertid can't borrow in Thodian pesos to undertake a money market hedge.

One opportunity is to hedge by selling US$ six months forward as the peso is linked to the dollar. This hedge engages considerable risk if the peso depreciates relative to the dollar or severs its link with the dollar which it could easily do.

Utilizing the spot rate of 228 pesos/US$ the equivalent of $15350.88 would be received if payment were at spot. The dollar is at a price cut to sterling the relevant six month forward rate being 1.469+0.0186 = US$1.4876/£. The hedge using dollars would therefore yield $15350.88 /1.4876 = £10319.23 but merely if the existing link of the peso and dollar still exists.