The Manager or Management Company

The firm sponsoring the Fund could often structure it as a management company. Its primary responsibility is to determine investment strategies, operating decisions and management fee charge and collection. The management fee usually ranges between 1-3 percent on assets managed and collected regularly.

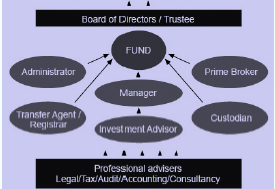

Figure: Traditional Hedge Fund Structure

Board of Directors

Board of Directors as in any form of organization, is responsible for monitoring, supervising and appointment of key personnel in the management of the organization. Often the Board of Directors appoints an executive committee to review the performance of Funds over a period of time. Usually, it appoints custodians, transfer agents, auditors and accountants, legal and tax advisors, reviews the performance of Funds and considers proposals of the management team.

Investment Advisor plays a limited role by giving professional advice on the Fund investments to the Hedge Funds as well as investors. The advisor tries to provide his services, which need to align with the Fund objectives, policies, and parameters as explained in the prospectus of the Fund. For Hedge Funds, an advisor could be an employee of the firm itself or an independent person, and usually receives a fixed fee for his services.

An Administrator

An Administration has a primary task to play, that is to maintain records, bookkeeping and independently verifying asset value of the Fund. During the time of redemption or transfer of interest among investors, an administrator calculates the value of the entire portfolio of Fund or the net asset value of shares that are not traded. The Fund usually charges an administration fee of 0.5 percent to 0.75 percent on the Fund net asset value per year.

Distributors are the sales force appointed for distribution of Fund shares to potential clients for investment. The expenditure the sales force incurs is considered marketing and distribution expenses of the Fund, and it varies in the range of 2 percent to 5 percent of the Fund commitment.

Registrar/Transfer Agent

Registrar/Transfer Agent processes subscriptions and redemptions, and maintains the register of shareholders.

The Custodian

The Custodian performs the activities of safekeeping of assets; clearing, settling, and recording confirmation of sale; transfer of securities on sale or purchase; and monitoring corporate actions.

Executive Brokers

The Executive brokers provide direct access to market by executing orders placed by Hedge Funds for purchase and sale of underlying securities.

The Prime broker provides access to stock loan and financing, as well as a host of value added services.

An Auditor looks whether the Hedge Fund complies with accounting procedures and practices that need to be followed for preparation of financial accounts.

Legal Advisors and Tax consultants provide suggestions related to structure and hurdles on tax and legal matters such as compliance with domestic regulations, holding of securities, tax related to gains, etc.