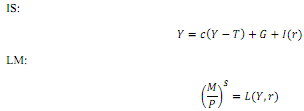

An economy's IS and LM curves are given by the following equations:

with Y indicating output (income), c indicating the marginal propensity to consume, I investment, G government spending, and r the real interest rate. M is money supply, P the price level, and L (Y,r) is the money demand function.

The government of this country institutes an investment tax credit (ITC). As a consequence, investors begin to make more investments at any given level of r.

(a) Suppose that the marginal propensity to consume c is 0.8 and that the investment increase coming from the ITC is equal to $1,000. By how many $ will income exactly change in the Keynesian Cross?

(b) How will the ITC affect income, the interest rate, consumption and investment in the IS-LM model? Use the IS-LM model graph (plus other graphs, if necessary) to support your answer.

Make sure that you label your graph properly and explain carefully in which direction and why particular curves shift.

(c) Is the impact of this policy on equilibrium income in the IS-LM model larger or smaller than the impact on income in the Keynesian Cross? Explain why.

(d) What should the central bank do in order to keep the interest rate at the initial level? Explain carefully and support your answer with a graph.