How much to order

Supposing the estimated annual usage of a component by Machinery Ltd is 20,000 units. Usage is even throughout the year and only one order per annum is placed with the supplier. Because only one delivery is made, average stock will be high, i.e. 20,000/2 = 10,000 and consequently stockholding costs will be very high. On the other hand, the costs of ordering will be negligible. If two orders are placed there will be less in stock (i.e. average 5,000), which will reduce holding costs, but ordering costs will increase. Thus, the higher the number of orders placed, the lower are stockholding costs, but the higher are ordering costs.

Stockholding costs include interest on the capital invested in stocks, storage, insurance, rates, security, building maintenance, heating, etc. Ordering costs include buying-department staff costs, receiving and handling.

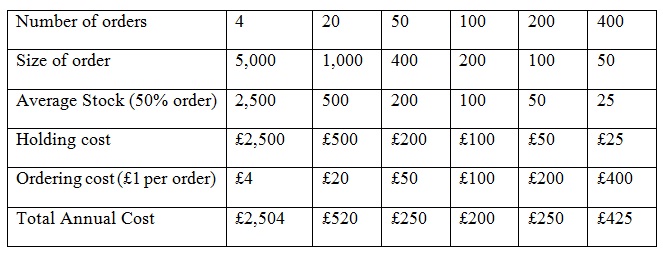

Assuming that the cost of each component is £10, that holding cost is 10% of stock value and the cost of placing an order is £1, the total annual cost of stockholding and ordering when different numbers of orders are placed, is as follows:

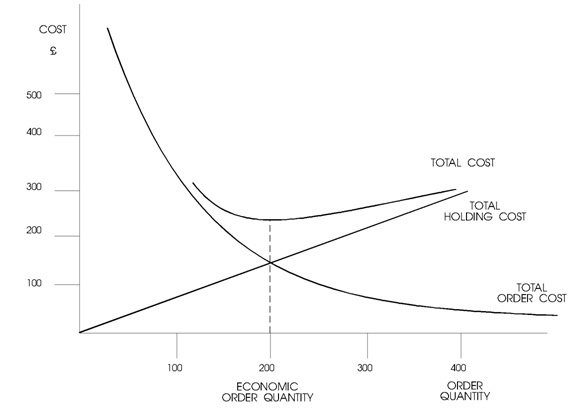

Figure: Economic Order Quantity

Placing 100 orders a year results in the lowest of ordering and holding cost of £200, therefore the economic order quantity is 200 units.

The same information is graphed in figure above, showing that the economic order quantity (EOQ) is the point where ordering and holding costs are equal, and total £200.