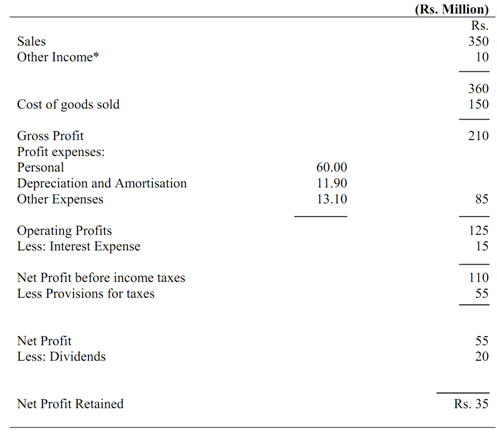

Consider as Illustration. Profit and loss account of TIL demonstrates, that, operations have given gross addition of Rs. 360 million to funds throughout the period. These funds show the sale proceeds of goods and services through the company.

We also identify what part of these funds is utilized for meeting the cost of input as personnel, material and the other operating costs. Separate from these we have also to meet the interest commitments and costs expiration of the machinery and equipment. Though, expiration of costs of the machinery and equipment as depreciation is one item that does not need use of funds in the current period.

TOOLS INDIA LTD. Summarized Profit and Loss Account

For the year ended December 31, 2002

* Other income involves Rs. 1 million profits on sale of furniture.

Hence the funds provided from the operations are actually the revenues earned from operations as also non-operating incomes less all instantaneous costs of goods sold needing use of funds. Conversely, this is net income or profit after taxes as well as all the non-cash expenses, as depreciation and amortization.

The funds flow statement would demonstrate funds from operations of TIL given as:

(Rs. in Millions)

Operations 55

Net Income

Add: Depreciation and Amortisation 11.90

66.90

Less: Profit on sale of furniture 1.00

Total funds provided from operations 65.90