1 (a) List two concerns with inflation.

(b) Suppose that we are in a condition of fully flexible prices, but production of nails will not go above 200 chairs/month. What price will chairs sell for if market demand is characterized by: (a) P=425-1.5Q, (b) P=530-1.5Q, and (c) P=400-0.5Q, where P is in $/chair and Q is in chairs/month?

(c) What are two reasons why prices might be sticky?

Ans: First, consumers prefer stable and predictable prices. Companies recognize this.

2 (a) Net investment can be positive, negative, or zero, but gross investment can never be less than zero. Explain.

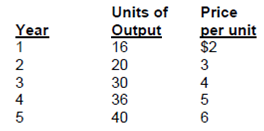

(b) Consider the following price and output data over a five-year period for an economy that produces only one good. Assume that year 2 is the base year.

i. If year 2 is the base year, give the price index for year 3.

ii. Give the nominal GDP for year 4.

iii. What is the real GDP for year 4?

iv. Tell which years you would deflate nominal GDP and which years you would inflate nominal GDP in finding real GDP.

3. (a) Explain why even small changes in the rate of economic growth are significant. Use the "rule of 70" to demonstrate the point.

(b) Are economic growth and progress synonymous? How might they differ?

(c) What phase of the business cycle is the Canadian and your provincial economy experiencing at the present time? Justify your answer.

4. (a) How is the unemployment rate affected if employment increases from 9 million to 9.5 million and the labour force increases from 10 million to 11 million?

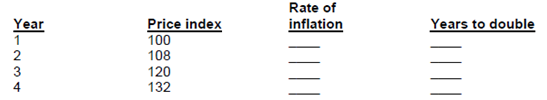

(b) The table below shows the price index in the economy at the end of four different years.

i. What is the rate of inflation in years 2, 3, and 4?

ii. Using the "rule of 70," determine how many years would it take for the prices to double at each of these three inflation rates?

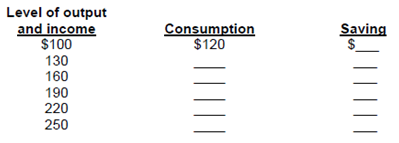

5. (a) Complete the following table assuming that (a) MPS = 1/3, (b) there is no government and all saving is personal saving.

(b) Define the multiplier. How is it related to real GDP and the initial change in spending? How can the multiplier have a negative effect?