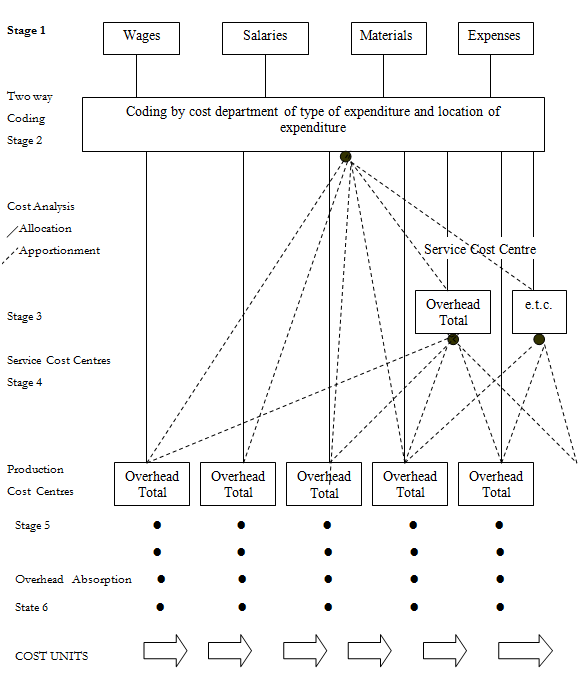

Cost Element

Stage 1. Cost Elements

The raw data concern with Labour, Expenses, and Materials are gathered from Invoices, Payroll, and Requisitions and Goods Issued Notes.

Stage 2. Coding

Each the raw cost data requires to be classified and after that coded in respect of the type of expense and location. This procedure is fundamental to all management and costing accounting procedures.

Stage 3. Cost Analysis

Whereas discrete items of cost can be selected to cost centers this is termed allocation. Whereas the cost has to be shared or spread over some cost centers this is identified as apportionment.

Stage 4. Service Cost Centres

These are cost centers that provide a service to production cost centers. Examples are Maintenance, Sores and Boiler House. Their costs are built up through the common process of allocation and primary apportionment and then their net costs are apportioned or secondary apportionment over the production cost centers, hence forming part of production overheads that are absorbed into the cost units produced. The difficulties of service cost centers are dealt along with in more detail underneath.

Stage 5. Production Cost Centres

These are the cost centers included directly in the production process. Typical examples are the , Spray Shop, Assembly shop, Centre lathes, Drilling machines.

Stage 6 Overhead Absorption

The overheads of all production cost centre are absorbed into the costs of the units produced, generally in proportion to the time included that is by the Machine Hour or Labour Hour Rate.