Components of Profit and Loss Account

The Profit & Loss Account intend to check profit. It has three parts.

1) The Trading Account:

These account the money in (revenue) and out (costs) of the business as a result of the business' 'trading' i.e. selling and buying. This may be buying raw materials and selling refined goods; it might be buying goods wholesale and selling them retail. The amount at the conclusion of this section is the Gross Profit.

2) The Profit and Loss Account:

This begins with the Gross Profit and adds to it any additional costs and revenues, as well as overheads. These additional costs and revenues may be in the nature of additional operating, administrative, selling and distribution expenses. This account also comprises expenses which are as of any other actions not directly related to trading (non-operating). An instance is interest on investments. Therefore, loss and profit account restrain all other expenses and losses, incomes and gains of the business for the accounting year for which financial statements are being organized. In this procedure, it follows the merchant basis of accounting (that is, it takes into account all paid and payable expenses, and received and receivable receipts). The net effect of profit and loss account is called as net profit. The key characteristic of profit and loss account is that it takes into account all expenses and incomes that fit in to the current accounting year and eliminate those expenses and incomes that fit in either to the earlier period or the future period.

3) The Appropriation Account.

This shows how the profit is 'appropriated' or divided among the three uses stated above.

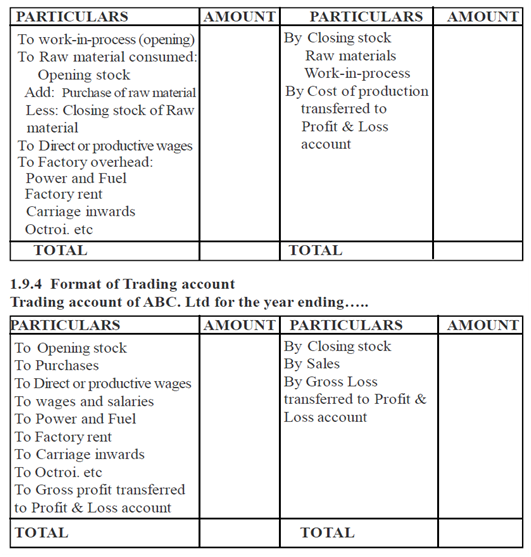

Introduction to Trading account:

A Trading account is a declaration prepared by a firm to determine its trading results for the accounting year. Identical to Profit & Loss account, it is also arranged for the year ending. It takes into account a variety of trading everyday expenditure (regularly all direct expenses) and incomes. The gross result will be either trading / gross loss or gross profit. In terms of a developed concern, it will organize an additional statement called a manufacturing account. A manufacturing account is arranged by a producer to ascertain the cost of goods manufactured through the existing accounting year.

Format of manufacturing account manufacturing account of ABC. Ltd