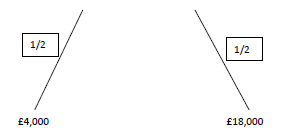

Assume that there are two firms, firm A and firm B. The firms have identical present values at £10,000 and an identical future value profile as given in the picture below. The probabilities of the two different future values are given on the branches below. The required rate of return on a risk free asset is 5%. There are no taxes at the present time and no synergies between the two firms of any type. There is one difference between the two firms which is that firm B has the same profile as firm A except that it is levered with a £5000 nominal debt that has to be repaid in the next period (this is a two period model). Assume that markets are competitive and efficient.

The present value for firm A = £10,000 = the present value for firm B = £10,000

a) What is the expected future value for firm A?

b) What is the expected future value for firm B?

c) Assume that 1000 shares have been issued by firm A. What is the price of one share?

d) Is the debt for firm B risky or riskless?

e) What is the present value of equity for firm B? (hint - you need to value a corporate bond - see p.653 of Brealey and Myers, 2009)

Now consider that the two firms merge to become firm AB.

f) What are the future values for the new merged firm AB?

g) What is the expected future value for the firm AB?

h) What is the required rate of return on the assets for the firm AB?

i) Is the debt for firm AB risky or riskless?

j) Did the merger relieve financial distress? Explain your answer.

Now, start over again with firm A and B as before, but let us now assume that we have corporate taxes and that the interest payments on debt are tax deductible. The corporate tax rate, Tc, is equal to 0.3. As at the beginning of the exercise, the firms are not yet merged. Assume that the present value for the tax shields for firm B is £1,300.

k) Are the tax shields for firm B risky or riskless?

l) What is the present value for firm B?

Now consider that, in this new environment with corporate taxes (as described above), the firms A and B merge to become firm AB.

m) What is the total present value of the merged firm (with corporate taxes as described above)?

n) What is the net gain (if any) of the merger to firm A's shareholders?

o) What conclusions do you reach from your answers?