Combined income statement

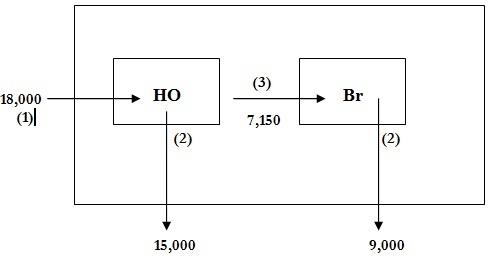

The figures to appear in the combined income statement are based on the following diagram:

1) An arrow pointing into a box refers to purchases by the organization represented by the box

2) An arrow leading out of the box refers to sales made by the organization represented by the box

3) The outside box refers to the combined entity.

4) When the head office purchased and received goods costing sh 18,000, the combined entity also purchased and received goods costing Sh 18,000. Thus the purchases reported by the head office (column 1) will usually be the purchases reported by the combined entity (column 3). The only exception would be if the branch also had external purchases.

5)If the head office and branch made sales of Sh 15,000 and Sh 9,000 respectively, the combined entity will have made sales of Sh 24,000 (Sh 15,000 + Sh 9,000)

6) The sales of Sh 7,150 made by the head office (which is deemed to be a purchase by the branch) cannot be claimed to be a sale or purchase by the combined entity.

7) The combined closing stock should be shown at original cost to the combined entity. This means that the combined closing stock is made up of two components, all at original cost:

- Closing stock at the head office at an original cost of Sh 1,500;

- Closing stock at the branch. This had cost the branch Sh 550 (as can be seen in the income statements), but had an original cost of Sh 500 (550 x 100/110) when received by the head office on behalf of the combined entity.