At current the working capital cycle is

Receivables days $0.4m/$10m * 365 = 15 days

Inventory days $0.7m/$8m * 365 = 32 days (cost of sales = $10m - $2m)

Payables days $1.5m/$8m * 365 = (68 days)

Total (21 days)

Clearly Keswick is exceptionally resourceful in its use of working capital.

The planned arrangement would shorten payables days in relation to half of cost of sales to 15 days. The effect is to inferior the average to

(½ * 68 days) + (½ * 15 days) = 41.5 days

Overall this will rise cycle time to

[15 + 32 - 41.5 days] that is to 5.5 days

Interest cover

At present interest cover earnings prior to interest and tax divided by interest is $2m/$0.5m

= 4.0 times this appears safe.

The advanced payment will increase interest costs but will generate savings via the discount. The discount relate to half of cost of sales that is ½ × $8m × 5% = $0.2m. The EBIT will rise accordingly.

The net advanced payment of ($4m - $0.2m) = $3.8m will have to be financed for an extra (68 - 15) days generating interest costs of

[$3.8m × 12% × 53/365] = $66,214

The interest covers somewhat declines to

[$2.0m + $0.2m]/[$0.50m + $0.066m] = 3.89 times

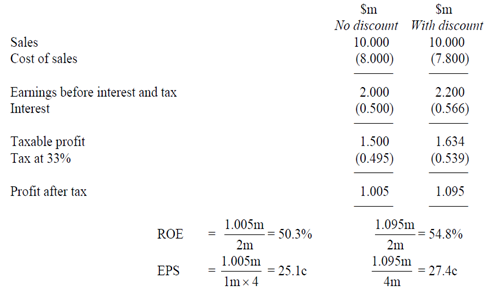

Profit after tax, ROE and EPS

The "before" and "after" income statements seems thus

The proposal seems beneficial to Keswick in terms of the effect on profitability measures that is EPS, EBIT, PAT, and ROE. But it does have a slightly harmful effect on its interest cover. It as well lengthens its working capital cycle and turns it into a net demander of working capital. This suggests an raise in its capital gearing.

Prior to the adjustment gearing at book values (overdraft/shareholder's funds) was

$3.0m/$2m = 150%

The overdraft will raise by

($3.8m × 53/365] = $0.55m

Ignoring the helpful effect on equity, gearing after the adjustment becomes

$3.55m/$2m = 178%

This appears rather dangerous considering the short-term nature of much of the debt and Keswick's low liquidity. May be Keswick must reconsider its policy regarding long-term borrowing although whether prospective lenders would oblige is probably doubtful.