Reference no: EM13498570

Portfolio Project Description

Your portfolio project is due by the end of Week 8. Please complete the following seven problems based on the serial problem presented in the textbook beginning with Chapter 13. You are encouraged to use the working papers to create your answers. Please make sure to cite all sources that support your overall conclusions. You should paste any required Excel tables and type your answers into a Microsoft Word document, clearly labeling label each problem.

Problem 1

Santana Rey created Business Solutions on October 1, 2011. The company has been successful and Santana plans to expand her business. She believes that an additional $86,000 is needed and is investigating these funding sources.

a. Santana's sister Cicely is willing to invest $86,000 in the business as a common shareholder. Since Santana currently had about $129,000 invested in the business, Cicely's investment will mean that Santana will maintain about 60% ownership and Cicely will have 40% ownership of Business Solutions.

b. Santana's Uncle Marcello is willing to invest $86,000 in the business as a preferred stockholder. Marcello would purchase 860 shares of $100 par value, 7% preferred stock.

c. Santana's banker is willing to lend her $86,000 on a 7%, 10-years not payable. She would make monthly payments of $1,000 per month for 10 years.

Questions:

1. Prepare the journal entry to reflect the initial $86,000 investment under each of the options (a), (b), and (c).

2. Evaluate the three proposals for expansion, providing the pros and cons of each option.

3. Which option did you recommend Santana adopt? Explain.

Problem 2

While reviewing the March 31, 2012, balance sheet of Business Solutions, Santana Rey notes that the business has built a large cash balance of $68,057. Its most recent bank money market statement shows that the funds are earning an annualized return of 0.75%, so Rey decided to make several investments with the desire to earn a higher return on the idle cash balance. Accordingly, in April, 2012, Business Solutions makes the following investments in trading solutions:

April 16 - Purchase 400 shares of Johnson & Johnson at $50 per share plus $300 commission.

April 30 - Purchase 200 shares of Starbucks Corporation at $22 per share plus $250 commission.

Questions:

1. Prepare journal entries to record the April purchases of trading securities by Business Solutions.

2. On June 30, 2012, prepare the adjusting entry to record any necessary fair value adjustment to its portfolio of trading securities.

Problem 3

Use the following selected data from Business Solutions' income statement for the three months ended March 31, 2012, and from its March 31, 2012, balance sheet to complete the requirements before computer services revenue, $25,307; net sales (of goods), $18,693; total sales and revenue, $44,000; cost of goods sold, $14,052; net income, $18,833; quick assets, $90,924; current assets, $95,568; total assets, $120,268; current liabilities, $875; total liabilities, $875, and total equity, $119,393.

Questions:

1. Compute the gross margin ratio (both with and without services revenues) and net profit margin ratio.

2. Compare the current ratio and acid-test ratio.

3. Compute the debt ratio and equity ratio.

4. What percent of its assets are current? What percent are long term?

Problem 4

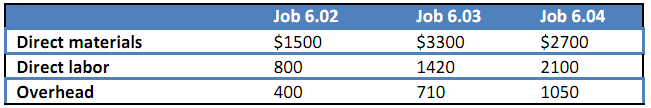

The computer workstation furniture manufacturing that Santana Rey started January is progressing well. As of the end of June, Business Solutions' job cost sheets show the following total costs accumulated on three furniture jobs.

Job 6.02 was started in production in May, and these costs were assigned to it in May: direct materials, $600; direct labor, $180; and overhead, $90. Job 6.03 and 6.04 were started in June. Overhead costs is applied with a predetermined rate based on direct labor costs. Jobs 6.02 and 6.03 are finished in June, and Job 6.04 is expected to be finished in July. No raw materials are used indirectly in June. (Assume this company's predetermined overhead rate did not change over three months).

Questions:

1. What is the cost of the raw materials used in June for each of the three jobs and in total?

2. How much total direct labor cost is incurred in June?

3. What predetermined overhead rate is used in June?

4. How much cost is transferred to finished goods inventory in June?

Problem 5

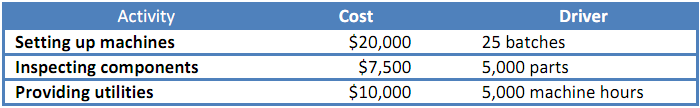

After reading an article about activity-based costing in a trade journal for the furniture industry, Santana Rey wondered if it was time to critically analyze overhead costs at Business Solutions. In a recent month, Rey found that setup costs, inspection costs, and utility costs made up most of its overhead.

Additional information about overhead follows:

Overhead has been applied to output at a rate of 50% if direct labor costs. The following data pertain to Job 6.15.

Questions:

1. What is the total cost of Job 6.15 if Business Solutions applies overhead at 50% of direct labor cost?

2. What is the total cost of job 6.15 is Business Solutions uses activity based costing?

3. Which approach to assigning overhead gives a better representation of the costs incurred to produce Job 6.15? Explain.

Problem 6

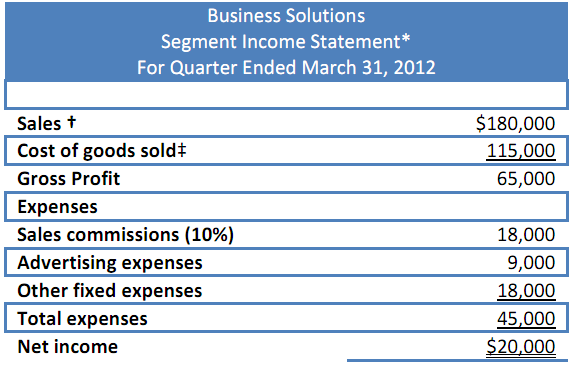

Santana Rey expects second quarter 2012 sales of her new line of computer furniture to be the same as the first quarter sales (reported below) without any changes in strategy. Monthly sales averaged 40 desk units (sales price of $1,250) and 20 chairs (sales price of $500).

*Reflect revenue and expense activity only related to the computer furniture segment.

†Revenue: (120 desks X $1,250)+ (60 chairs X $500) = $150,000+$30,00 + $180,000

‡ Cost of goods sold: (120 chairs C $750) + (60 chairs X $250) + $10,000 = $115,000

Santana Rey believes that sales will increase each month for the next three months (April - 48 desks, 32 chairs: May - 52 desks, 35 chairs: June - 56 desks, 38 chairs) if selling prices are reduced to $1,150 for desks and $450 for chairs, and advertising expenses are increased by 10% and remain at that level for all three months. The products' variable cost will remain at $750 for desks and $250 for chairs. The sales staff will continue to earn a 10% commission, the fixed manufacturing costs per month will remain at $10,000 and other fixed expenses will remain at $6,000 per month.

Questions:

1. Prepare budgeted income statements for each of the months of April, May, and June that show the expected results from implementing the proposed changes. Use a three-column format, with one column for each month.

2. Use the budgeted income statements from part 1 to recommend whether Santana Rey should implement the proposed changes. Explain.

Problem 7

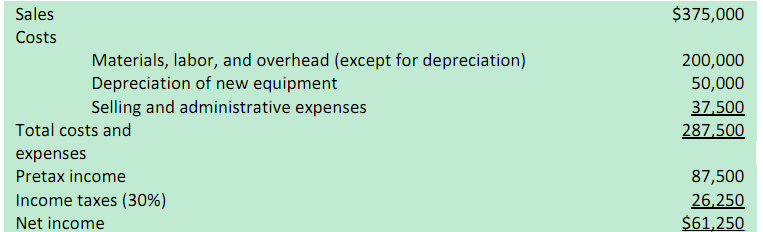

Santana Rey is considering the purchase of equipment for Business Solutions that would allow the company to add a new product to its computer furniture line. The equipment is expected to cost $300,000 and to have a six-year life and no salvage value. It will be depreciated on a straight line basis. Business Solutions expects to sell 100 units of the equipment's products each year. The expected annual incomes related to this equipment follows.

Question:

1. Compute the (1) payback period and (2) accounting rate of return for this equipment. (Record answers as percents, rounded to one decimal.)