Reference no: EM13492070

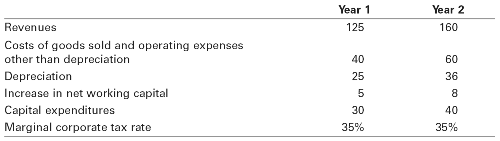

1.Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars):

a. What are the incremental earnings for this project for years 1 and 2?

b. What are the free cash flows for this project for the first two years?

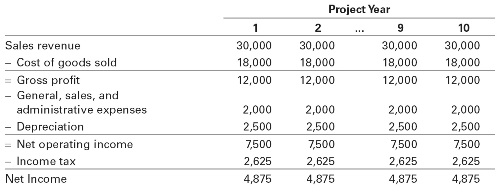

2.You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant’s report on your desk, and complains, “We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion.” You open the report and find the following estimates (in thousands of dollars):

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended. The report concludes that because the project will increase earnings by $4.875 million per year for 10 years, the project is worth $48.75 million.

You think back to your halcyon days in finance class and realize there is more work to be done! First, you note that the consultants have not factored in the fact that the project will require $10 million in working capital upfront (year 0), which will be fully recovered in year 10. Next, you see they have attributed $2 million of selling, general and administrative expenses to the project,but you know that $1 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on!

a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project?

b. If the cost of capital for this project is 14%, what is your estimate of the value of the new project?

|

Find the minimum force required to move the box down ramp

: A box weighing 600 N is at rest on a ramp at an angle of 32.5o with the horizontal. Find the minimum force required to move the box down the ramp

|

|

Find the frequency of sound heard by a stationary listener

: A railroad train is traveling at 30 m/s. The locomotive whistle emits a loud tone at frequency 440 Hz. what is the frequency of the sound heard by a stationary listener in front of the locomotive

|

|

Find taxable interest income from bank deposits

: Ryan Ross (111-11-1111), Oscar Oleander (222-22-2222), Clark Carey (333-33-3333), and Kim Kardigan (444-44-4444) are equal members in ROCK the ages, LLC.

|

|

What potential difference is required between the plates

: It is desired that 5.5 microcoulomb of charge be stored on each plate of a 2.5 microF - capacitor. What potential difference is required between the plates

|

|

What is your estimate of the value of the new project

: All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended. The report concludes that..

|

|

Determine the mass of the sun

: Determine the mass of the Sun using the known value for the period of the Earth and its distance from the Sun

|

|

Calculate the uncertainty in momentum

: let ?1 and ?2 be the ground state and first excited state wave functions for a particle in a deep potential well of width L. calculate the uncertainty in momentum

|

|

Explain what is the molar mass of hemoglobin

: Each hemoglobin combine with 4 O2. If 1.02 g of hemoglobin combine with 1.6 ml of O2 at 37degree c and 724torr. What is the molar mass of Hemoglobin

|

|

Obtain the change in momentum

: You were driving a car with velocity ‹ 19, 0, 11 › m/s. You quickly turned and braked, and your velocity became ‹ 13, 0, 15 › m/s. The mass of the car was 1200 kg. What was the (vector) change in momentum

|