Reference no: EM131137157

Instructions

(a) Answer the following questions.

(1) What are the source documents for direct materials, direct labor, and manufacturing overhead costs assigned to this job?

(2) What is the predetermined manufacturing overhead rate?

(3) What are the total cost and the unit cost of the completed job?

(b) Prepare the entry to record the completion of the job.Job Cost Sheet

JOB NO. 469

ITEM White Lion Cages FOR Tesla Company Quantity 2,000 Date Requested 7/2

Date Completed 7/31

Date Direct Materials Direct Labor Manufacturing

Overhead

7/10 828

12 900

15 440 528

22 380 456

24 1,600'

27 1,500

31 648

Cost of completed job:

Direct materials --------------------------

Direct labor --------------------------

Manufacturing overhead Total cost --------------------------

Unit cost --------------------------

2. At May 31, 2005, the accounts of Yellow Knife Manufacturing Company show thefollowing.

1. May 1 inventories-finished goods $12,600, work in process $14,700, and raw materials$8,200.

2. May 31 inventories-finished goods $11,500, work in process $17,900, and raw materials$7,100.

3. Debit postings to work in process were: direct materials $62,400, direct labor $32,000,and manufacturing overhead applied $48,000.

4. Sales totaled $200,000.

Instructions

(a) Prepare a condensed cost of goods manufactured schedule.

(b) Prepare an income statement for May through gross profit.

(c) Indicate the balance sheet presentation of the manufacturing inventories at May 31, 2005.

3.The Sanding Department of Han Furniture Company has the following production and manufacturing cost data for April 2005.

Production: 12,000 units finished and transferred out; 3,000 units started that are 100% complete as to materials and 40% complete as to conversion costs.

Manufacturing costs: Materials $36,000; labor $30,000; overhead $37,320. Instructions

Prepare a production cost report. There is no beginning work in process.

4. Mary Mahr has recently been promoted to production manager, and so she has just started to receive various managerial reports. One of the reports she has received is the production cost report that you prepared. It showed that her department had 1,000 equivalent units in ending inventory. Her department has had a history of not keeping enough inventory on hand to meet demand. She has come to you, very angry, and wants to know why you credited her with only 1,000 units when she knows she had at least twice that many on hand.

Instructions

Explain to her why her production cost report showed only 1,000 equivalent units in ending inventory. Write an informal memo. Be kind and explain very clearly why she is mistaken.

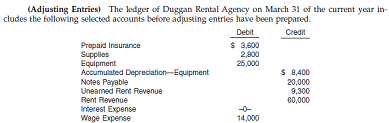

An analysis of the accounts shows the following.

1. The equipment depreciates $250 per month.

2. One-third of the unearned rent was earned during the quarter.

3. Interest of $500 is accrued on the notes payable.

4. Supplies on hand total $850.

5. Insurance expires at the rate of $300 per month.

Instructions

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are: Depreciation Expense; Insurance Expense; Interest Payable; and Supplies Expense. (Omit explanations.)

|

What should be done to correctit

: Explain to Lynn Benedict in a memo why the original balance sheet is incorrect, and what should be done to correctit.

|

|

What role does our genetic makeup have in uniqueness

: What role does our genetic makeup have in uniqueness and why does copying it infringe upon human dignity?

|

|

Identify some advantages to incorporating systems

: Identify some advantages to incorporating systems consolidation and discuss how this can be facilitated. In addition and keeping in step with a collaborative EA, the total cost of ownership (TCO) can be a difficult measure, especially for IT personne..

|

|

Discuss the principles of managing complexity

: Discuss the principles of managing complexity and relate some of these principles to organizations that must contend with complexity. In addition, present a working definition of Lean and Agile methodologies and principles, then compare and contrast ..

|

|

What is the predetermined manufacturing overhead rate

: (a) Answer the following questions.(1) What are the source documents for direct materials, direct labor, and manufacturing overhead costs assigned to this job?(2) What is the predetermined manufacturing overhead rate?

|

|

Define the meaning of diverse organization

: Define the meaning of a diverse organization; then, identify three challenges that a manager might encounter when attempting to develop team cohesion.

|

|

What is her optimal order quantity to minimize total cost

: A retailer sells an excellent grape soda. She buys the soda from a supplier and incurs a setup charge of $10 each time she orders. Demand for the soda is 4000 cases per year, and holding cost are 2$ per case per year. The purchase price per case is $..

|

|

Why a denominator cannot be zero

: Find the domain for each of your two rational expressions. Write the domain of each rational expression in set notation. Explain in your own words what the meaning of domain is. Also, explain why a denominator cannot be zero.

|

|

What data fields might be necessary to manage information

: We want to design a new database for college operation that will produce class status, student’s tuition and instructors’ salaries per semester. What data fields might be necessary to manage information for the tables Students, Classes, and Instructo..

|