Reference no: EM131102490

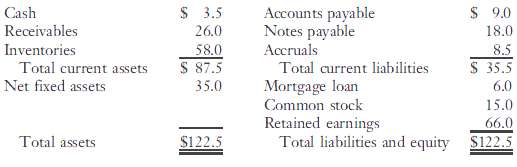

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton's balance sheet as of December 31, 2010, is shown here (millions of dollars):

Sales for 2010 were $350 million and net income for the year was $10.5 million, so the firm’s profit margin was 3.0%. Upton paid dividends of $4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate is 40%, and it operated at full capacity. Assume that all assets/sales ratios, spontaneous liabilities/sales ratios, the profit margin, and the payout ratio remain constant in 2011.

a. If sales are projected to increase by $70 million, or 20%, during 2011, use the AFN equation to determine Upton’s projected external capital requirements.

b. Using the AFN equation, determine Upton’s self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds?

c. Use the forecasted financial statement method to forecast Upton’s balance sheet for December 31, 2011. Assume that all additional external capital is raised as a bank loan at the end of the year and is reflected in notes payable (because the debt is added at the end of the year, there will be no additional interest expense due to the new debt). Assume Upton’s profit margin and dividend payout ratio will be the same in 2011 as they were in 2010. What is the amount of notes payable reported on the 2011 forecasted balance sheets?

|

Fully developed with a comprehensive analysis

: Paper is fully developed, with a comprehensive analysis of the main ideas explored in this analysis, including usage of specific examples from the poem to substantiate claims.

|

|

What is happening beneath the surface to cause the waves

: When you are at the beach, you notice that the waves seem to "break" at the same point as they come towards shore. Explain what is happening beneath the surface to cause the waves to break at this point.

|

|

Binary work and then shift the bits

: If you encode the signed integer -5 into an 8 bit binary work and then shift the bits to the right by two places; and wrap the bits (that fall off on the right) around to the left side of the word what value would you get?

|

|

Why then is there such concern about fraudulent financial

: One writer recently noted that 99.4 percent of all companies prepare statements that are in accordance with GAAP. Why then is there such concern about fraudulent financial reporting?

|

|

What is the maximum growth rate the firm can

: If sales are projected to increase by $70 million, or 20%, during 2011, use the AFN equation to determine Upton’s projected external capital requirements. b. Using the AFN equation, determine Upton’s self-supporting growth rate. That is, what is the ..

|

|

Consultant for firm that is perfectly competitive

: Examine whether each of the following statements is true or false. Explain. a. [15 points] If MC is less than ATC then AVC falls as output rises. b. If MC exceeds AVC then ATC rises as output rises. [Notations/Abbreviations : MC = marginal cost; AVC ..

|

|

Functional behavior assessment short paper

: Describe how teachers collect data in order to determine the functions of a behavior.

|

|

Prioritize the various cyber threats

: Use research to add credibility. We learned about a lot of different cyber threats. They're not all equally dangerous. Make sure you prioritize the various cyber threats for the audience.

|

|

What are the sources of error in the simulation program

: The preceding example demonstrated the required amplitude response of the VSB filter. We now consider the phase response. Assume that the VSB filter has the following amplitude and phase responses for f > 0:

|