Reference no: EM131379110

Problem 1. You have $24,435.78 in a brokerage account, and you plan to deposit an additional $6,000 at the end of every future year until your account totals $240,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? Round your answer to two decimal places at the end of the calculations.

Problem 2. Time for a lump sum to double

If you deposit money today in an account that pays 5.5% annual interest, how long will it take to double your money? Round your answer to two decimal places.

Problem 3. Present and future values of a cash flow stream

An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $300 at the end of Year 5, and $600 at the end of Year 6.

a. If other investments of equal risk earn 4% annually, what is its present value? Round your answer to the nearest cent.

b. If other investments of equal risk earn 4% annually, what is its future value? Round your answer to the nearest cent.

Problem 4. Future value of an annuity

Find the future values of these ordinary annuities. Compounding occurs once a year. Round your answers to the nearest cent.

a. $1,000 per year for 10 years at 6%.

b. $500 per year for 5 years at 3%.

c. $1,000 per year for 16 years at 0%.

Rework previous parts assuming that they are annuities due. Round your answers to the nearest cent.

d. $1,000 per year for 10 years at 6%.

e. $500 per year for 5 years at 3%.

f. $1,000 per year for 16 years at 0%.

Problem 5.

Present and future values for different periods

Find the following values using the equations and then a financial calculator. Compounding/discounting occurs annually. Round your answers to the nearest cent.

a. An initial $500 compounded for 1 year at 8%.

b. An initial $500 compounded for 2 years at 8%.

c. The present value of $500 due in 1 year at a discount rate of 8%.

d. The present value of $500 due in 2 years at a discount rate of 8%.

Problem 6.

Yield Curves

|

TERM

|

RATE

|

|

6 months

|

5.03%

|

|

1 year

|

5.41%

|

|

2 years

|

5.65%

|

|

3 years

|

5.79%

|

|

4 years

|

5.87%

|

|

5 years

|

6.1%

|

|

10 years

|

6.35%

|

|

20 years

|

6.63%

|

|

30 years

|

6.76%

|

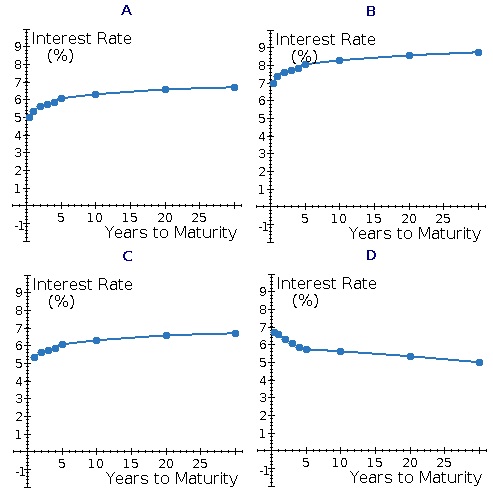

a. Plot a yield curve based on these data.

The correct sketch is A, B, C, D

b. What type of yield curve is shown?

1. The yield curve is abnormal

2.upward sloping

3. curve is flat

4. downward sloping

5. inverted

c. What information does this graph tell you?

1. In general the rate of inflation is expected to increase and the maturity risk premium is less than zero

2. In general the rate of inflation is expected to decrease and the maturity risk premium is less than zero

3. In genera the rate of inflation is expected to increase and the maturity risk premium is greater than zero

4. The shape of the yield curve depends only on expectations about future inflation which is expected to increase

5. In general the rate of inflation is expected to decrease and the maturity risk premium is greater than zero

d. Based on this yield curve, if you needed to borrow money for longer than one year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain. I, II, III, IV or V

I. Even though the borrower renews the loan at increasing short-term rates, those rates are still below the long-term rate, but what makes the higher long-term rate attractive is the rollover risk that may possibly occur if the short-term rates go even higher than the long-term rate (and that could be for a long time!).

II. Generally, it would make sense to borrow short term because each year the loan is renewed the interest rate would be higher.

III. Generally, it would make sense to borrow short term because each year the loan is renewed the interest rate would be lower.

IV. Generally, it would make sense to borrow long term because each year the loan is renewed the interest rate would be lower.

V. Differences in yields that may exist between the short term and long term cannot be explained by the forces of supply and demand in each market.

Problem 7.

Future value of an annuity

Your client is 23 years old; and she wants to begin saving for retirement, with the first payment to come one year from now. She can save $13,000 per year; and you advise her to invest it in the stock market, which you expect to provide an average return of 9% in the future.

a. If she follows your advice, how much money will she have at 65? Round your answer to the nearest cent.

b. How much will she have at 70? Round your answer to the nearest cent.

c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age? Round your answers to the nearest cent.

Annual withdrawals if she retires at 65 $

Annual withdrawals if she retires at 70 $

Problem 8.

Finding the required interest rate

Your parents will retire in 26 years. They currently have $390,000, and they think they will need $2,150,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places.

Problem 9.

Loan amortization and EAR

You want to buy a car, and a local bank will lend you $20,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 6% with interest paid monthly.

a. What will be the monthly loan payment? Round your answer to the nearest cent.

b. What will be the loan's EAR? Round your answer to two decimal places.

Problem 10.

Future value: annuity versus annuity due

a. What's the future value of a 7%, 5-year ordinary annuity that pays $600 each year? Round your answer to the nearest cent.

b. If this was an annuity due, what would its future value be? Round your answer to the nearest cent.

Problem 11.

Future value

If you deposit $5,000 in a bank account that pays 8% interest annually, how much would be in your account after 5 years? Round your answer to the nearest cent.

Problem 12. Amortization schedule

a. Set up an amortization schedule for a $12,000 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 9% compounded annually. Round all answers to the nearest cent.

b. What percentage of the payment represents interest and what percentage represents principal for each of the 3 years? Round all answers to two decimal places.

c. Why do these percentages change over time?

I. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the balance declines.

II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the balance declines.

III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the balance increases.

IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the balance increases.

V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment.

Problem 12. Present value

What is the present value of a security that will pay $11,000 in 20 years if securities of equal risk pay 12% annually? Round your answer to the nearest cent.

Problem 13. PV and loan eligibility

You have saved $3,000 for a down payment on a new car. The largest monthly payment you can afford is $400. The loan will have a 9% APR based on end-of-month payments.

a. What is the most expensive car you could afford if you finance it for 48 months? Round your answer to the nearest cent.

b. What is the most expensive car you could afford if you finance it for 60 months? Round your answer to the nearest cent.

c. The real risk-free rate is 2.3%. Inflation is expected to be 3% this year, 4.95% next year, and then 2.45% thereafter. The maturity risk premium is estimated to be 0.05(t - 1)%, where t = number of years to maturity. What is the yield on a 7-year Treasury note? Round your answer to two decimal places.

Problem 14. Default Risk Premium

A company's 5-year bonds are yielding 8% per year. Treasury bonds with the same maturity are yielding 5.3% per year, and the real risk-free rate (r*) is 2.45%. The average inflation premium is 2.45%, and the maturity risk premium is estimated to be 0.1(t - 1)%, where t = number of years to maturity. If the liquidity premium is 1.4%, what is the default risk premium on the corporate bonds? Round your answer to two decimal places.

Problem 15. Maturity Risk Premium

The real risk-free rate is 2%, and inflation is expected to be 3% for the next 2 years. A 2-year Treasury security yields 8.75%. What is the maturity risk premium for the 2-year security? Round your answer to two decimal places.

Problem 16. Loan amortization

Jan sold her house on December 31 and took a $50,000 mortgage as part of the payment. The 10-year mortgage has a 9% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year.

a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent.

How much interest was included in the first payment? Round your answer to the nearest cent.

How much repayment of principal was included? Round your answer to the nearest cent.

How do these values change for the second payment? I, II, III, IV or V

I. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases.

II. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal decreases.

III. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan.

IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also declines.

V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases.

• How much interest must Jan report on Schedule B for the first year? Round your answer to the nearest cent.

• Will her interest income be the same next year?

Her interest income will increase in each successive year

Her interest income will remain the same in each successive year

She will not receive interest income only a return of capital

Her interest income will decline in each successive year

She will receive interest only when the mortgage is paid off in 10 years

• If the payments are constant, why does the amount of interest income change over time? I, II, III, IV or V

I. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases.

II. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases.

III. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines.

IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines.

V. As the loan is amortized (paid off), the beginning balance declines, but the interest charge and the repayment of principal remain the same.