Reference no: EM131274539

Question 1.

a) What is the nominal rate of interest and how does it differ from the real rate of interest?

| Quantity of units |

|

| Sales price per unit |

|

| Variable operating cost per unit |

$1 |

| Total fixed costs |

$28,000 |

| Ordinary shares issued |

$20,000 |

| Preference shares issued |

$10,000 |

| Preference dividend per share |

$0.20 |

| Total debt |

$60,000 |

| Interest rate on debt |

10% |

| Tax rate |

40% |

A) calculate the breakpoint units

B) Based on the firm's current sales of 400000 units per year and an expected 5% increase in sales, Calculate the EBIT and EPS

C) Calculate the firm's DOL

D) Calculated the firm's DFL

E) Calculate the firm's DTL

Question 2

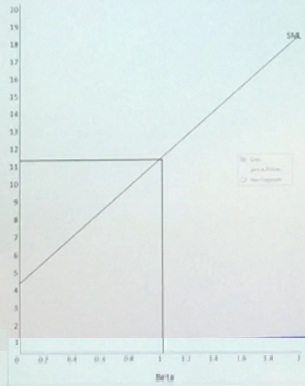

Utilise the following graph please answer the questions below

b) your stock has a Beta of 1.4. calculate the market risk premium?

Market premium_______________________-

C) you have worked out that the return on a one period stock( using [Ending Price less Opening Price + Dividend]?Beginning price) gives you a return of 15% although it has a beta of only 8.(I.e. it plots above the SML line). Discuss this in term of both the CAPMI and the Security Market Line and what an investor would or should do with this stock

Question 3

Red I.td in the process of replacing its old machmery which can be sold now for $20000 scrap. The new machamery will cost $480,000 and is expected to have a salvage value of $25,000.

$25,000. The new machinery is to be depreciated over its useful life. For tax purpose such machinery can be depreciated at 33.3 percent annum. It is estimated that the new machine will produce 95.000 units per annum over its five year useful life. Sa;es price per unit is proposed to remain constant at $14 per unit witbh variable operating costs being $6.50 per unit. Fixed operating costs are estimated at $270,000 per annum. The firm's accountant has advised that the machinery will incur interest/financing charge of $40,000. The machinery will require overhauls estimated at $45,000 in year three and will also require interseted working capital of $15,000. The tax rate is 30 percent. The company applies a discount rate of 8 percent on such projects.

Calculate the Net Present Value

|

0 |

1 |

2 |

3 |

4 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discount Factor |

|

0.926 |

0.857 |

0.794 |

0.735 |

0.681 |

|

|

|

|

|

|

|

| Discount Factor |

|

0.926 |

0.857 |

0.794 |

0.735 |

0.681 |

Question 4

A company is considering 2 project: X and Y. Which project is preferableand why?

| Initial Investment year |

Project X |

|

Project Y |

Year |

Discount Factor |

|

70000 |

|

85000 |

|

|

|

|

Net Cash inflows |

|

0 |

0.1 |

| 1 |

28000 |

|

35000 |

1 |

0.9091 |

| 2 |

33000 |

|

30000 |

2 |

0.8264 |

| 3 |

38000 |

|

25000 |

3 |

0.7513 |

| 4 |

|

|

20000 |

4 |

0.683 |

| 5 |

|

|

15000 |

5 |

0.6209 |

| 6 |

|

|

10000 |

6 |

0.5645 |

| Cost of capital |

10% |

|

|

|

|

| Net Present Value |

$11,277.24 |

|

$19,0.13.27 |

|

|

Quetion 5

Rollins Corporation is constructing its MCC schedule. Its largest capital structure is 20 percent debt. 20 percent preferred stock and 60 percent common equity. Its bonds have a 12 percent coupon, paid semiannually, a current maturity of 20 years, and sell for par at $1,000. The firm could sell, at per. $100 preferred stock which pays a 12 percent annual dividend but flotation costs of 5 percent would be incurred. Rollin's beta is 1.2 the risk-free rate is 10 percent and the market risk premium is 5 percent. Rollin is a constant growth firm which just paid a dividend of $2.00 sells for $27.00 per share and has a growth rate of 8 percent. The firm's policy is ot use a risk premium of 4 percentage points when using the bond-yield-plus-risk-premium method to find rs. The firm's net income is expected to be $1 million, and its dividend payout ratio is 40 percent. Flotation costs on new common stock total 10 percent and the firm's marginal tax rate is 40 percent.

a) What is Rollin's component cost of debt(after tax)?

a.10.0%

b.9.1%

c.8.6%

d.8.0%

e.7.2%

b) What is Rollin's cost of preferred stock?

a. 10.0%

b. 11.0%

c.12.0%

d.12.6%

e.13.2%

c) What is Rollins cost of ordinary shar capital using the CAPM approch?

a. 13.6%

b. 14.1%

c.16.0%

d.16.6%

d) What is the firm's cost of ordinary share capital using the DCF approch?

a.136.%

b.14.1%

c.16.0%

d.16.6%

e.16.9%

e) What is Rollin's WACC?

a. 13.6 %

b. 14.1 %

c.16.0%

d. 16.6%

e.16.9%

Question 6

| Sales price per unit |

$1.00 |

| Variable operating cost per unit |

$0.84 |

| Total Fixed Costs |

$28,000 |

| Ordinary Shares Issued |

$20,000 |

| Preference Share Issued |

$10,000 |

| Preference Dividend per Share |

$0.20 |

| Variable operating cost per unit |

$0.84 |

| Total Fixed costs |

$28,000 |

| Ordinary share Issued |

20000 |

| Preference share Issued |

10,000 |

| Preference dividend Per Share |

$0.20 |

| Total Debt |

$60,000 |

| Interest rate on Debt |

10% |

| Tax Rate |

40% |

a) Calculate the breakpoint units

b) Based on the firm's current sales of 400,000 units per year and an expected 5% increase in sales calculate its EBIT and earnings per share.

c) Calculate the firm's DOL.

d) caluclate the firm's DFL.

Question 7

Jenny Corporation provides you with the following data

|

Sales

|

$2,000,000

|

|

Cost of goods sold

|

$1,200,000

|

|

Inventory purchase

|

$1,300,000

|

|

Average inventory

|

$230,000

|

|

Average receivable

|

$230,000

|

|

Average payables

|

$200,000

|

Assume a 360 day period

Calculate the cash Conversion Cycle

Question 8

If a commercial bill investing to a value of $500,000 in 90days can be sold for $480000, what annual interest rate percent is paid on the issue?

Question 9

Annual demand 78000

Carrying cost per unit $4 00

Cost per order $260 00

Order lead time 4 weeks

Demand per week 52 1500 per week

Safety stock 100

a) calculate the economic order quantity

b) Calculate the reorder point with safety stock

Question 10

Legend - ke =cost of equity, kd =cost of debt; WACC - weight average cost of capital

a) Discuss the relevant of issues associated with graph A

b) Discuss the relevant issues associated with Graph B

c) Discuss the relevant issues associate with Graph C