Reference no: EM131133256

Taxes, inflation, and home ownership

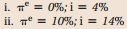

In this chapter, we discussed the effect of inflation on the effective capital-gains tax rate on the sale of a home. In this question, we explore the effect of inflation on another feature of the tax code-the deductibility of mortgage interest. Suppose you have a mortgage of $50,000. Expected inflation is πe, and the nominal interest rate on your mortgage is i. Consider two cases.

a. What is the real interest rate you are paying on your mortgage in each case?

b. Suppose you can deduct nominal mortgage interest payments from your income before paying income tax (as is the case in the United States). Assume that the tax rate is 25%. So, for each dollar you pay in mortgage interest, you pay 25 cents less in taxes, in effect getting a subsidy from the government for your mortgage costs. Compute, in each case, the real interest rate you are paying on your mortgage, taking this subsidy into account.

c. Considering only the deductibility of mortgage interest (and not capital-gains taxation), is inflation good for homeowners in the United States?

|

Bloomfield tires has assigned a discount rate

: Bloomfield Tires has assigned a discount rate of 14.4 percent to a new project that has an initial cost of $229,000 and cash flows of $74,300, $128,700, and $89,500 for Years 1 to 3, respectively. What is the net present value of this project?

|

|

Compute the debt-to gdp ratio in 10 years

: Using your favorite spreadsheet software, compute the debt-to-GDP ratio in 10 years, assuming that the primary deficit stays at 4% of GDP each year; the economy grows at the normal growth rate in each year; and the real interest rate is constant, ..

|

|

How did they impact european-native american relations

: What is a "virgin soil" epidemic? How did they impact European-Native American relations? What would have happened throughout North America if Native Americans had not been so vulnerable to these diseases?

|

|

In the context of the agency relationship managers

: Select as choices all of the following that you believe depict the 'agency' relationship inside the corporation.

|

|

The effect of inflation on the effective capital-gains tax

: What is the real interest rate you are paying on your mortgage in each case?

|

|

Libris expects assets and current liabilities to grow

: The Libris Publishing Company had revenues of $200 million this year and expects a 50% growth to $300 million next year. Costs and expenses other than interest are forecast at $250 million.

|

|

Research to develop a new computer game

: Your company has spent $250,000 on research to develop a new computer game. The firm is planning to spend $1,400,000 on a machine to produce the new game. Shipping and installation costs for the new machine total $200,000 and these costs will be c..

|

|

The following questions on a separate document

: Directions: Answer the following questions on a separate document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both. Submit your assignment using the assignment link in the course shell. This h..

|

|

Economic policy maker in the united states

: Do you agree with your colleague? Discuss the advantages and disadvantages of imposing an explicit Taylor rule on the Fed.

|