Reference no: EM13837556

Question 1:

It is 2006 and you notice that there are a lot of television programs about people that "flip" houses. That is, programs in which people buy houses, remodel them, and hope to sell them at a profit. You think that this sounds intriguing and consider buying a house to sell one year later.

Assume that this house costs $2M today. The house, after you remodel it, will take on one of five market values next year: $1.40M, $1.70M, $2M, $2.30M, or $2.60M. Assume that remodeling the house is costless.

a) Suppose you have $2M in cash and decide to buy the house. What is your percentage return for each of the five possible house values next year? Graph your percentage return on the y-axis versus the percentage change in the value of the house on the x-axis. Draw a straight line through the five points. Hint: this is a trivial case where your percentage return exactly equals the percentage change in the value of the property.

b) Suppose you only have $1.50M in cash. Your friend agrees to lend you the remaining $0.50M that you need, but only if you pay him back with 10 percent interest as soon as you sell the house one year later. You get the cash that is left over after selling the house and repaying your friend. Graph your percentage return on your personal $1.50M investment on the y-axis versus the percentage change in the value of the property on the x-axis. Draw a straight line through the five points.

c) Now suppose you only have $0.75M in cash. Your friend agrees to lend you the remaining $1.25M that you need, but only if you pay him back with 10 percent interest as soon as you sell the house one year later. You get the cash that is left over after selling the house and repaying your friend. Graph your percentage return on your personal $0.75M investment on the y-axis versus the percentage change in the value of the property on the x-axis. Draw a straight line through the five points.

d) Comment on the slopes of the lines from the previous three questions. Which scenario appears riskiest for your personal cash investment?

e) Stock returns are more risky when a firm has a higher percentage of debt on its balance sheet. Briefly comment on how this statement relates to your results.

Question 2:

You are the financial manager of General Electric Company (symbol: GE) and are considering the purchase of an independent home appliance manufacturer. GE will benefit by not only receiving the net cash flows generated by this company, but also via synergies produced by having the companies combine forces. You want to figure out the maximum you are willing to pay for this manufacturing company.

GE has determined that the hypothetical cash flows generated by this purchase would be of similar riskiness to its own total asset cash flows. Therefore, GE will use its asset expected return to discount the future cash flows it expects to receive from the manufacturing company. Your challenge is to calculate GE's asset expected return, which will be used as the independent manufacturer's discount rate.

a) First, calculate GE's equity beta. Go to Yahoo! Finance and click on "Get Quotes" for GE. Click on "Historical Prices" and download monthly GE price data from August. 1, 2012 to August 3, 2015. Do the same for the S&P500 (symbol: ^GSPC), our underlying proxy for the market return.

Next, calculate monthly returns for each security using the equation ??t = (??t - ??t-1)⁄??t-1, where ??t is the return in month t, and ??t is the adjusted closing price in month t. When calculating returns, make sure your data are sorted so that time is in ascending order, not the default descending order. Convert all of your returns into excess returns (??t - ??f) by subtracting the monthly risk-free rate, which we will assume as 0.03/12. You will not have a return observation for the first month of your time series.

Then, run a linear regression of GE excess returns (your Y variable) on S&P500 excess returns (your X variable). You can find "Regression" in Microsoft Excel in "Data Analysis" under the "Data" tab.1

If the X-variable coefficient is positive and statistically significant (t-statistic greater than 1.95), then we conclude (with 95% confidence) that if S&P500 returns are 1 percent higher, then GE returns are (Coefficient multiplied by 1 percent) higher.

Report the X-variable coefficient along with its t-statistic. The X-variable coefficient is the equity beta for GE. This was derived by fitting data to the CAPM.

b) Next, we need GE's market values of debt and equity. Go back to the GE page in Yahoo! Finance. The market value of equity is also known as "market capitalization" and can be found on the "Summary" page.

To find the market value of debt, click on "Balance Sheet" on the left hand side and obtain GE's "Total Liabilities" from December 31, 2014. Because GE's debt is fairly stable, it is safe to assume that the book value of debt equals the market value of debt. Because GE's debt is considered very low risk, we will assume GE's debt beta equals 0.05.

Report the market value of equity and the market value of debt for GE.

c) Using the information from parts (a) and (b), calculate the asset beta for GE. Show your workings.

d) Using the CAPM, calculate and report the expected return for GE's assets. Assume a market risk premium of 6.0% and a risk-free rate of 3.0% (an approximate yield on 30-year U.S. treasury securities). Show your workings.

You expect this acquisition to generate its first cash flow next year and that it will be equal to 0.10 percent of your firm's end-of-2014 cash flows provided by operating activities (see GE's most recent cash flow statement, which can be found under "Cash Flow" on the left hand side of the GE page on Yahoo! Finance). Forecasts inform you that these cash flows will grow by 0.25 percent per year thereafter, and that you will receive cash flows in perpetuity. These cash flows are due to the cash flows generated by the acquired manufacturing company and the projected benefits from having GE combine forces with this company.

e) What is the maximum you would be willing to pay for this independent manufacturing company? That is, what is the value of this independent manufacturing company?

Question 3:

You are an original owner of a publicly traded food service company called Smith's Foods (SF). Your company has been in the high-end restaurant business (HE) for the past ten years. You announced today that the company will be issuing debt today to open a new fast food division (FF).

Opening this new division costs $10M today, which you will fund by issuing debt. Revenues from this new division are expected to be $3M next year and are projected to grow by 4 percent per year. Costs from this new division are expected to be $2M next year and are projected to grow by 2 percent per year. The life of this project is 15 years.

Analysis of other fast food businesses suggests that the beta of a fast food division equals 0.70. Assume that the revenues and costs have similar risk. Throughout this problem, assume a risk-free rate of 3 percent and a market risk premium of 6 percent.

a) What is the NPV of this new investment? Is it a good investment? Hint: you will need to use the growing annuity formula twice. Once for revenues and once for costs.

A regression of monthly SF excess stock returns on monthly S&P 500 excess returns from the past ten years tells you that the beta of the high-end division equals 1.5. Directly before the investment in the fast food division, SF was an all-equity firm with 1M shares outstanding trading at $25 per share.

Assume that the announcement of the new division does not affect the value or beta of the high-end division.

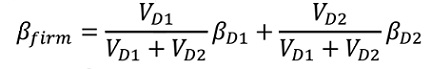

b) What is the beta of the firm after the announcement of the new division? The beta of a firm can be calculated as the value-weighted average of the division betas:

where the value of a division (??D1 or ??D2) equals the present value of its future net cash flows.

a) Assume that the beta of the new debt (valued at $10M) is equal to 0.1. What is the beta of the firm's equity after the announcement of the new division?

b) The beta of your firm's equity was originally 1.6. There are two reasons why the announcement caused the beta of your firm's equity to slightly change - one reason causes the original beta to decrease while the other causes it to increase. Briefly explain these reasons.

c) What is the change in the expected return of the firm due to the announcement?