Reference no: EM131247288

Community Bank must decide whether to open a new branch. The current market value of the bank is $2,500,000. According to company policy (and industry practice), the banks capital structure is highly leveraged. The present (and optimal) ratio of debt to total assets is .9. Community Banks debt is almost exclusively in the form of demand, savings, and time deposits. The average return on these deposits to the banks clients has been 5% over the past five years.

However, recently interest rates have climbed sharply, and as a result Community Bank presently pays an average annual rate of 64% on its accounts in order to remain competitive.

In addition, the bank incurs a service cost of n% per account. Because federal "Regulation Q" puts a ceiling on the amount of interest paid by banks on their accounts, the banking industry at large has been experiencing disintermediation-a loss of clients to the open money market (Treasury bills, etc.), where interest rates are higher.

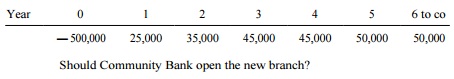

Largely because of the interest rate situation (which shows no sign of improving), Community Banks president has stipulated that for the branch project to be acceptable its entire cost of $500,000 will have to be raised by 90% debt and 10% equity. The banks cost of equity capital, k,, is 11%. Community Banks marginal tax rate is .48. Market analysis indicates that the new branch may be expected to return net cash flows according to the following schedule

Should Community bank open the new branch?

|

Computing the dimes and quarters

: A sum of money amounting to $6.90 consists of dimes and quarters. If there are 39 coins in all, how many are quarters?

|

|

Analysis of two personal electronics manufactures

: You need to provide comparative business analysis of two personal electronics manufactures. This analysis should include: business strategy analysis, financial analysis and prospective analysis (as a basis for valuation). Companies need to be comp..

|

|

What is your estimate of the asthenospheric viscosity

: Ten years after an earthquake, you find that the shear strain rate changes sign 30 km from the fault. What is your estimate of the asthenospheric viscosity? (You may assume that all the other parameters are the same as in the previous problem.)

|

|

What equal monthly deposit

: Acme Annuities recently offered an annuity that pays 7.8% compounded monthly. What equal monthly deposit should be made into this annuity in order to have $133,000 in 10 years?

|

|

Should community bank open the new branch

: Community Bank must decide whether to open a new branch. - According to company policy (and industry practice), the banks capital structure is highly leveraged. -Should Community bank open the new branch?

|

|

Compute the creep and relaxation functions

: Derive the generalized tensor form of the Maxwell constitutive equation

|

|

Find the expected number of students

: (a) Find the expected number of students that will get an A, and the standard deviation of number of students that will get an A. (b) Find the probability that no student gets an A. (c) Find the probability that at most 2 students get an A.

|

|

Percentage of the households

: a. How many households were only watching Lotto? b. What percentage of the households were not watching either broadcast?

|

|

Derive the approximate closed form viscoelastic solution

: Derive the approximate closed form viscoelastic solution for a strike-slip fault appropriate for times short compared to the material relaxation time, equation

|