Reference no: EM13943332 , Length: word count:2500

Instructions

Using the scenario below, or information from your own organisation answer the questions that follow.

Matt Hodgson is the manager of the CA City Café which is growing. His job has also grown and originally involved just running the café, however it now encompasses catering and manufacturing a small range of condiments.

Matt has decided to ask Hugh Brown, currently working as a waiter at the Café to take on a manager's role to help run the manufacturing side of the business. He is to assume his new role in January 20x2.

You are to assume the role of Hugh Brown.

Traditionally the Café has prepared budgets 12 monthly. You are not sure if this is often enough but this has always been like this. The budgets are done by the accounts department and none of the team in the café have been consulted with. Since this is a new project you might consider reviewing this process.

Background information

CA City Café: 12 Bean Street, Grindville, 4000, ABN 12 345 678 901

A busy café located in CA City as part of the CA City Retail Group. The café employs staff at all levels, full time, part time, and casual to service customers in the three different areas of operation:

• The café - to serve excellent food and the best coffee from our own beans and fresh seasonal produce

• The catering - to provide innovative and flexible solutions for events, in house, offsite, specialising in food, service and amazing experiences

• The manufacturing - Aim to produce the best condiments in the world, showcasing CA City produce in a unique way. The best gourmet food products using the best ingredients for the best price. This part of the business has recently been established and the long term feasibility is still to be proven

Objectives for the manufacturing:

• Provide a sound and reliable source of product at an economical price for use in the café and catering parts of the business (these are referred to in house units as opposed to stock for sale to wholesale customers)

• Provide an additional income stream for the business. Budgeted income from the beginning of January to the end of March 20X1 from the project is expected to be $26 640.00 (exclusive of GST). Operating profit is expected to be 50%

IMPORTANT:

All legislation and administration is managed well by bookkeepers and accountants. All terms for the café are 30 days for all customers and suppliers.

CA Chutney has an extended shelf life - no need to factor this issue into the planning. Additional information:

The café has been trading for some years Matt has advised that he has had a look over historical figures for the café and he imagines the patterns will be similar. The festive season is very busy for the café and the catering, traditionally quieter over January and February although this is not always predictable.

No one is sure how the Christmas period will affect production and sales for the Chutney, consider that this could be a problem in the first months of the New Year

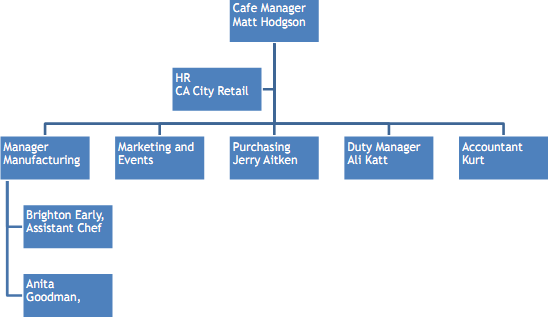

The organisational chart for this assessment is as follows:

Manufacturing detail

Hugh Brown manufacturing manager - your responsibilities

• Priority is to focus on establishing CA-Chutney as the initial product in the range of gourmet foodstuffs. Product is available in 500 gm jars at this stage only. It is also to be sold wholesale only for wholesale prices $11.10 per unit. There may be potential for future retail sales but not at this stage

• Supervise and assist manufacturing staff

• Roster and coordinate with staff for shifts, special orders and changes to schedules

• Ensure food safety and all WHS standards maintained

• For all human resource issues you are to report to Café Manager Matt Hodgson and Human Resource department of CA City Retail Group

• Budgeting for manufacturing/forecasts in conjunction with the entire team

Your team and their roles in the process

Matt Hodgson - Café Manager

Matt is your main contact for issues and changes to process and budget. Matt provides support for all members of the café and ensures systems and processes are in place for effective management for all aspects of the operation.

Kurt Washington - Accountant, CA City Retail Group

Manages all invoices, payments, banking, and petty cash, accounts receivable and payable related to the manufacturing in conjunction with you and Matt Hodgson. Drives the budget process. Kurt is responsible in particular for the accuracy of all financial documents

Jerry Aitken - Purchasing Manager

Main contact for current pricing. All orders to go through Jerry. He needs to communicate immediate changes to stock and issues related to price and supply. There needs to be a good relationship with recordkeeping and flow of information regarding costs.

Cam Payne - Marketing and Events

All marketing and promotional events designed and distributed by marketing department. They need to work with you and Matt to maintain budget and to measure success of marketing initiatives.

Matt has allocated three experienced staff who have been working in the café for some years (both on the floor and in the kitchen) to work on this project with you. Brighton Early, Assistant Chef; Anita Goodman, Barista; and Ali Katt, Duty Manager They will all work part time in this role and be allocated to the café and catering as required. Wage costs are allocated for you at this stage. You do not need to consider them except to monitor costs to provide information for future planning.

Suppliers (all suppliers work on 10% GST on all products for this assignment, even though this may not be realistic in real life as some items are GST exempt)) Jars R Us Supply the café with labels and packaging. The decision has been made to stay with one supplier from a standpoint of sustainability and economy. You have to buy in bulk from this supplier but this allows for better discounts and less transport issues. Storage is not an issue for the café.

Fruit and Vegetable Local supplier, working within a 200 km supply radius for local produce.

Grocery Local supplier for all café, catering and manufacturing.

Customers - The Chutney you produced for use in the café has been so popular the decision has been made to sell it wholesale only to businesses outside CA City at this stage. Lately there has been work done on the promotion plan and it is hoped that the new promotional activities have worked and orders will grow as anticipated in the next quarter.

These are the existing wholesale customers outside CA City. These are indicated order levels - early estimates only. Final orders and re orders will depend these outlets:

• Del-enormous 200 jars per month

• Fab-Food 300 jars per month

• Mickey Mao 150 jars per month

There are figures available from Kurt Washington on volumes for:

• Wholesale customers

• Café for internal use

Future ideas and additional information:

• Retail sales through the café for customers of the café. The recommended retail price (RRP) for 500 gm jars is $ 24.95

• Introducing a bulk pack for use in the café and catering 2kg cost $12.90. Wholesale price $19.35. RRP $42.75

• Before making our own Chutney we paid $23.15 wholesale for 2 kg, we used 9 of these in a month for our various dishes

Task 1

Question 1

You have commenced your role. Matt advised you that all budgets/ financial plans are able to be accessed from the accounts department. Draft an email to the accountant asking for copies of the documents you need. You must include the following in your email:

• Introduce yourself, use the name of the accountant and outline the working relationship you hope to have. Specify at least three reports you will need to begin your analysis:

Question 2

The accounts department has responded to your email. The response and all budget and financial documents available have been sent to you and are attached as Appendix. Review the the following questions using figures to demonstrate your thoughts:

2a Please provide comments on at least three issues from the forecast, aged payable and aged receivable summaries. Minimum 75 words.

2b Are the financial budgets that have been presented able to be understood? Who would you consult with if you were unsure about your understanding of the financial budgets?

2c You have noticed the forecast sales for December through to March are similar even though, you and Matt know traditionally sales are higher during the Christmas period for catering and café sales. Who should you consult with to clarify your thoughts and why? Hint: Consider your team. Minimum 25 words

Question 3

3a You realise the sales figures for January, February and March are not realistic. You feel you need to renegotiate the budget with Matt and Kurt. Using the information in the Cash Flow forecast provided in the appendix 1, and considering your objectives for manufacturing, specify three items for further discussion with Matt and Kurt.

Hint: Consider your objectives, volumes sold to help achieve your desired outcomes. 3b It is important to have thorough preparation for a successful negotiation, what would

you need to consider?

Question 4

Matt and Kurt have agreed on the need to review the sales figures for the next three months. You all agree to reduce the sales figures by 15% for each of the three months. There has been a directive however via the CEO of the CA City Retail Group, he is insisting on achieving a gross profit ratio of 37 % by the end of the financial year. You need to complete the following forecast document template here using the new figures for January, February and March.

|

Forecast

|

Budgete d units sold

|

Actual Units sold

|

Budgeted income

|

Actual income

|

Budgeted total costs

|

Actual total op costs

|

|

October

|

|

500

|

|

|

|

|

|

November

|

900

|

550

|

|

|

|

|

|

December

|

900

|

950

|

|

|

|

|

|

January

|

|

|

|

|

|

|

|

February

|

|

|

|

|

|

|

|

March

|

|

|

|

|

|

|

Question 5

If the profit figures are not reached by the end of March, please identify three contingency plans and your reasoning for each. Minimum 100 words.

Task 2

Question 1

Before implementation of any budget or financial plan it is important all members of the team who are impacted by the plan are involved in its formation and introduction. Explain at least four methods of communication to share this information. Minimum 75 words.

Question 2

Complete the following table (provide at least two methods or points for each: support and systems and resources).

Task 3

Question 1

After development of a budget, it is essential to monitor actual expenditure and control costs across the financial activities of your work team. What processes would be necessary to introduce to the team to make sure you are able to monitor the budget process, identify costs and control outcomes?

You need to identify at least three processes that might suit your workplace or the scenario and explain your answer. Minimum 100 words.

Hint: You must consider and comment on the impact of accounts receivable and payable being unmanaged.

Question 2

What documents would you use to monitor actual expenditure and control costs? Minimum 25 words.

Question 3

3a Explain what is meant by a budget variance?

3b What is the formula to calculate budget variance, as a percentage 3c What is the importance of budget variances to managers?

Question 4

All managers need to monitor and control financial processes and use that information to identify variance in the budget or past financial plan. Use your own organisations budget variances or use the scenario budget over the months November- January inclusive, to explain the following.

4a Why is a monthly budget monitoring cycle appropriate? What alternative can be used? Minimum 100 words.

4b Explain two approaches to collect and analyse data and information gathered? Minimum 25 words.

4c What are the reasons for and against, for using spreadsheet to manage budgets? Minimum 30 words.

Question 5

You and Matt have realised the importance of regular review of budgets and have implemented an organisational policy to review monthly as outlined in the table below.

It is now the 4th of February and you have the results for the month of January available to include with your budget analysis.

The actual sales for January were 550 units. 510 to wholesale customers. 40 units requisitioned by the kitchen for use in the café (in-house units).

You now need to identify budget variances for the scenario (or your own example) complete the following table.

Remember these are the prices for you to use: Wholesale sales price $11.10 Wholesale cost per unit $7.40

|

Fore cast

|

Budg eted units sold

|

Actu al Unit s sold

|

Vari anc e units sold

|

%

varian ce on units sold

|

Budg eted incom e

|

Actual incom e

|

Varian ce incom e

|

%

varian ce on incom e

|

Budge ted total costs

|

Actual total op costs

|

Varian ce Costs

|

%

varia nce on cost s

|

Gross Profit

|

Gross Profit Ratio (%)

|

|

Octo ber

|

|

500

|

|

|

|

$ 5

550.00

|

|

|

|

$ 3

475.00

|

|

|

|

|

|

Nove mber

|

900

|

550

|

|

|

$9 990.0

0

|

$ 6

105.00

|

|

|

$ 6

660.00

|

$ 4

070.00

|

|

|

|

|

|

Dece mber

|

900

|

950

|

|

|

$9 990.0

0

|

$10 545.00

|

|

|

$ 6

660.00

|

$ 7

030.00

|

|

|

|

|

|

Janua

ry

|

680

|

|

|

|

$7 548.0

0

|

|

|

|

$ 5

032.00

|

|

|

|

|

|

|

Febru

ary

|

680

|

|

|

|

$7 548.0

0

|

|

|

|

$ 5

032.00

|

|

|

|

|

|

|

Marc

h

|

680

|

|

|

|

$7 548.0

0

|

|

|

|

$ 5

032.00

|

|

|

|

|

|

|

Units sold

|

Budgeted WS units sold

|

Actual WS units sold

|

Budgeted In house use units

|

Actual In house use units

|

Budgeted units sold total

|

Actual items sold total

|

|

October

|

650

|

460

|

40

|

40

|

500

|

500

|

|

November

|

650

|

510

|

40

|

40

|

900

|

550

|

|

December

|

650

|

870

|

50

|

80

|

900

|

950

|

|

January

|

680

|

|

50

|

|

680

|

550

|

|

February

|

|

|

|

|

680

|

|

|

March

|

|

|

|

|

680

|

|

Question 6

After identifying variances in a budget/financial plan, managers need to make decisions as to whether the objectives will be achieved or if the plan needs to be modified.

Using this information regarding variances, draft an email reporting on the changes to the budget for your team. Do you feel that it is necessary to implement some contingency plans? If so, explain what action you would recommend and why? How would you monitor this and what would you do if the contingency plan failed to produce the desired financial outcome? Minimum 100 words

Hint: Remember the CEO's requirement for a 37% gross profit ratio at the end of the financial year (June 30) Consider making a case for alternative uses of products and the future new ideas as proposed in the scenario as well as options through the Café and catering opportunities.

Task 4

Question 1

What documents you would use to collect and collate data and information on the effectiveness of the financial management process. Provide a comprehensive overview of all documents needed to assess this. At least three documents must be discussed and their importance to the process explained.

Minimum 100 words.

Hint: This is in general, not limited to the information provided in this scenario. You need to discuss and demonstrate an understanding of the impact of GST on cash flow.

Question 2

GST is an important part of the financial management process.

2a The CEO has asked us to consider increasing the price of the 500 gm jars from $11.10 to $12.77.

If this was to occur how much more GST would be paid per jar. Hint GST only works in whole numbers no cents.

|

GST Calculation

|

Wholesale Cost

|

GST amount

|

|

Current wholesale cost

|

|

|

|

Proposed wholesale cost

|

|

|

|

Variance $

|

|

|

2b What is the name of the document would you expect to lodge the GST information for the business? How often would this report be lodged and with whom? What are the penalties for noncompliance? Minimum 25 words.

Question 3

When completing your paperwork for Hugh you notice the amount for packaging in Octobers figures is incorrect. The amount per item for the 500 gm jars should be $.45. This represents a shortfall of $225.00 for this month. Where has the $225 come from since you know the packaging was purchased? On closer inspection the petty cash is out by the same amount, you discover that the packaging order had not arrived in October and your last assistant was picking up the materials on her way in and being reimbursed by petty cash each week. No one else seemed to know about this. Using this, or a similar example from your own organisation, answer the following:

3a Identify the improvement opportunity in this case and your recommendations for process improvements to ensure the effectiveness, efficiency and reliability of the process. You need to monitor your team's ability to cope with the processes.

Hint: Managing money even small amounts like petty cash are important procedures to monitor and maintain. How would you manage petty cash in this case?

3c Explain the importance of aligning the financial management process to the financial objectives.

Hint: You need to consider the financial objectives in the scenario and the directive from the CEO, as well as record keeping and auditing as important aspects to the business

Attachment:- Assignment.rar