Reference no: EM1381265

1. According to estimates by Goolsbee and Petrin (2004), the elasticity of demand for basic cable service is ?0.51, and the elasticity of demand for direct broadcast satellites is ?7.40. Suppose that a community wants to raise a given amount of revenue by taxing cable service and the use of direct broadcasting satellites. If the community's goal is to raise the money as efficiently as possible, what should be the ratio of the cable tax to the satellite tax? Discuss briefly the assumptions behind your calculation.

2. Suppose the Working Income Tax Benefit tops up a single individual's income by 25 percent of the amount that employment earnings exceed $3000, up to a maximum payment of $950. Assume the refundable credit is reduced by 15 percent on the amount of earnings in excess of $10,500.

a. Then over what range of earnings is the credit at its maximum value?

b. At what income is the credit reduced to zero?

c. Let the statutory income tax be a flat rate of 30 percent, with a basic personal exemption of $10,000. Ignore all other taxes and program benefits in the economy. Calculate and describe the effective marginal tax rate (EMTR) faced by this individual on income ranging from zero to $20,000.

d. Discuss the incentive effects associated with this EMTR schedule, regarding the decision to join the workforce and to increase hours worked, say, from part-time to full-time.

3. Jack and Jill live alone on an island. Their labour supply schedules are identical and given by L = (1 - t)w, where t is the income tax rate and w denotes the wage. Jill's wage is 6 and Jack's is 2. The tax paid by an individual is twL and each receives a transfer equal to half the total revenues. Jack and Jill have identical utility functions given by U = C - (1/2)L2 , where C denotes consumption (the individual's income after tax and transfer). If the social welfare function is W = 3Ujack + UJill, what is the optimal tax rate?

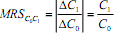

4. Nancy is endowed with $1000 of income in period 0 and $315 in period 1. The market interest rate is 5 percent. Her preferences between consumption in the future (C1 in period 1) and consumption in the present (C0 in period 0) are characterized by the utility function ) ,U(C1,C0) = C0C1 = , which has a marginal rate of substitution given by

a. In the absence of taxation, how much money does she save or borrow?

b. Now suppose the government (which ran on a political campaign slogan of "live in the present") introduces a tax on interest income equal to 75 percent. Furthermore, any interest payments on borrowed money are not tax deductible. Draw the after-tax budget constraint. Label the intercepts and the slope.

c. Find the after-tax level of saving or borrowing.

d. Identify the excess burden and the tax revenue raised on your diagram and determine their corresponding numerical values.

5. Jenna's boss has decided to pay her a one-time bonus of $5,000. She decides to save the money until she retires, 4 years from now. She contemplates two savings options. Option A is to save the money for four years outside of an RRSP in a foreign corporate bond that will pay her 10 percent per year. Option B is to save for four years in an RRSP account with a domestic government bond that will pay her 8 percent per year. The marginal income tax rate that Jenna faces while she is working is 30 percent. When she retires her marginal tax rate will drop to 25 percent, as she will be in a lower tax bracket. As her financial advisor, which option do you recommend?

6. The ABC corporation is contemplating purchasing a new computer system that would yield a before-tax return of 30 percent. The system depreciates at 10 percent a year. The after-tax interest rate is 8 percent, the corporation tax rate is 35 percent, and depreciation allowances follow the straight-line method over five years. There is no investment tax credit. Do you expect ABC to buy the new computer system? Explain your answer.

|

Should a marketing manager or a business refuse to produce

: Should a marketing manager or a business refuse to produce an "energy-gobbling" appliance that some consumers are demanding? Should a firm install an expensive safety device that will increase cost but that customers do not want?

|

|

Determine the defender lowest euac

: Determine the defender's lowest EUAC what is the challenger's economic life? When, if at all, should we replace the defender with thechallenger?

|

|

Articulate key aspects of operations management

: Articulate key aspects of operations management. Explain why operations management is important to managers in various organizational areas. Please provide specific examples

|

|

What traits does this person have

: Think of a leader you admire. What traits does this person have? Are they consistent with the traits discussed in this chapter? If not, why is this person effective despite the presence of different traits

|

|

Ratio of cable tax to the satellite tax

: what should be the ratio of the cable tax to the satellite tax? Discuss briefly the assumptions behind your calculation and discuss the incentive effects associated with this EMTR schedule, regarding the decision to join the workforce and to increas..

|

|

Compute producer and surplus and consumer surplus

: Use a diagram to show consumer surplus price of 8.00and production of 6 million meals per day. If price remain at 8.00but production were cut to 3 million meals per day.

|

|

Why do you think a project needs a champion

: Why do you think a project needs a champion? Do you believe that being a project champion might be the path to senior management in today's business world?

|

|

What potential causes of poor decision making existed

: What potential causes of poor decision making existed at WorldCom during Bernard Ebbers' administration? What might have happened if Ebbers had been prone to a different conflict-handling style, such as compromise or collaboration?

|

|

What other traits can you think of that would be relevant

: How can organizations identify future leaders with a given set of traits? Which methods would be useful for this purpose? (Be specific) What other traits can you think of that would be relevant to leadership?

|