Reference no: EM13326833

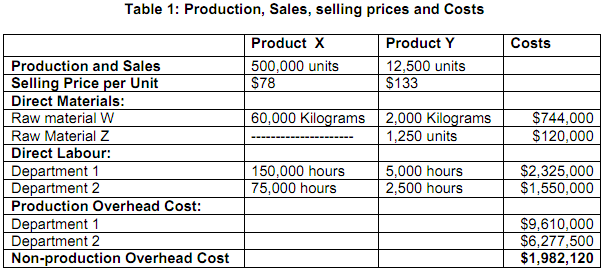

Beta Company Ltd manufactures two products (product X & product Y) in two production departments (Department 1 & Department 2). Product X is a simple, high-volume product and product Y is a complex, low-volume product. Both products are processed in departments 1 and 2. Product X uses only one raw material (W), but product B uses two raw materials (W and Z). Table 1 provides data on the production, sales, selling prices and costs incurred for the last year ended 30 June 2012.

Under the traditional costing system Beta Company Ltd allocated production overhead cost to products using departmental overhead rates based on direct labour hours (for both departments). Non-production overhead cost was absorbed on a sales volume basis.

The Manager (Mr Ahmed) argues that traditional costing ignores the different complexity of products X and Y as it allocates production and non-production overhead cost based on volume-based overhead application rates such as direct labour and sales volume.

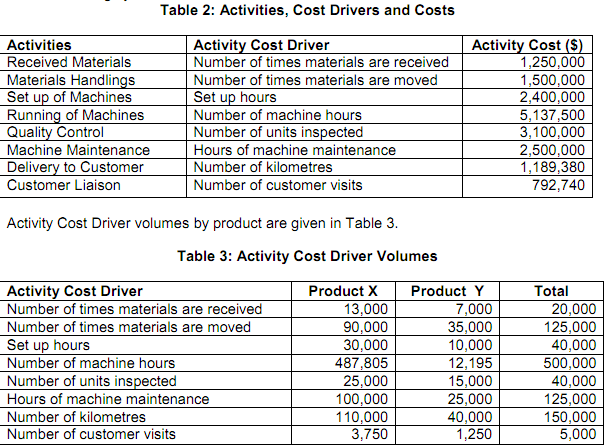

Beta Company Ltd attempts to overcome the problem of cost distortions resulting from the traditional costing system. They consider introducing the ABC costing system that attributes costs to products based on the activities they demand. Table 2 presents the activities, cost drivers and costs identified by Beta Company Ltd's management accountants for applying the ABC costing system.

Required:

(a) Calculate full unit cost for products X and Y under the traditional costing system.

(b) Calculate full unit cost for products X and Y under the new activity-based costing (ABC) system.

(c) Calculate the difference between the full unit cost for products X and Y calculated under the traditional costing system and that calculated under the ABC costing system.

(d) Explain the differences calculated in (c) above for both products.

(e) Calculate the difference between product costs of both products and their respective current selling prices based on the traditional costing system.

(f) Calculate the difference between product costs of both products and their respective current selling prices based on the ABC costing system.

(g) Identify and explain to Mr Ahmed the possible advantages and disadvantages of adopting the ABC costing system.

|

What is the mass flow rate fo water

: The intake to a hydraulic turbine installed in a flood control dam is located at an elevation of 10 m above the turbine exit. what is the mass flow rate fo water, in kg/s

|

|

Why viruses encodes rather than making use of cells snares

: Viruses are the ultimate scavenger-a necessary consequence of their small genomes. Wherever possible they make use of the cell's machinery to accomplish the steps involved in their own reproductions.

|

|

What is offshoring of white collar service jobs

: What is offshoring of white collar service jobs, and how does it relate to international trade? Why has it recently increased? Why do you think more than half of all offshored jobs have gone to India?

|

|

What is the principle of adequate protection

: What is the principle of adequate protection? Do you agree with the principle? What difficulties are associated with implementing it?

|

|

Product cost and respective current selling price

: Calculate full unit cost for products X and Y under the traditional costing system and calculate full unit cost for products X and Y under the new activity-based costing (ABC) system.

|

|

Build a gantt chart using microsoft project

: Discuss what it will take to build a Web architecture, move an existing Website with minimal downtime, and provide a disaster recovery solution to ensure the site is always available.

|

|

An increase in the demand for the firm’s product

: What is the impact on the firm’s employment level from the following events, according to the marginal productivity theory of labor demand?

|

|

Describe the molecular changes expected to occur

: a. a mutation that makes it impossible to deoxyribonucleotides to bind to the polymerase active site of DNA polymerase I b. a mutation in the coding sequence of DnaA in E. coli.

|

|

Calculate the cost per equivalent unit

: Prepare a schedule of equivalent units for each cost element for the month of March using the first in first out (FIFO) method and calculate the cost per equivalent unit for each cost element for the month of March using the weighted average method..

|