Reference no: EM13250032

Problem #1

The following information is available to reconcile Litner Co.'s book balance of cash with its bank statement cash balance as of April 30. The April 30 cash balance according to the accounting records is $78,356, and the bank statement cash balance for that date is $83,525.

a. The bank erroneously cleared a $480 check against the account in April that was not issued by Litner. The check documentation included with the bank statement indicates the check was actually issued by Lightning Co.

b. On April 30, the bank issued a credit memorandum for $53 interest earned on Litner's account.

c. When the April checks are compared with entries in the accounting records, it is found that Check No. 1828 had been correctly drawn for $1,530 to pay for advertising but was erroneously entered in the accounting records as $1,350

d. A credit memorandum indicates that the bank collected $10,000 cash on a note receivable for Litner, deducted a $30 collection fee, and credited the balance to the company's Cash account. Litner did not record this transaction before receiving the statement.

e. A debit memorandum of $895 is enclosed with the bank statement for an NSF check for $870 received from a customer. The bank assessed a $25 fee for processing it.

f. Litner's April 30 daily cash receipts of $5,102 were placed in the bank's night depository on that date, but do not appear on the April 30 bank statement.

g. Litner's April 30 cash disbursements journal indicates that Check No. 1837 for $584 and Check No. 1840 for $1,219 were both written and entered in the accounting records, but are not among the canceled checks.

1. Prepare the bank reconciliation for this company as of April 30.

|

Litner Company

|

|

|

|

|

|

|

Bank Reconciliation

|

|

|

|

|

|

|

April 30 2014

|

|

|

|

|

|

Book Balance

|

|

Bank Balance

|

|

|

|

Balance per books, Apr 30

|

|

78,356

|

|

Balance per bank, Apr 30

|

|

83,525

|

|

Add: Interest Income

|

53

|

|

|

Add: Deposit in Transit

|

|

5,102

|

|

Cr Memo for Notes Rec collected

|

9,970

|

10,023

|

|

Bank error on clearing chk

|

|

480

|

|

Total

|

|

88,379

|

|

Total

|

|

89,107

|

|

Less: Error on check 1828

|

|

|

|

Less: Check 1837 not included by bank

|

|

(584)

|

|

(Chk sh be 1,530 instead of 1,350)

|

|

(180)

|

|

Check 1840 not included by bank

|

|

(1,219)

|

|

NSF Check and bank charges

|

|

(895)

|

|

|

|

|

|

Adjusted balance per books

|

|

87,304

|

|

Adjusted balance per bank

|

|

87,304

|

2. Prepare the journal entries necessary to bring the company's book balance of cash into conformity with the reconciled cash balance as of April 30.

|

Journal Entries: DR (CR)

|

|

|

|

|

|

|

|

a) N/A

|

|

|

|

|

|

|

|

b) Cash in Bank 53

|

|

|

|

|

|

|

|

Interest Income (53)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c)Advertising Exp 180

|

|

|

|

|

|

|

|

Cash in Bank (180)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d) Bank Fees 30

|

|

|

|

|

|

|

|

Cash in Bank 9,970

|

|

|

|

|

|

|

|

Notes Receivables (10,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e) Bank Fees 25

|

|

|

|

|

|

|

|

Accts Recvble 870

|

|

|

|

|

|

|

|

Cash in Bank (895)

|

|

|

|

|

|

|

Problem #2 -

A company purchased merchandise inventory costing $15,000 with credit terms of 2/10, n/30 on November 7. On November 15, the company paid 1/3 of the amount due. The remaining balance was paid on December 7.

Required:

a. Record the journal entries related to this transaction using the gross method of recording purchases.

b. Record the journal entries related to this transaction using the net method of recording purchases.

c. Which method do you prefer? Why?

Problem #3

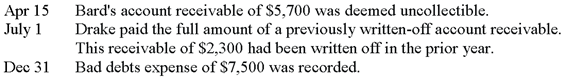

Timmons Company had a January 1, balance in its Allowance for Doubtful Accounts of $7,000 for the current year. The following transactions and events affected the Allowance for Doubtful Accounts during the current year:

a. What amount should appear in the allowance for doubtful accounts in the December 31, balance sheet for the current year?

b. How are the direct write-off method and the allowance method applied in accounting for uncollectible accounts receivables? Please explain in words.

Problem #4

A company purchased a machine for $75,000 that was expected to last 6 years and to have a salvage value of $6,000. At the beginning of the machine's fourth year the company decided that the machine's estimated useful life should be revised to a total of 10 years instead of 6 years. Also, the salvage value was re-estimated to be $5,500. Straight-line depreciation was used throughout the machine's life. Calculate the depreciation expense for the fourth year of the machine's useful life.

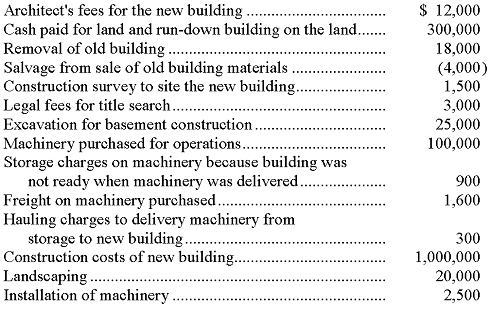

Problem #5

A company made thefollowing expenditures in connection with the construction of its new building:

Prepare a schedule showing the amounts to be recorded as Land, Buildings, and Machinery.

Problem #6

A company sells computers at a selling price of $1,800 each. Each computer has a 2 year warranty that covers replacement of defective parts. It is estimated that 2% of all computers sold will be returned under the warranty at an average cost of $150 each. During November, the company sold 30,000 computers, and 400 computers were serviced under the warranty at a total cost of $55,000. The balance in the Estimated Warranty Liability account at November 1 was $29,000. What is the company's warranty expense for the month of November?

Problem #7

Xtreme Sports has $100,000 of 8% noncumulative, nonparticipating, preferred stock outstanding. Xtreme Sports also has $500,000 of common stock outstanding. In the company's first year of operation, no dividends were paid. During the second year, Xtreme Sports paid cash dividends of $30,000. How should this dividend be distributed between common and preferred stockholders? Show your calculations.

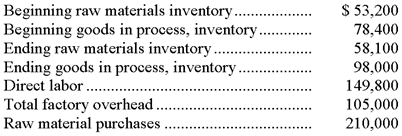

Problem #8

Information for the Ace Manufacturing Company follows:

Calculate the cost of goods manufactured for this company.

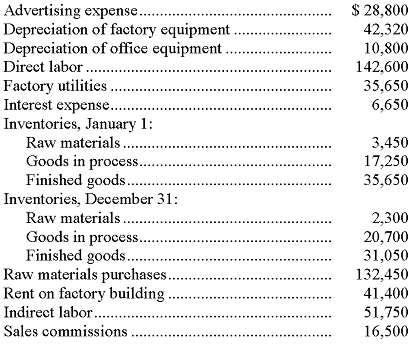

Problem #9

The following calendar year information about the Tahoma Corporation is available on December 31:

The company applies overhead on the basis of 125% of direct labor costs.

a. Calculate the amount of over- or under-applied overhead.

b. What is the significance of this over- or under-applied amount of overhead?

Problem #10

A company has a goal of earning $100,000 in after-tax income. The company must pay $28,000 in income tax if it achieves the goal. The contribution margin ratio is 30%. What dollar amount of sales must be achieved to reach the goal if fixed costs are $64,000?

Problem #11

Hess Co. manufactures a product that sells for $12 per unit. Total fixed costs are $96,000 and variable costs are $7 per unit. Hess can buy a newer production machine that will increase total fixed costs by $22,800 but variable costs will be decreased by $0.40 per unit. What effect would the purchase of the new machine have on Hess's break-even point in units?

Problem #12

This problem is the discussion board activity about the two homework problems on budgeting. Follow the instructions on the Week #10 budgeting discussion board. Your posting/participation in the discussion board activity is considered part of your final exam and is worth up to 10 points on the final exam. Your answers must be in your own words.