Reference no: EM13183587

Listed below are costs found in various organizations.

- 1. Property taxes, factory.

- 2. Boxes used for packaging detergent produced by the company.

- 3. Salespersons' commissions.

- 4. Supervisor's salary, factory.

- 5. Depreciation, executive autos.

- 6. Wages of workers assembling computers.

- 7. Insurance, finished goods warehouses.

- 8. Lubricants for production equipment.

- 9. Advertising costs.

- 10. Microchips used in producing calculators.

- 11. Shipping costs on merchandise sold.

- 12. Magazine subscriptions, factory lunchroom.

- 13. Thread in a garment factory.

- 14. Billing costs.

- 15. Executive life insurance.

- 16. Ink used in textbook production.

- 17. Fringe benefits, assembly-line workers.

- 18. Yarn used in sweater production.

- 19. Wages of receptionist, executive offices.

Required:

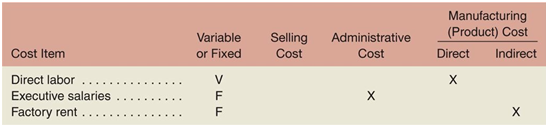

Prepare an answer sheet with column headings as shown below. For each cost item, indicate whether it would be variable or fixed with respect to the number of units produced and sold; and then whether it would be a selling cost, an administrative cost, or a manufacturing cost. If it is a manufacturing cost, indicate whether it would typically be treated as a direct cost or an indirect cost with respect to units of product. Three sample answers are provided for illustration.

Various costs associated with the operation of factories are given below:

- 1. Electricity to run production equipment.

- 2. Rent on a factory building.

- 3. Cloth used to make drapes.

- 4. Production superintendent's salary.

- 5. Wages of laborers assembling a product.

- 6. Depreciation of air purification equipment used to make furniture.

- 7. Janitorial salaries.

- 8. Peaches used in canning fruit.

- 9. Lubricants for production equipment.

- 10. Sugar used in soft-drink production.

- 11. Property taxes on the factory.

- 12. Wages of workers painting a product.

- 13. Depreciation on cafeteria equipment.

- 14. Insurance on a building used in producing helicopters.

- 15. Cost of rotor blades used in producing helicopters.

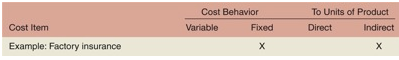

- Required: Classify each cost as either variable or fixed with respect to the number of units produced and sold. Also indicate whether each cost would typically be treated as a direct cost or an indirect cost with respect to units of product. Prepare your answer sheet as shown below:

Staci Valek began dabbling in pottery several years ago as a hobby. Her work is quite creative, and it has been so popular with friends and others that she has decided to quit her job with an aerospace company and manufacture pottery full time. The salary from Staci's aerospace job is $3,800 per month.

Staci will rent a small building near her home to use as a place for manufacturing the pottery. The rent will be $500 per month. She estimates that the cost of clay and glaze will be $2 for each finished piece of pottery. She will hire workers to produce the pottery at a labor rate of $8 per pot. To sell her pots, Staci feels that she must advertise heavily in the local area. An advertising agency states that it will handle all advertising for a fee of $600 per month. Staci's brother will sell the pots; he will be paid a commission of $4 for each pot sold. Equipment needed to manufacture the pots will be rented at a cost of $300 per month.

Staci has already paid the legal and filing fees associated with incorporating her business in the state. These fees amounted to $500. A small room has been located in a tourist area that Staci will use as a sales office. The rent will be $250 per month. A phone installed in the room for taking orders will cost $40 per month. In addition, a recording device will be attached to the phone for taking after-hours messages.

Staci has some money in savings that is earning interest of $1,200 per year. These savings will be withdrawn and used to get the business going. For the time being, Staci does not intend to draw any salary from the new company.

Required:

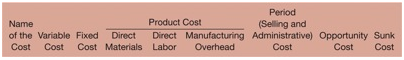

- 1. Prepare an answer sheet with the following column headings:

List the different costs associated with the new company down the extreme left column (under Name of Cost). Then place an X under each heading that helps to describe the type of cost involved. There may be X's under several column headings for a single cost. (That is, a cost may be a fixed cost, a period cost, and a sunk cost; you would place an X under each of these column headings opposite the cost.) Under the Variable Cost column, list only those costs that would be variable with respect to the number of units of pottery that are produced and sold.

- 2. All of the costs you have listed above, except one, would be differential costs between the alternatives of Staci producing pottery or staying with the aerospace company. Which cost is not differential? Explain.

|

Does this firm exhibit economies or diseconomies of scale

: Which input bundle represents efficient production of 100 units of output if the rental paid to capital is $25 and the wage paid to labor is $50? Round any decimals to the nearest hundredth. Derive the firm's cost function using the rental and wa..

|

|

What rate of nominal wage growth will workers seek

: Assume that workers, employers and investors all believed that inflation in the coming year would equal the annualized rate of inflation experienced in the past 6 months. Also assume that workers had been receiving nominal wage gains of 5% during ..

|

|

What is the output level that each of the firms agrees to

: A,B, and C decide to act illegally as a cartel, to divide the market equally among the three of them, and to set the price and output that will maximize their total profits. What price and output do they set? What is the output level that each of ..

|

|

What will happen because it is out of quilibrium

: Calculate total revenue, marginal revenue, marginal cost, and average cost at each level of sales fo the store. If Swim N Style is a profit maximizer, what number of suits will it sell per hour? What will its price and profit be? How can you tell wha..

|

|

Prepare an answer sheet with column headings

: All of the costs you have listed above, except one, would be differential costs between the alternatives of Staci producing pottery or staying with the aerospace company. Which cost is not differential? Explain.

|

|

State the final solid product sodium oxide

: Sodium bicarbonate decomposes to form the final solid product sodium oxide. Using a balanced equation, you are to convert the grams of sodium bicarbonate, one number is 5.213, to moles.

|

|

State the bracket series of emission lines falls

: The Bracket series of emission lines falls in the infrared region of the em spectrum, and each line is a result of an electron falling from a higher Bohr orbit to the n=4 level.

|

|

State what is the structure of the molecule

: In the NMR Spectra there is : 2 quartet( one has 2 hydrogens and the other has 3 hydrogens they are both located in the range 7.5-6.5) and there are two triplets at 4.5-3.5 and they both have two hydrogens, and there is a singlet located at 2.0 th..

|

|

Describe jscs current budget process

: Describe JSC's current budget process in terms of the concept of 'participative budgeting' and advise the CEO on how the current budget process may be leading to the performance problems being experienced at JSC, and on what changes you would recom..

|