Reference no: EM131110861

Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2013. The firm expects 2013 sales to total $3,000,000. The following information has been gathered.

(1) A minimum cash balance of $50,000 is desired.

(2) Marketable securities are expected to remain unchanged.

(3) Accounts receivable represent 10% of sales.

(4) Inventories represent 12% of sales.

(5) A new machine costing $90,000 will be acquired during 2013. Total depreciation for the year will be $32,000.

(6) Accounts payable represent 14% of sales.

(7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged.

(8) The firm's net profit margin is 4%, and it expects to pay out $70,000 in cash dividends during 2013.

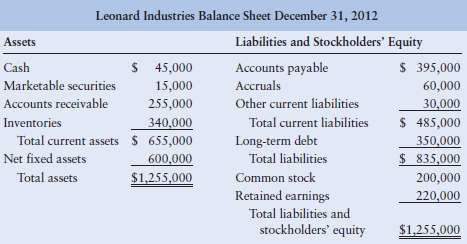

(9) The December 31, 2012, balance sheet follows.

�

a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2013, for Leonard Industries.

b. How much, if any, additional financing will Leonard Industries require in 2013? Discuss.

c. Could Leonard Industries adjust its planned 2013 dividend to avoid the situation described in part b? Explainhow.

|

Define and differentiate among the three basic patterns

: Define and differentiate among the three basic patterns of cash flow:(1) A single amount, (2) An annuity, and (3) A mixed stream.

|

|

What is the difference between future value and present val

: What is the difference between future value and present value? Which approach is generally preferred by financial managers? Why?

|

|

Press release indicating that sales will not be as high

: The SEC is trying to get companies to notify the investment community more quickly when a “material change” will affect their forthcoming financial results. In what sense might a financial manager be seen as “more ethical” if he or she follows this d..

|

|

Discuss the financing changes suggested by the statement

: Prepare a pro forma balance sheet dated December 31, 2014. Discuss the financing changes suggested by the statement prepared in parta.

|

|

Prepare a pro forma balance sheet for december

: Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2013. The firm expects 2013 sales to total $3,000,000. The following information has been gathered.

|

|

Explain how the percent of sales method could result

: Use the percent-of-sales method, the income statement for December 31, 2012, and the sales revenue estimates to develop pessimistic, most likely, and optimistic pro forma income statements for the coming year. Explain how the percent-of-sales method ..

|

|

Compare and contrast the statements developed

: Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2013. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2013. Compare and contrast the stat..

|

|

Discuss how knowledge of the timing and amounts involved

: Prepare a scenario analysis of Trotter's cash budget using -$20,000 as the beginning cash balance for October and a minimum required cash balance of $18,000. Use the analysis prepared in part a to predict Trotter's financing needs and investment oppo..

|

|

Check statements that will be affected immediately

: The following represent financial transactions that Johnsfield & Co. will be undertaking in the next planning period. For each transaction, check the statement or statements that will be affected immediately.

|