Reference no: EM13506971

Jan Martinelli, a junior in college, has been seeking ways to earn extra spending money. As an active sports enthusiast. Jan plays tennis regularly at the Naples Tennis Club, where her family has a membership. The president of the club recently approached Jan with the proposal that she manage the club's four indoor and 10 outdoor courts, including court reservations.

In return for her services, the club would pay Jan $300 per week, plus Jan could keep whatever she earned from lessons and the fees from the use of the ball machine. The club and Jan agreed to a one-month trial, after which both would consider an arrangement for the remaining two years of Jan's college career. On this basis, Jan organized Topspin. During remaining two years of Jan's college career. On the basis, Jan organized Topspin During April 2012, Jan managed the tennis courts and entered into the following transactions;

a. Opened a business account by depositing $1,000.

b. paid $300 for tennis supplies (practice tennis balls, etc).

c. Paid $200 for the rental of video equipment to be used in offering lessons during April.

d. Arranged for the rental of two ball machines during April for $250. Paid $100 in advance, with the remaining $150 due May 1.

e. Received $1,600 for lessons given during April.

f. Received $500 in fees from the use of the ball machines during April.

g. Paid $800 for salaries of part-time employees who answered the telephone and took reservations while Jan was giving lessons.

h. Paid $225 for miscellaneous expenses.

i. Received $1,200 from the club for managing the tennis courts during April.

j. Determined that the cost of supplies on hand at the end of the month totaled $180; therefore, the cost of supplies used was $120.

k. Withdraw $250 for personal use on April 30.

As a friend and accounting student, you have been asked by Jan to aid her in assessing the venture.

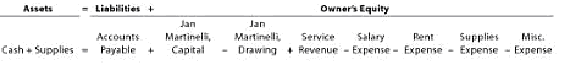

l. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Prepare an income statement for April.

3. Prepare a statement of owner's equity for April. The statement of owner's equity for a proprietorship is similar to the retained earnings statement for a corporation. The balance of the owner's capital as of the beginning of the period is listed first. Any investments made by the owner during the period are then listed and the net income (net loss) is added (subtracted) to determine a subtotal. From this subtotal, the owner's withdrawals are subtracted to determine the increase (decrease) in owner's equity for the period. This increase (decrease) is then added to (subtracted from) the beginning owner's equity to determine the owner's equity as of the end of the period.

4. Prepare a balance sheet as of April 30.

5. a. Assume that Jan Martinelli could earn $9 per hour Working 30 hours week as a waitress. Evaluate which of the two alternatives, working as a waitress or operating Topsin, would provide Jan with the most income per month.

b. Discuss any other factors that you believe Jan should consider before discussing a long-term arrangement with the Naples TennisClub.