Reference no: EM13201

1- Explain how a policy mix (like the one used in 1990s) could help reduced to eliminate the budget deficit without having an adverse effect on the output. Illustrate your answer using IS-LM graph.

2- A 1- year Canadian bond with a face value of 5000 can be purchased at 4800.

a) Calculate the nominal interest rate in Canada.

b) If the Canadian dollar is expected to depreciate against the US dollar by 1 % over the next year, calculate the current nominal interest rate in the US.

c) How much could an American bond with the same Face value as the Canadian bond sell in the market?

3- Suppose the economy is currently in recession, and the exchange rate if fixed using the IS-LM model.

a) explain and illustrate the economy adjustment ( in the medium run)

b) Explain and illustrate the economy adjustment (in the medium run) without devaluation.

4- Suppose the firm mark up over the cost is 10% and the wage setting equation is W=P (1-u) where U is the unemployment rate.

a) Find out the real wage rate implied by the price setting equation.

b) Determine the natural rate of unemployment.

c) Plot the wage- setting and price setting equation or a property labelled graph and identity the nature rate of unemployment.

5- Carefully explain the neutrality of money on the medium run. Use an aggregate demand - Aggregate supply diagram to illustrate your answer.

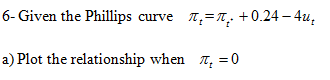

b) Find the natural rate of unemployment (NAIRO)

c) What is likely to happen to the curve if wage indexation becomes more widespread? illustrate your answer on the graph?

|

A comprehensive study about web-based email implementation

: Conduct a comprehensive study about web-based email implementation in gmail. Optionally, you may use sniffer like wireshark or your choice to analyze the communication traffic.

|

|

Finite difference method

: Use the finite difference method to calculate the temperature at the point specified since it is easier.

|

|

Edmonton tornado 1987 - canadian disaster assignment

: Research and write a paper on a devastating catastrophe which has occurred in Canadian history. In the paper, you must address the following questions: Topic: Edmonton tornado 1987

|

|

Cost accounting assignment

: Evaluate Method of measuring costs associated with production, budgeting process, normal job-order costing system , master budget, cycle time.

|

|

Macroeconomics fourth canadian edition

: Answer the following questions as these general questions pertain to the specific issue selected.The questions that you will cover with respect to your choice of broad social issue in the paper are given.

|

|

Social issue

: Answer the following questions as these general questions pertain to the specific issue selected.The questions that you will cover with respect to your choice of broad social issue in the paper are given.

|

|

Lithium ion battery technology

: The paper includes Lithium ion battery technology with its advantages and disadvantages. The paper discusses about the Lithium air battery in which detailed reactions of Lithium with air including nonaqueous as well as aqueous are given.

|