Reference no: EM131115247

Jacob Bower has a liability that:

• has a principal balance of $100 million on June 30, 1998,

• accrues interest quarterly starting on June 30, 1998,

• pays interest quarterly,

• has a one-year term to maturity, and

• calculates interest due based on 90-day LIBOR (the London Interbank Offered Rate).

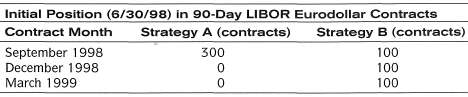

Bower wishes to hedge his remaining interest payments against changes in interest rates. Bower has correctly calculated that he needs to sell (short) 300 Eurodollar futures contracts to accomplish the hedge. He is considering the alternative hedging strategies outlined in the following table.

a. Explain why strategy B is a more effective hedge than strategy A when the yield curve undergoes an instantaneous nonparallel shift.

b. Discuss an interest rate scenario in which strategy A would be superior to strategyB.

|

Compute the roi for each company

: Compute the ROI for each company. Which company has higher profit margin? Does it make sense, based on what you know about Apple and Dell

|

|

Calculate mean and standard deviation for the percent change

: Use Excel to calculate the mean and standard deviation for the percent changes in market indices. Perform the same calculations for the percent changes in interest rates. What do these numbers indicate?

|

|

Accounting for pollution expenditure counting crows company

: Accounting for Pollution Expenditure Counting Crows Company operates several plants at which limestone is processed into quicklime and hydrated lime.

|

|

Linear programming model for the make

: Formulate a linear programming model for the make-or-buy decision for Cleveland Stapler that will meet the 5,000-unit demand at a minimum total cost.

|

|

Is he considering the alternative hedging strategies outline

: calculates interest due based on 90-day LIBOR (the London Interbank Offered Rate). Bower wishes to hedge his remaining interest payments against changes in interest rates. Bower has correctly calculated that he needs to sell (short) 300 Eurodollar fu..

|

|

How much or how little their life is mcdonaldized

: In the final journal entry, they will reflect upon the first three entries to decide, overall, how much or how little their life is McDonaldized, and state how this impacts their relationships, their sense of identity, and their choices in life. S..

|

|

Prepare the intangible assets section of montana matts golf

: Prepare the journal entry to record amortization expense for 2010. Prepare the intangible assets section of Montana Matt's Golf Inc. at December 31, 2010. (No impairments are required to be recorded in 2010.)

|

|

Would it be advantageous to the organization to have two hr

: Would it be advantageous to the organization to have two HR Departments, one department assigned the responsibility for compliance with external and internal regulations.

|

|

Purpose of using data flow diagramming

: What is the purpose of using data flow diagramming in analysis phase? How would you analyze and depict the workings of a process? List at least three advantages of using data flow diagramming in the analysis phase.

|