Reference no: EM13503312

Question 1 Strategic Management Accounting Case Study

(For assistance on how to answer this question you are advised to undertake the case study from Mars Petcare which is provided online in Module 2 as the Topic Reflection Task)

'Nutty Nut' Candy Coated Chocolate

STRATEGIC MARKET ANALYSIS

You have joined the cross-discipline Strategic Management Committee of the Confectionery Division within Jupiter Australia as the management accounting representative. The key issue facing this top level management committee at the moment is how to improve profitability in several key product categories.

The product currently under discussion is the 'Nutty Nut' line of sugar coated chocolates sold by Jupiter through the major supermarket chains in Australia and New Zealand. The product has been a great success story for the Jupiter Confectionery Division however lately it has come under increased price competition and the sales and market share of 'Nutty Nut' chocolates have fallen dramatically. The major competition comes from a similar product branded as 'N&N's' which is manufactured by a multinational rival.

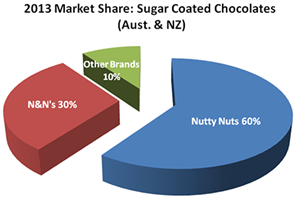

The Marketing Department for the Jupiter Confectionery Division has provided the following information about the sugar coated chocolate market during 2013:

The Marketing Department advises you that at the end of the 2012 year Nutty Nut's market share had been 80% and N & N's had been only 10%. Since that time N & N's have been advertising heavily and aggressively pricing their product in the market, increasing their market share to the current level of 30%. The marketing department believes that by discounting the wholesale sale price by $0.25 to $2.75, gross unit sales will increase by 20%. The research and development team have identified that by slightly altering the raw material mix a saving of 10% of prime costs can also be made.

As the Management Accounting representative you have provided the Strategic Management Committee with the following breakdown of revenues and costs for the 'Nutty Nut' product line for the just completed 2013 year:

|

Nutty Nut

|

|

|

Total Assets 'Nutty Nut' Factory

|

$30m

|

|

Total Sales (Volume in Units)

|

18m

|

|

Regular Retail Price (per unit retail price)

|

$3.99

|

|

Gross Sales Value Received (per unit wholesale price)

|

$3.20

|

|

Supermarket Rebates (per unit)

|

$0.20

|

|

Net Sales Value Received (per unit)

|

$3.00

|

|

Prime Costs (per unit)

|

$0.75

|

|

Other Manufacturing Costs (per unit)

|

$1.25

|

|

Logistic Costs (per unit)

|

$0.75

|

|

Gross $ Margin (Gross Profit) (per unit)

|

$0.25

|

|

Total $ Margin (Gross Profit)

|

$4.5m

|

|

% Margin on Net Sales Value

|

8.33%

|

|

% Return on Total Assets (ROTA)

|

15%

|

The CEO of Jupiter Confectionery, who is the Chair of the Strategic Committee, advises that even allowing for the 10% reduction in prime costs, discounting the product by $0.25 per unit will mean that the product will no longer achieve the firm's required return on total assets (ROTA) of 17.5%. ROTA is calculated by dividing Gross Profit by Total Assets and currently sits at 15%. The CEO argues that if this remains the case, the previously successful 'Nutty Nut' product line may have to be discontinued.

You advise the Committee that you are aware that the 'Nutty Nut' manufacturing facility is currently running at 53% of its practical capacity and that the warehouse facility (logistics) is running at 62% capacity. You are also aware that whilst the 'Nutty Nut' product's Prime Costs are 100% Variable, Other Manufacturing Costs and Logistic Costs are made up of 80% Fixed and 20% Variable cost.

It can be assumed that this cost break-down between variable and fixed costs will hold consistently across the industry (including for the 'N & N' competitor). Assume 90% of the predicted 'Nutty Nut' unit sales increase is made at the expense of their main competitor 'N&Ns' unit sales. Finally, assume that 'N&N' costs start out the same as 'Nutty Nut' and that the competitors make no immediate competitive adjustment to their offering.

You ask if you can be given time to prepare a report for the Strategic Committee on the cost and profit implications of the proposed changes and resultant increase in sales and production.

(i) Using excel prepare a 'before and after' comparative analysis of the revenues and costs of the 'Nutty Nut' product line incorporating the 20% predicted sales increase and the 10% predicted savings in prime costs (Ensure you include any impact of the production increase on manufacturing and logistics costs in your analysis).

(ii) Prepare a brief report (approx. 300 words) for the Strategic Management Committee outlining the key points of your findings. Include some discussion on:

a. the likely impact of the changes on the cost and profit structure of Jupiter Confectionery (derived from your answer to (i)).

b. Calculate and discuss the likely impact of the changes on the cost structure of 'N&N's' our main competitor (use Excel).

c. Make a recommendation to the Committee on whether to go ahead with the planned changes. Include any other strategic advice that you consider relevant to the Committee's decision making.

Question 2 Manufacturing Cost Schedule and Income Statement

Neptune Manufacturing Co is a wholly owned subsidiary of Jupiter Australia and utilises a traditional manufacturing cost flow inventory and accounting system. Neptune Manufacturing Co is incorporated and operates in Australia and pays tax at the Australian corporate rate of 30%. There are no adjustments for accruals or prepayments.

Trading data for Neptune Manufacturing Co for the 2013 calendar year was as follows:

|

Account:

|

$

|

|

Raw Materials & Ingredients (Purchases)

|

12,582,000

|

|

Freight Inwards

|

370,000

|

|

Plant Utility Costs

|

2,486,500

|

|

Depreciation of Factory Plant, Equipment & Machinery

|

1,250,000

|

|

Depreciation of Office Equipment & Furniture

|

156,000

|

|

Office Salaries and Costs

|

1,256,000

|

|

Factory Direct Labour Cost

|

3,658,000

|

|

Factory Indirect Labour Cost

|

1,123,000

|

|

Manufacturing Overhead

|

482,000

|

|

Interest & other charges

|

1,901,000

|

|

Sales Revenue

|

32,101,000

|

|

Freight Outwards

|

672,000

|

|

Sales & Marketing Expenses

|

1,985,000

|

|

Accounting & Audit costs

|

875,000

|

On December 31st 2013 selected account balances of Neptune Manufacturing Co were as follows (with comparative 31/12/2012 Opening Balance figures):

|

Account:

|

Dec 31, 2013

|

Dec 31, 2012

|

|

Cash & Cash Equivalents

|

327,000

|

1,243,000

|

|

Accounts Receivable

|

2,459,000

|

1,926,000

|

|

Factory Plant, Equipment & Machinery (at cost)

|

8,500,000

|

7,125,000

|

|

Office Equipment & Furniture (at cost)

|

1,500,000

|

1,450,000

|

|

Land & Buildings (at cost)

|

13,500,000

|

13,500,000

|

|

Raw Material Inventory

|

386,500

|

426,000

|

|

Work in Process (WIP) Inventory:

|

|

|

|

Raw Materials

|

1,178,000

|

902,000

|

|

Direct Labour

|

647,000

|

561,000

|

|

Manufacturing Overhead

|

296,000

|

205,000

|

|

Total WIP

|

2,121,000

|

1,668,000

|

|

Finished Goods Inventory

|

1,254,000

|

1,002,000

|

|

Accounts Payable

|

621,000

|

987,000

|

|

Long Term Debt

|

15,000,000

|

15,000,000

|

Using Excel prepare a Schedule of Cost of Goods Manufactured, Schedule of Cost of Goods Sold, and an income statement for the Jupiter Manufacturing Co from the information provided.

Question 3 Process Costing

As management accountant for the Confectionery Division of Jupiter Australia you are required to produce end of period product costing for a range of different product lines including the 'Nutty Nut' chocolate range. The Jupiter Australia factory responsible for manufacturing these products operates continuously 24 hours a day, 7 days a week and utilises a process costing system and manufactures for the Australian domestic market and the Australasian export market.

The process for manufacturing Nutty Nut is to first make the chocolate, which is then formed into the correct size for each Nutty Nut candy, and which are then coated in a colourful sugar casing. All Raw Material ingredients for the chocolate and sugar coating are added at the commencement of the process including cocoa, milk products, and chocolate liqueurs. For the purpose of accounting the conversion costs of manufacturing are assumed to occur evenly across the whole of the production cycle which takes several hours.

The following information relates to the production of 'Nutty Nut' confectionary during the month of January 2014. The Stock Keeping Unit (SKU) adopted for inventory purposes is a batch pack of 1000 individual chocolates.

|

Work-in-Process: Jan 1, 2014

|

87,214 SKUs

|

|

|

Stage of completion

|

Value

|

|

Raw materials

|

100%

|

$526,800

|

|

Conversion

|

30%

|

$202,100

|

|

|

|

|

Work-in-Process: Jan 31, 2014

|

127,800 SKUs

|

|

|

75% Complete

|

A total of 3,926,100 SKUs were commenced during January and the following costs were incurred.

|

Costs incurred during January 2014:

|

|

Raw materials

|

$24,546,500

|

|

Conversion

|

$28,236,400

|

Required:

(i) Using the Weighted Average Cost Method determine the cost value of closing WIP and the cost value of goods transferred out during the period.

(ii) Using the First In First Out (FIFO) method determine the cost value of closing WIP and the cost value of goods transferred out during the period.

Question 4 Comprehensive Manufacturing Budget

You have been asked to prepare a 5 year budget forecast for the 'Chumpy' Dog Food canned product.

This division of the Neptune Australia company utilises a traditional manufacturing cost flow inventory and accounting system.

As at December 31st 2013 the following financial and trading data was provided:

|

2013 Year data (all costs are per unit)

|

|

|

Sales (Units)

|

52.7 million

|

|

Price (average 2013 price received)

|

$1.2500

|

|

Prime Costs (per unit)

|

|

|

Ingredients & Canning

|

$0.2150

|

|

Labour

|

$0.0150

|

|

Other Manufacturing Costs (per unit)

|

$0.5450

|

|

Inventory on Hand (at valuation):

|

|

|

Ingredients & Packaging (1,013,000 units)

|

$223,000

|

|

Finished Goods (2,020,500 units)

|

$1,580,500

|

|

Sales and Marketing Costs

|

3,275,000

|

|

Finance Costs

|

2,865,200

|

|

Administration Costs

|

3,865,000

|

|

|

|

Market Research has indicated that the canned dog food market will continue to grow faster than the general economy. Sales of the Chumpy product are expected to increase in unit terms at a rate of 6% above the current long term inflation rate of 2.5%. Sales Price increases for Chumpy are expected to be kept in line with inflation during the budget period. All other manufacturing costs including direct labour and ingredient costs are expected to increase at the rate of inflation. All manufacturing costs (including overhead) are assumed to vary directly with production (unless otherwise stated). The company pays tax at the Australian Corporate tax rate which is expected to hold at current levels. The inflation rate of 2.5% is expected to hold over the 5 year budget period.

The 'Chumpy' canned dog food factory maintains target safety stock of raw materials inventory and tin can inventory amounting to the equivalent of one (1) week of the current year's budgeted unit production. Finished goods inventory levels are kept at the equivalent of two (2) weeks of the current year's budgeted unit sales. At the end of the 2013 calendar year there were 2,020,500 completed units of Finished Goods in the warehouse. There was enough raw materials and tin can inventory on hand at December 31st to manufacture 1,013,000 units. The Chumpy dog food division does not utilise a Work in Process inventory account.

The Chumpy factory has been operating out of its site in Wodonga for nearly 40 years and has undergone several upgrades. The manufacturing facility is currently operating at approximately 85% of its total practical capacity of 62 million cans of dog food per annum.

(i) Using Excel develop a Sales, Production and Purchase budget as well as a budgeted Schedule of Cost of Goods Manufactured, Schedule of Cost of Goods Sold, and an Income Statement for each of the 5 years in the budget period (commencing 2014) (advice on the form of these budgets will be provided on the subject Interact site and is also available in the Appendix to Chapter 9 of the text book). This budget must also take into account the manufacturing facility practical capacity production constraint. Your spreadsheet must include a data section which enables inputs to be simply altered and 'what if' analysis to be undertaken. (Excel resources are provided on your Interact site to guide students on the use of the 'IF' formula which can be used for the budget production constraint).

You should be able to drag the formula across for the whole of the budget if the first years are properly constructed with a data input section and using absolute referencing. This makes the process much quicker and easier. An Excel help file has been placed on the Interact site to assist students.

(ii) The Neptune Australia Strategic Management Committee has before them two options for consideration. Option 1 is to leave the facility as it is and incur normal repair and maintenance costs which are already budgeted for in factory running costs. Option 2 is to undertake major capital works and upgrade the cooking ovens and production line technology which will increase practical production capacity by 25% in the 2016 year. The upgrade can be completed by the end of the 2015 calendar year. If the upgrade is undertaken it will cost the firm $600,000 in financing costs per annum commencing in the 2016 year.

Using the excel model developed in part (i) calculate the impact on sales and profit if the option of upgrading the manufacturing facility is exercised and the practical production capacity of the factory is increased by 25% (Submit results as a separate worksheet).

(iii) Given your findings from part (i) and (ii) write a report for the Strategic Management Committee of Neptune Australia recommending whether to take up the option to upgrade the production facility. In your report consider all of the strategic and financial implications to the firm of reaching its production constraint and any implications or opportunities arising from upgrading the facility and having extra productive capacity. Your grade will depend on the accuracy and depth of your analysis, and your capacity to identify strategic issues which management should consider when making their decision (approx. 300 words).

Question 5 Overhead Allocation

Pluto Pasta Co (a division of Neptune Australia) manufactures ready to eat pasta meals. Pluto Pasta has two largely automated production departments: Mixing and Cooking. The Mixing and Cooking departments are supported by three support departments: Repairs & Maintenance (R&M), Information Technology (IT) and Human Resources (HR).

The support costs of the R&M department are allocated to other departments based on the number of machines operating in each of the other departments. In the Mixing production department there are 10 automated mixing machines, the Cooking production department operates using 6 automated cooking machines, and the IT and HR departments have no machines requiring maintenance.

IT department costs are allocated based on the number of computers requiring service in each of the other departments. In the Mixing department there are 10 computers, the Cooking department operates using 20 computers, and the R&M and HR departments have 5 computers each.

HR department costs are allocated based on the number of staff employed in each department. R&M employ 4 staff, IT employ 6, whilst Mixing and Cooking employ 20 staff each.

Manufacturing costs for the year for the Mixing department is $1,900,000 whilst for Cooking it is $2,300,000. The R&M department has budgeted costs of $702,000, IT has budgeted costs of $786,000, and HR has budgeted costs of $525,000.

The following schedule represents the use of the R&M, IT and HR departments services during the year:

|

|

User of Service

|

|

Provider of Service

|

R&M

|

IT

|

HR

|

Mixing

|

Cooking

|

|

R&M (No. of Machines)

|

-

|

0

|

0

|

10

|

6

|

|

IT (No. of Computers)

|

5

|

-

|

5

|

10

|

20

|

|

HR (No. of Staff)

|

4

|

6

|

-

|

20

|

20

|

One of the service departments (R&M) does not provide any services to the other service departments (IT & HR) and so does not have a reciprocal relationship.

The solution I would propose is that the R&M service department be distributed directly to the Mixing and Cooking production departments.

This will leave only HR and IT remaining with the reciprocal relationship to resolve. However, this will mean that the % weights of service provision for each of those service departments will need to be recalculated following the removal of the % weight provided to R&M (as in the Step method). After doing this the reciprocal method can be solved for by using simultaneous equations between the IT and HR service departments as per the fully worked practice set solution provided in the Tutorial folder in Resources on Interact.

Required: Calculate the total production cost for both the Mixing department and the Cooking department using:

(i) The Direct Method of Overhead Allocation

(ii) The Step Method of Overhead Allocation (Use the method recommended in the text on p. 307 to decide in which order to allocate departments)

(iii) The Reciprocal Method of Overhead Allocation (Students may solve using either Excel or Simultaneous Equation methods)

(iv) Briefly compare and contrast Activity Based Costing (ABC) approaches to Overhead Allocation with traditional methods of allocating overhead such as using department or factory-wide cost drivers

Question 6 Just-in-time

Following your preparation of the 5 year budget for Chumpy dog food (Question 4) you are concerned by the levels of inventory held by the company in Raw Materials and in Finished Goods. A long sales and production history for the Chumpy product is available (40 years) and sales and production levels have been very predictable.

Write a report to the Strategic Management Committee detailing the potential benefits of adopting a Just-In-Time (JIT) manufacturing system for Chumpy. Use the data provided on inventory levels in the question 4 and the long sales/production history to support your analysis.

In your report identify any potential business risks associated with adopting a JIT approach.

Rationale

This assignment directly addresses some of the key learning outcomes for ACC210 including that on successful completion of the subject students will:

• be able to demonstrate technical, computational, and analytical skills associated with the design and operation of product costing and accounting control systems;

• be able to discuss issues associated with contemporary performance measurement;

• be able to use computer spreadsheets as an aid to product costing, budgeting and performance evaluation; and

• be able to communicate effectively in designing reports for management.

The requirements of this assignment cover up to and including Topic 7 of the Subject Outline. The assignment is designed to develop your problem solving, spreadsheet (Excel) design, and written communication skills. The questions require you to apply the knowledge and tools covered in the subject topics in order to demonstrate your understanding of the subject content and also to illustrate your capacity for strategic thinking. The assignment will also test your ability to communicate and explain the impacts of your findings whether through quantitative or written reports.

The ability to communicate effectively has been identified by the accounting professional bodies as being critical to your future role as an accountant.