Reference no: EM1388077

Question 1:

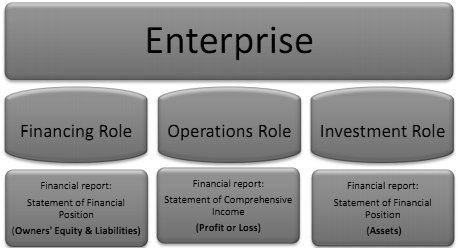

1.Using the diagram below,‘Building Blocks of Financial Management', explain the three most important decisions financial managers make. Use an example from your workplace (or one with which you are familiar) to demonstrate your understanding.

2 Assume a loaf of bread costs R12.50 and that grocery prices increase at a rate of 8% per year. How much will a loaf of bread cost in six years' time? Show the formula and your calculations.

3 One of your clients is willing to settle a dispute with your company. They will pay you R7 000 per year for the next ten years (at the end of each year) or one lump sum right now. Assuming your money is worth 9%, what lump sum would you be willing to settle for? Show the formula and your calculations.

Question 2

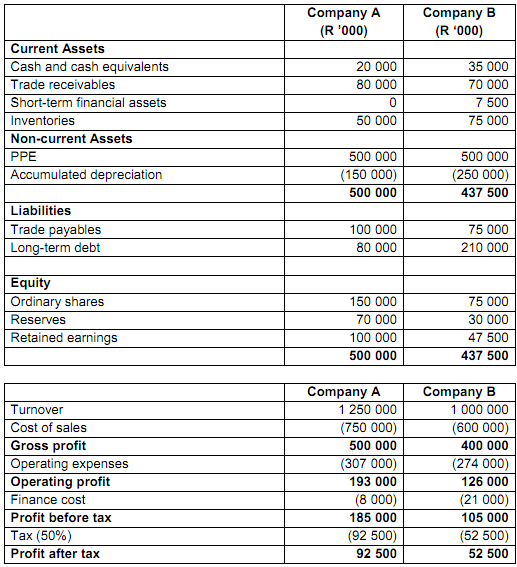

You have been provided with selected data from two companies A and B, both of which are in the same industry.

Both companies have 75 000 ordinary shares issued.

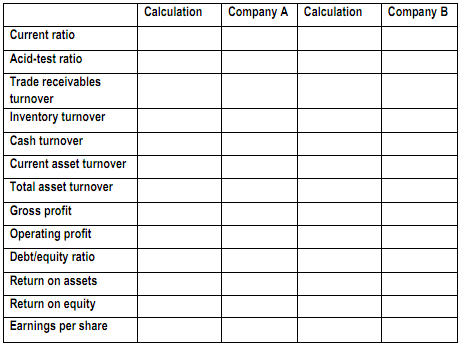

1 Calculate the ratios listed in the table below. In each case show your calculation in the preceding column.

2 Compare the data from companies A and B keeping in mind they are both in the same industry.In comparing the ratios, look at each ratio (or set of ratios) and conclude with an overall assessment of their financial performance.

3 In no more than 2 to 3 sentences describe the industry in which your company (or one with which you are familiar) operates.

Then, identify three appropriate industry specific ratios that you could recommend to management for use in the analysis of periodic results in your company. In each case, state the ratio (formula), explain the components, and discuss why the ratio will be a useful contribution to periodic analysis.

4 Discuss the disadvantages of ratio analysis. You must use questions 1 to 3 and examples from your workplace to substantiate your discussion.

Question 3

1. Assume that you want to buy a kombi taxi for R100 000. The annual revenue generated by this kombi is expected to be R50 000, increasing by 10% per annum. Expenses will amount to R12 000, increasing by 5% per annum. The kombi taxi must be depreciated by 20% per annum and you are in the 40% tax bracket. Determine the annual operating cash flows for this project for the five-year life of the project.

2. Using the data from above calculate:

a) theNet Present Value using a discount rate of 12%; and

3. Using the information from 1 and 2 above, discuss whether you should go ahead with the project.