Reference no: EM131145790

Directions 1:

Complete the tasks described in the steps provided. Submit both a Microsoft Word and a Microsoft Excel document that contain the results of the tasks that show the completion of the tasks.

Refer to the Century National Bank data.

Let's assume that the 60 sample account balances of Century National Bank customers are a random sample from the population of all Century National Bank customers.

Part I

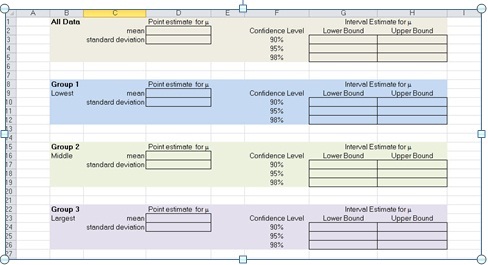

1. Find a point estimate and confidence interval estimates of the mean account balance of all Century National Bank customers.

Find a point estimates and confidence interval estimates of the mean account balance of Century National Bank customers for each of the groups: Lowest balances, Middle balances and Largest balances. Use formulas in the Excel spreadsheet.

See the screenshot below as a guide for organizing your answer.

2. Create at least one graphic to help you better understand the findings.

3. What further analysis do you recommend?

4. Test the hypothesis that the mean account balance of all customers is greater than or equal to $1,700.

The null hypothesis is H0: µ > 1,700 .

See the suggestion below for organizing your answer using the steps given in the textbook.

|

1. State the null hypothesis and the alternate hypothesis

|

H0: µ > 1,700

|

|

|

|

|

2. Select the level of significance

|

α = .05

|

|

|

|

|

3. Select the test statistic or calculate the P-value

|

|

|

|

z-Test statistic:

|

?????

|

|

|

P-value

|

?????

|

|

|

|

|

4. Formulate the decision rule

|

Reject if the test statistic is less than the critical value z = ?????

|

|

|

|

Or reject if α > P-value

|

|

|

|

|

5. Make a decision

|

???????

|

|

|

|

|

6. Interpret the result

|

?????????

|

5. Write a paragraph summarizing your findings.

Directions 2:

Complete the tasks described in the steps provided. Submit both a Microsoft Word and a Microsoft Excel document that contain the results of the tasks that show the completion of the tasks.

Refer to the Century National Bank data.

Let's assume that the account balances of Century National Bank customers in each of the three groups are a random sample from the lowest balances, middle balances and largest balances of Century National Bank customers. Let µ1, µ2, and µ3 denote the mean balance of the group with the lowest, middle and largest balances, respectively.

Part I

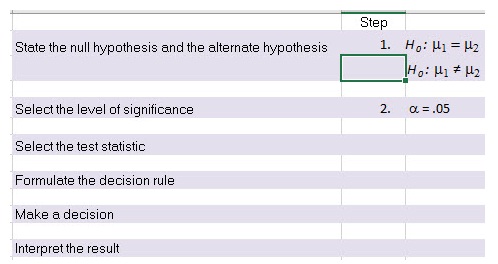

1. Conduct two - samples tests of hypothesis on difference between each of the 3 group mean balances:

H0: µ1 - µ2 = 0

H0: µ1 - µ3 = 0

H0: µ2 - µ3 = 0

2. See the screenshot below as a guide for organizing your answer.

3. What assumptions did you make in the analysis?

4. Write a paragraph summarizing your findings.

Part II

5. Conduct tests of hypothesis of the three account balance variances:

H0: σ12 - σ22 = 0

H0: σ12 - σ32 = 0

H0: σ22 - σ32 = 0

6. Do the results of the hypothesis tests contradict the assumptions made in Part I of this assignment?

7. Conduct an ANOVA test on account balances for the three groups to determine whether the various group means came from a single population or different populations with different means. Show each step of six-step hypothesis-testing procedure.

H0: μ1=μ2=μ3

8. What assumptions did you make in the analysis?

9. What is your interpretation of the results?

10. What further analysis do you recommend?

Attachment:- _Homework-Excel-direction 1.rar

Attachment:- Homework-Excel-Direction 2.rar

|

Which savings account offers the higher apy

: savings account A compounds interest semiannually, while savings account B compounds interest quarterly. Which savings account offers the higher APY?

|

|

Provide an example that fits the given description

: All foreign currency transactions are foreign transactions, but not all foreign transactions are foreign currency transactions. Provide an example that fits this description, and explain why it is important to understand this concept.

|

|

What happens to the unemployment rate in the short run

: What should the Fed do? Show how the Fed's action, combined with the decline in business confidence, affects the AS-AD diagram in the short run and the medium run.

|

|

Discussion training method as applies to today virtual era

: Based on the scenario, assess key roles of the lecture / discussion training method as it applies to today's virtual era. Provide examples from the scenario and the textbook to support your rationale

|

|

Find a point estimate and confidence interval estimates

: ind a point estimate and confidence interval estimates of the mean account balance of all Century National Bank customers.

|

|

Internal recruiting

: Discuss the given point below on Internal recruiting OBJECTIVES:• Understand how recruitment can focus on filling positions with employees already employed in an organization • Grasp the issues associated with internal recruitment

|

|

Discuss the specific risks and nature of the company

: Consider and discuss the specific risks and nature of the company you will be auditing. Create comprehensive audit programs for the cash, financial instruments, sale, and receivables accounts and cycles.

|

|

What does this imply for the slope of the is curve

: What does this imply for the slope of the AD curve? Continue to assume that the interest rate has no effect on investment.

|

|

Should keith be concerned about the payments

: Should Keith be concerned about the payments, and if so, why? After reviewing the supplemental Ethics Power Point Presentation, which ethical approach (choose one from the choices below) best explains the ethical principles behind laws prohibiting ..

|