Reference no: EM131119791

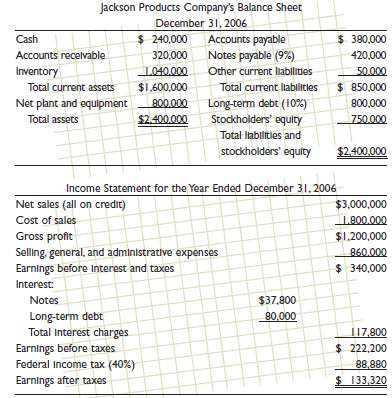

Using the following data for Jackson Products Company, answer Parts a through g:

Jackson Products Company's Balance Sheet

Industry Averages

Current ratio .................. 2.5:1

Quick ratio .................. 1.1:1

Average collection period (365-day year) ...... 35 days

Inventory turnover ratio ............. 2.4 times

Total asset turnover ratio ............. 1.4 times

Times interest earned ratio ............. 3.5 times

Net profit margin ratio .............. 4.0%

Return on investment ratio ............. 5.6%

Total assets/stockholders' equity (equity multiplier) ratio .. 3.0 times

Return on stockholders' equity ratio ......... 16.8%

P/E ratio .................. 9.0 times

a. Evaluate the liquidity position of Jackson relative to that of the average firm in the industry. Consider the current ratio, the quick ratio, and the net working capital (current assets minus current liabilities) for Jackson. What problems, if any, are suggested by this analysis?

b. Evaluate Jackson's performance by looking at key asset management ratios. Are any problems apparent from this analysis?

c. Evaluate the financial risk of Jackson by examining its times interest earned ratio and its equity multiplier ratio relative to the same industry average ratios.

d. Evaluate the profitability of Jackson relative to that of the average firm in its industry.

e. Give an overall evaluation of the performance of Jackson relative to other firms in its industry.

f. Perform a DuPont analysis for Jackson. What areas appear to have the greatest need for improvement?

g. Jackson's current P/E ratio is 7 times. What factor(s) are most likely to account for this ratio relative to the higher industry averageratio?