Reference no: EM131384

Question 1

You are considering investing in Facial Laboratories. Suppose Facial is currently undergoing expansion and is not expected to change its cash dividend while expanding for the next 4 years. This means that its current annual $3.00 dividend will remain for the next 4 years. After the expansion is completed, higher earnings are expected to result causing a 30% increase in dividends each year for 3 years. After these three years of 30% growth, the dividend growth rate is expected to be 2% per year forever. If the required return for Facial's common stock is 11%, what is a share worth today?

Question 2

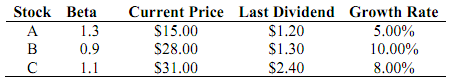

You are considering three stocks for investment purposes. The required return (rj) on the market portfolio is 14%, and the riskless return is 9%. On the basis of the information that follows, in which (if any) of the below stocks should you invest?

Question 3

Joe Brown and Fred Anthony are planning to invest in a Go Green project. The marginal tax rate is 26% and the company tax rate is 30%. Due to their lack of finance expertise, they have asked your assistance in determining whether they should invest in Go Green or not.

They have provided you with the following information:

- The project has a life of 6 years.

- The equipment costs $280000 with an additional installation cost of $25000.

- The equipment will be sold at the end of project life for $55,000

- Straight line method is used in calculating depreciation.

- The Fiji Tax Authority has given this type of equipment an effective life of 5 years.

- Sales for the first year will be $85000 and sales are expected to grow at 7% pa for each year of the project.

- Cost of goods sold is 18 percent of sales every year

- Working capital will be 7% of sales revenues for each year. The working capital investment has to be made at the start of each period. All working capital will be recovered.

- Marketing costs will be 2% of sales per annum.

- The hurdle rate is 10%.

Required:

a. Determine NPV for Go Green project.

b. Determine IRR for Go Green project using interpolation method (trial and error method).

c. Advice Joe Brown and Fred Anthony on the acceptability of Go Green project.

d. Is IRR or NPV more reliable when choosing a project? Why?

Question 4

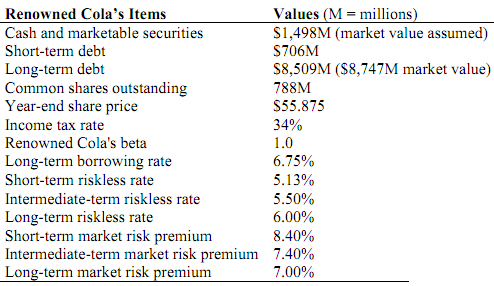

The cost of capital for a firm can differ from the cost of capital for each of its businesses. When a firm has multiple businesses, it is important to use the cost of capital appropriate to the particular project under consideration, rather than the firm's overall cost of capital, when evaluating a proposed project. Renowned Cola, Inc.'s 2005 annual report explains that Renowned Cola's investments are expected to generate cash returns that exceed its "long-term cost of capital," which Renowned Cola estimated to be approximately 10% at year-end 2005. Renowned Cola has three main lines of business, soft drinks, notably Dr. Cola; snack foods, such as Fritos; and restaurants. Restaurant investments include NPC, which has a beta of 0.80 and a debt-to-firm value ratio is 0.31. Renowned Cola did not report costs of capital separately for these three businesses. Below, we have available year-end data for 2005 provided by Renowned Cola.

Given the above information, answer the below questions.

(1) Determine the market value of Renowned Cola's debt at year-end 2005. What is the book value of debt? Why do usually use market or book values for debt? Explain.

(2) To the nearest million, Determine the market value of Renowned Cola's stockholders' equity at year-end 2005.

(3) Renowned Cola subtracts the value of its short-term debt from its total debt when calculating its "net debt ratio." Renowned Cola believes that the market values for its traded debt are not accurate because the bonds trade infrequently. Given this belief and their treatment of short-term debt, Evaluate Renowned Cola's net debt ratio using book values for debt and market value for equity.

(4) Evaluate Leverage keeping the short-term debt as part of total debt. Using the CAPM Evaluate re for short-term, medium-term, and long-term investments. Evaluate WACC for short-term, medium-term, and long-term investments. Suppose you were considering a long-term capital investment project, which WACC would you use and why? You can assume that the asset's risk profile for the project mirrors Renowned Cola's overall risk profile.

(5) Should Renowned Cola use its overall cost of capital to evaluate its restaurant capital investments? Under what circumstances would it be correct to do so?