Reference no: EM131318098

EAT AT MY RESTAURANT - CASH FLOW

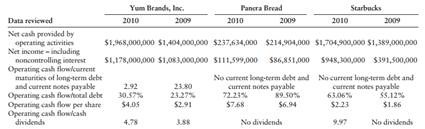

With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows:

1. Yum Brands, Inc.

December 25, 2010; December 26, 2009 (52 weeks each year) "YUM consists of six operating segments: KFC - U.S., Pizza Hut - U.S., Taco Bell - U.S., Long John Silver's ("LJS") - U.S., and A&W All American Food Restaurants ("A&W") - U.S., YUM Restaurants International ("YRI" or "International Division") and YUM Restaurants China ("China Division")." 10-K

2. Panera Bread

December 28, 2010; December 29, 2009 (52 weeks each year) "Panera Bread Company and it subsidiaries, referred to as "Panera Bread," "Panera," the "Company," "we," "us," and "our," is a national bakery-café concept with 1,453 company-owned and franchise-operated bakery-café locations in 40 states, the District of Columbia, and Ontario, Canada." 10-K

3. Starbucks

October 3, 2010; September 27, 2009 (Fiscal year 2010 included 53 weeks, while fiscal year ended 2009 included 52 weeks) "Starbucks is the premier roaster and retailer of specialty coffee in the world, operating in more than 50 countries." 10-K

Required

a. Comment on the difference between net cash provided by operating activities and net income including noncontrolling interest. Speculate on which number is likely to be the better indicator of long-term profitability.

b. Comment on the data reviewed for each firm.

c. Do any of these firms appear to have a cash flow problem? Comment.

|

Decision tree or rule learner in r code

: This homework is part of a private Kaggle competition, in the end we only want to submit an excel file with ID and Expected column, and I need the R code as well to submit. I am attaching the data files, both should be used in the code. The assign..

|

|

Considering acquiring a new computer

: Your company is facing earnings pressure and is considering acquiring a new computer system that will initially cost $1 million and will save $300,000 per year in inventory and receivables management costs. The system is will last for five years.

|

|

What is the value of this bond if the coupon payments

: BA Corp is issuing a 10 year bond with a coupon rate of 8 percent and a par value of $1,000. The market interest rate on similar bonds is currently 6 percent. If the coupon payments are made annually, what is the value of this bond? Knight, Inc. has ..

|

|

Explain the rationale underlying volume consolidation

: Explain the rationale underlying volume consolidation. What are the risks associated with using a single supplier for an item?

|

|

Do any of these firms appear to have a cash flow problem

: Comment on the difference between net cash provided by operating activities and net income including noncontrolling interest. Speculate on which number is likely to be the better indicator of long-term profitability.

|

|

Percent and a standard deviation

: Asset K has an expected return of 20 percent and a standard deviation of 35 percent. Asset L has an expected return of 8 percent and a standard deviation of 19 percent. The correlation between the assets is .44. What are the expected return and st..

|

|

What is the degree of operating leverage for a production

: Calculate the value of a bond with £100 face value, 5 years to maturity, coupon rate of 7% p.a. paid annually, when the discount rate (expected rate of return on similar instruments) is 4% p.a - What is the degree of operating leverage for a produc..

|

|

Why is it so important to his political theory in general

: Why is it so important to his political theory in general?What might be the political implications or consequences of opposing views of property (i.e. "there is no right of private property at all, and the government owns it all" vs. "the right of..

|

|

Differences between transactional and relationship marketing

: Why are the four primary service outputs of spatial convenience, lot size, waiting time, and product variety important to logistics management? Provide examples of competing firms that differ in the level of each service output provided to custome..

|