Reference no: EM13501697

Questions 1

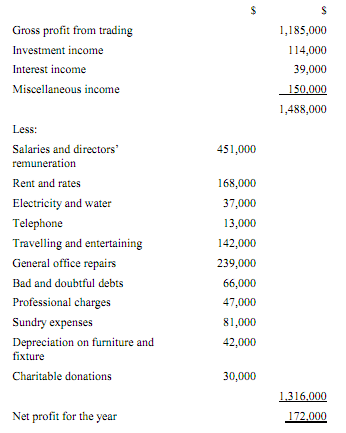

Kwong Fai Co. Ltd has been carrying on business as a garment manufacturer for many years. The income statement of the company for the year ended 31 December 2011 is as follows:

The following information relating to the above account is available:

i Depreciation charges on plant and machinery of $98,000 is included in the cost of sales.

ii Interest income:

Interest on loan to a wholly owned subsidiary resident in Hong Kong $15,000

Interest on a fixed deposit in US dollars with a local bank $24,000

iii Investment income:

Dividends from a subsidiary in Hong Kong $60,000

Rental income from property in Macau $54,000

iv Miscellaneous income:

Rent from subletting a property in Hong Kong $120,000

Gain on exchange $30,000

(realized, relating to open account with customers)

v Travelling and entertaining:

Workers' transportation costs $60,000

Travelling allowances to staff $22,000

Cost of gasoline and repairs to the managing director's car $60,000

vi General office repairs:

Electrical wiring in factory premises $200,000

Repairs to furniture and fixture $15,000

Cost of purchase of sundry utensils $24,000

($20,000 for initial purchases, other purchases are for replacement)

vii The bad debt accounts:

Increase in general provision for bad debts $7,000

Decrease in specific provision for bad debts ($41,000)

Loan to a director written off $100,000

viii Professional charges:

Audit fee $2,000

Legal fee: debt collection $15,000

Fee paid for designing a new machine $30,000

ix Sundry expenses:

Subscription to trade association $3,000

Expenses of staff dinner at the New Year $15,000

Special contribution to a recognized occupational retirement $60,000

scheme established during the year

Miscellaneous expenses (all allowable) $3,000

x Charitable donations:

Except for $2,000 which was used for purchase of raffle tickets, the others were made to various approved charitable organizations without consideration. The raffle tickets were used for lucky draw by the general staff during the annual dinner.

Required:

a For Hong Kong profits tax purposes, determine the assessable profits of Kwong Fai Co. Ltd for the year of assessment 2011/12 before

depreciation allowances.

b Briefly explain your treatments to the items in notes (vi), (vii), (ix), and (x) above.

Question 2

Mr Ma was a manager employed by a local import and export company. In his employment contract covering the three years ended 31 March 2012, it was provided that Mr Ma's salary would be $55,000 per month with one month's bonus payable at the end of March each year. Mr Ma was entitled to receive a holiday passage allowance, free quarters, reimbursement of utilities and free education benefits for his child.

However, Mr Ma was required to pay for all local travelling expenses when visiting local clients and customers without reimbursement from the employer. At the end of the contract period, Mr Ma was entitled to a gratuity of $300,000. In the year ended 31 March 2012, Mr Ma received a holiday passage allowance of $60,000, three-fifths of which was used to purchase holiday packages for him and his family while the balance was retained by him. Mr Ma's son, aged 20, was studying at the University of London, the tuition fee for the year being $90,000. Mr Ma lived with his wife in a flat in Causeway Bay provided by his employer, and the utility benefit he received during the year was $10,000. The total travelling expenses incurred by Mr Ma during the year for visiting the local clients amounted to $24,000. Mr Ma donated $80,000 to the Community Chest of Hong Kong during the year. He contributed $25,000 to an MPF-exempt retirement scheme during the year ended 31 March 2012. His employer contributed an equal amount to the stated scheme. In January 2012, Mr Ma's application to emigrate to Australia was approved, and therefore he decided not to renew his employment contract with the employer. Mrs Ma has been a housewife and did not earn any salary income during the year. For many years, Mrs Ma had paid $1,500 per month for the maintenance of her father, who was 65 years old at the end of March 2012 and was resident in Hong Kong.Required:

a Determine the Hong Kong salaries tax liability of Mr Ma for the year of assessment 2011/12, making the best election where appropriate. Ignore provisional salaries tax and tax reduction or waiver.

b Justify and explain the tax treatments you have accorded to the following items in the tax computation:

i reimbursement of utilities

ii gratuity upon completion of contract

iii contribution to retirement schemes

iv holiday passage allowances.

Question 3

Ms Chan is the operations manager of Evergreen Trading Company Ltd, an import-export company carrying on business in Hong Kong. She tells you that in December 2011 the company purchased a residential flat in Hung Hom ‘for rental purposes' at a price of $6,000,000. The flat was used as security for a mortgage loan of $3,500,000 obtained from a local bank. To this day, no tenant has been found. She also tells you that a person seeing the company's advertisement in the newspaper for renting the flat offered to buy it for $9,000,000. She is prepared to accept this price - but only if you can assure her that the gain on sale will not be subject to tax in Hong Kong.

Required:

Evaluate Ms Chan's situation by referring to the six badges of trade and advise on whether the gain will be subject to Hong Kong profits tax. As the information given above may not be sufficient to deal with the issue adequately, you are required to set out in your answer what further information you might need in order to better assess the situation.

Question 4

Marfan Ltd carries on business in Hong Kong as an agent of its parent company, Trouble Ltd, which was incorporated in the Cayman Islands. Under the terms of the Agency Agreement, Marfan Ltd is required to negotiate with customers in Hong Kong on behalf of Trouble Ltd, and has the sole and exclusive authority to fix prices and accept orders. In return for its services, Marfan Ltd is paid an agency fee based on 15% of the annual profits made on the contracts negotiated. Sales contracts are made in the name of Trouble Ltd and administered in Hong Kong by Marfan Ltd. All sales and purchases are recorded in the books of Trouble Ltd. Trouble Ltd purchases the goods from overseas suppliers, but the shipments are often made directly to the customers in Hong Kong. In November 2012, Marfan Ltd was approached by a customer in Korea who was interested in placing a substantial order. Marfan Ltd sent its business development director to negotiate with the customer in Korea, and signed the contract there. Shipment was then made directly to the customer in Korea.

Required:

a Discuss the Hong Kong tax implication of the profits earned by Trouble Ltd in respect of the sales made to the Hong Kong customers through Marfan Ltd.

b State, giving reasons, whether the agency fee earned by Marfan Ltd is taxable in Hong Kong.

c Explain the Hong Kong profits tax implications to Marfan Ltd in respect of the sale transaction conducted in Korea.