Reference no: EM13831964

Problem 1:

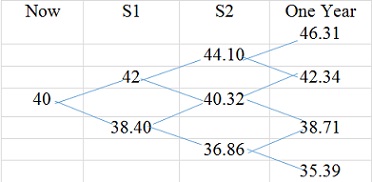

1. Assuming that a one-year call option with an exercise price of $38 is available for the stock of the DEW Corp., consider the following price tree for DEW stock over the next year:

a. If the sequence of stock prices that DEW stock follows over the year is $40.00, $42.00, $40.32, and $38.71, describe the composition of the initial riskless portfolio of stock and options you would form and all the subsequent adjustments you would have to make to keep this portfolio riskless. Assume the one-year risk-free rate is 6 percent.

b. Given the initial DEW price of $40, what are the probabilities of observing each of the four terminal stock prices in one year? (Hint: In arriving at your answer, it will be useful to consider (1) the number of different ways that a particular terminal price could be achieved and (2) the probability of an up or down movement.)

c. Use the binomial option model to calculate the present value of this call option. d. Calculate the value of a one-year put option on DEW stock having an exercise price of$38; be sure your answer is consistent with the correct response to Part c.

Problem 2:

2. Consider the following questions on the pricing of options on the stock of ARB Inc.:

a. A share of ARB stock sells for $75 and has a standard deviation of returns equal to 20 percent per year. The current risk-free rate is 9 percent and the stock pays two dividends: (1) a $2 dividend just prior to the option's expiration day, which is 91 days from now (i.e., exactly one-quarter of a year), and (2) a $2 dividend 182 days from now (i.e., exactly one-half year). Calculate the Black-Scholes value for a European-stylecall option with an exercise price of $70. b. What would be the price of a 91-day European-style put option on ARB stock havingthe same exercise price?

c. Calculate the change in the call option's value that would occur if ARB's managementsuddenly decided to suspend dividend payments and this action had no effect on theprice of the company's stock.

d. Briefly describe (without calculations) how your answer in Part a would differ underthe following separate circumstances: (1) the volatility of ARB stock increases to 30percent, and (2) the risk-free rate decreases to 8 percent.

Problem 3:

3. Suppose the current value of a popular stock index is 653.50 and the dividend yield onthe index is 2.8 percent. Also, the yield curve is flat at a continuously compounded rate of 5.5 percent.

a. If you estimate the volatility factor for the index to be 16 percent, calculate the value of an index call option with an exercise price of 670 and an expiration date in exactly three months.

b. If the actual market price of this option is $17.40, calculate its implied volatility coefficient.

c. Besides volatility estimation error, explain why your valuation and the option's traded price might differ from one another.

Problem 4:

4. Melissa Simmons is the chief investment officer of a hedge fund specializing in options trading. She is currently back-testing various option trading strategies that will allow her to profit from large fluctuations-either up or down-in a stock's price. An example of such typical trading strategy is straddle strategy that involves the combination of a long call and a long put with an identical strike price and time to maturity. She is considering the following pricing information on securities associated with Friendwork, a new Internet start-up hosting a leading online social network:

Friendwork stock: $100

Call option with an exercise price of $100 expiring in one year: $9

Put option with an exercise price of $100 expiring in one year: $8

a. Use the above information on Friendwork and draw a diagram showing the net profit/ loss position at maturity for the straddle strategy. Clearly label on the graph the break- even points of the position.

b. Melissa's colleague proposes another lower-cost option strategy that would profit from a large fluctuation in Friendwork's stock price:

Long call option with an exercise price of $110 expiring in one year: $6

Long put option with an exercise price of $90 expiring in one year: $5

Similar to Part a, draw a diagram showing the net profit/loss position for the above alternative option strategy. Clearly label on the graph the breakeven points of the position.

Problem 5:

5. In developing the butterfly spread position, we showed that it could be broken down intotwo call option money spreads. Using the price data for SAS stock options from Exhibit 22.17, demonstrate how a butterfly profit structure similar to that shown in Exhibit 22.30 could be created using put options. Be specific as to the contract positions involved in the trade and show the expiration date net payoffs for the combined transaction.

Part 2:

Problem 1:

1. The treasurer of a British brewery is planning to enter a plain vanilla, three-year, quarterly settlement interest rate swap to pay a fixed rate of 8 percent and to receive three-month sterling LIBOR. But first he decides to check various cap-floor combinations to see if any might be preferable. A market maker in British pound sterling OTC options presents the treasurer with the following price list for three-year, quarterly settlement caps and floors:

|

|

INTEREST RATE CAPS

|

INTEREST RATE FLOORS

|

|

Strike Rate

|

Buy

|

Sell

|

Buy

|

Sell

|

|

7%

|

582 GBP

|

597 GBP

|

320 GBP

|

335 GBP

|

|

8%

|

398

|

413

|

401

|

416

|

|

9%

|

205

|

220

|

502

|

517

|

The prices are in basis points, which when multiplied by the notional principal give the actual purchase or sale price in pounds sterling. These quotes are from the perspective ofthe market maker, not the firm. That is, the treasurer could buy a 9 percent cap from the market maker for 220 BP, or sell one for 205 BP. The strike rates are quoted on a 365-day basis, as is sterling LIBOR.

In financial analysis of this sort, the treasurer assumes that the three-year cost of funds on fully amortizing debt would be about 8.20 percent (for quarterly payments). Should another structure be considered in lieu of the plain vanilla swap?

Problem 2:

2. You are considering the purchase of a convertible bond issued by Bildon Enterprises, a non-investment-grade medical service firm. The issue has seven years to maturity and pays a semiannual coupon rate of 7.625 percent (i.e., 3.8125 percent per period). The issue is callable by the company at par and can be converted into 48.852 shares of Bildon common stock. The bond currently sells for $965 (relative to par value of $1,000), and Bildon stock trades at $12.125 a share.

a. Calculate the current conversion value for the bond. Is the conversion option embedded in this bond in the money or out of the money? Explain.

b. Calculate the conversion parity price for Bildon stock that would make conversion of the bond profitable.

c. Bildon does not currently pay its shareholders a dividend, having suspended these distributions six months ago. What is the payback (i.e., breakeven time) for this convertible security, and how should it be interpreted?

d. Calculate the convertible's current yield to maturity. If a "straight" Bildon fixed-income issue with the same cash flows would yield 9.25 percent, calculate the net value of the combined options (i.e., the issuer's call and the investor's conversion) embedded in the bond.

Problem 3:

3. On May 26, 1991, SvenskExportkredit (SEK), the Swedish export credit corporation, is- sued a Bull Indexed Silver Opportunity Note (BISON). Consider an extended version of this BISON issue that has the following terms:

Maturity May 26, 1993

Coupon 6.50%

Face Value USD 30 million

Purchase Price 100,123% of par value

Additionally, this BISON includes a redemption feature that, for each USD 1,000 of face value held at maturity, repays the investor's principal according to the following formula:

USD 1,000 + [(Spot Silver Price per Ounce - USD 4.46) × (USD 224.21525)]

a. Demonstrate that, from SEK's perspective, the BISON represents a combination of a straight debt issue priced at a small premium and a derivative contract. Be explicit as to the type of derivative contract and the underlying asset on which it is based. What implicit speculative position are the investors who buy these bonds taking?

b. Calculate the yield to maturity for an investor holding USD 10,000 in face value of these BISON if the May 1993 spot price for silver is (1) USD 4.96 per ounce, or (2) USD 3.96 per ounce.

c. In May 1991 (i.e., when the BISON were used), the prevailing delivery price on a two- year silver futures contract was USD 4.35 per ounce. If SEK wanted to hedge its BISON-related exposure to silver prices with an offsetting futures position at this price, what type of position would need to be entered? Ignoring margin accounts and underwriting fees, calculate SEK's average annualized borrowing cost of funds for the resulting synthetic straight bond.

Problem 4:

4. A firm has 100,000 shares of stock outstanding priced at $35 per share. The firm has no debt and does not pay a dividend. To raise more capital, it plans to issue 10,000 warrants, each allowing for the purchase of one share of stock at a price of $50. The warrants are European-style and expire in five years. The standard deviation of the firm's common stock is 34 percent, and the continuously compounded, five-year risk-free rate is 5.2 percent.

a. Estimate the fair value of the warrants, first using the relevant information to calculate the Black-Scholes value of an analogous call option.

b. Determine the stock price at expiration, assuming the warrants are exercised if the value of the firm is at least $5,200,000.

c. Using the information in Parts a and b about initial and terminal warrant and stock prices, discuss the relative merits of these two ways of making an equity investment in the firm.