Reference no: EM131109674

Question 1 - You are evaluating the HomeNet project under the following assumptions: Sales of 50,000 units in year 1 increasing by 50,000 units per year over the life of the project, a year 1 sales price of $ 260/unit, decreasing by 10 % annually and a year 1 cost of $ 120/unit decreasing by 20 % annually. In addition, new tax laws allow you to depreciate the equipment, costing $ 7.5 million, over three years using straight-line depreciation. Research and development expenditures total $ 15 million in year 0 and selling, general, and administrative expenses are $ 2.8 million per year (assuming there is no cannibalization).

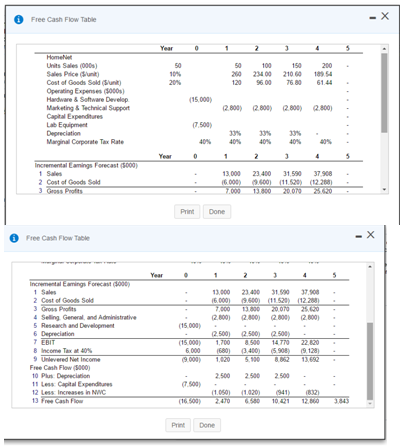

Also assume HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). However, receivables related to HomeNet are expected to account for 15 % of annual sales, and payables are expected to be 15 % of the annual cost of goods sold. Under these assumptions the unlevered net income, net working capital requirements and free cash flow are shown in the Table:

Using the FCF projections given:

a. Calculate the NPV of the HomeNet project assuming a cost of capital of 10 %, 12 % and 14 %.

The NPV of the FCF's of the HomeNet project assuming a cost of capital of 10% is

The NPV of the FCF's of the HomeNet project assuming a cost of capital of 12% is

The NPV of the FCF's of the HomeNet project assuming a cost of capital of 14% is

b. What is the IRR of the project in this case?

Question 2 - A bicycle manufacturer currently produces 313,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $2.10a chain. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $1.40per chain. The necessary machinery would cost $295,000 and would be obsolete after ten years. This investment could be depreciated to zero for tax purposes using a ten-year straight-line depreciation schedule. The plant manager estimates that the operation would require additional working capital of $53,000 but argues that this sum can be ignored since it is recoverable at the end of the ten years. Expected proceeds from scrapping the machinery after ten years are $22,125.

If the company pays tax at a rate of 35% and the opportunity cost of capital is 15%, what is the net present value of the decision to produce the chains in-house instead of purchasing them from the supplier?

Project the annual free cash flows (FCF) of buying the chains.

The annual free cash flows for years 1 to 10 of buying the chains is $___. (Round to the nearest dollar. Enter a free cash outflow as a negative number.)

Compute the NPV of buying the chains from the FCF.

The NPV of buying the chains from the FCF is $____. (Round to the nearest dollar. Enter a free cash outflow as a negative number.)

Compute the initial FCF of producing the chains.

The initial FCF of producing the chains is $_____. (Round to the nearest dollar. Enter a free cash outflow as a negative number.)

Compute theFCF in years 1 through 9 of producing the chains.

The FCF in years 1 through 9 of producing the chains is $___. (Round to the nearest dollar. Enter a free cash outflow as a negative number.)

Compute the FCF in year 10 of producing the chains.

Question 3 - Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $4.36 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.17 million this year and $6.17 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $3.29 million each year.

Kokomochi's gross profit margin for the Mini Mochi Munch is 34%, and its gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 33% both this year and next year. What are the unlevered net incomes associated with the advertising campaign?

Note: Assume that the company has adequate positive income to take advantage of the tax benefits provided by any net losses associated with this campaign.

Calculate the unlevered net income for year 1 below: (Round to three decimal places.)

|

|

|

Year 1

|

|

Incremental Earnings Forecast million)

|

|

|

|

Sales of Mini Mochi Munch

|

$

|

|

|

Other Sales

|

$

|

|

|

Cost of Goods Sold

|

$

|

|

|

Gross Profit

|

$

|

|

|

Selling, General, and Administrative

|

$

|

|

|

Depreciation

|

$

|

|

|

EBIT

|

$

|

|

|

Income Tax at 33%

|

$

|

|

|

Unlevered Net Income

|

$

|

|

|

Describe any organ-specific cell types that are present

: Describe any organ-specific cell types that are present and if these cell types have any special structures (e.g., presence of microvilli and/or abundance of particular organelle such as mitochondria).

|

|

Assume that the overhead rates you computed

: Assume that the overhead rates you computed in (1) above are in effect. The job cost sheet for Job 203, which was started and completed during the year, showed the following:

|

|

The dollar change in value during the next year

: The current spot exchange rate is S0¥/$ = ¥190/$ and the 1-year forward rate is F1¥/$ = ¥210/$. The prime rate in the United States is 15 percent.

|

|

What is southwest business model and why is it so effective

: Compile a comparative analysis of two competing airlines to Southwest with respect to service and price. How might Southwest react to the changes discussed in the "Tuesday Meeting" (last couple of paragraphs of case)?

|

|

Compute the npv of buying the chains from the fcf

: A bicycle manufacturer currently produces 313,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $2.10a chain. Compute the NPV of buying the chains from the FCF

|

|

Describe the various functions of epithelial tissue

: Describe the various functions of epithelial tissue. In your post, describe the multiple morphologies (shapes) and structures of epithelial tissue. Provide an example of an organ in the human body that has epithelial tissue.

|

|

Find the court decision located

: Find the court decision located at 2007-1 USTC ¶50,210. a. What court heard the case?

|

|

To determine their investment plan for the year

: It is January 2nd and senior management of Chester meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing $10,000,000 in bonds.

|

|

Record the following transactions for the current year

: On August 1, Clayton Co. issued $1,300,000 of 20-year, 9% bonds, dated August 1, for $1,225,000. Interest is payable semiannually on February 1 and August 1. Present the entries to record the following transactions for the current year.

|