Reference no: EM131035325

1. (a) Consider an investor who holds a portfolio P and is contemplating buying an asset which is known to yield high returns on average, but with high volatility. The investor is concerned about this investment being too risky. What would be your advice?

(b) The investment opportunity set comprises N risky assets and one riskfree asset with rate of return Rf. The vector of expected returns on the N risky assets is μ = (μ1, ..., μN) and their covariance matrix is Σ. Consider an investor with utility

U(ω) = μP(ω) - (λ/2)σP2(ω),

where ω = (ω1, ..., ωN)' denotes a vector of risky portfolio weights, and μp(ω) and σP2(ω) denote portfolio expected return and variance, respectively.

i. Give explicit expressions for , μP(ω) and σ2P(ω).

ii. Describe the optimal (unconstrained) portfolio allocation over the N + 1 assets (you can refer to formulas proved in the lecture without having to derive them).

iii. Derive the level of utility corresponding to the optimal portfolio. How does it relate to the maximum Sharpe ratio?

(c) Securities A, B and C have the following characteristics:

|

|

Expected return

|

Standard deviation

|

|

A

|

15%

|

20%

|

|

B

|

8%

|

10%

|

|

C

|

8%

|

10%

|

|

Correlations

|

A

|

B

|

C

|

|

A

|

1

|

0.3

|

0.7

|

|

B

|

|

1

|

0.1

|

|

C

|

|

|

1

|

In this question, you do not need to calculate optimal portfolio weights. You should only give intuitive answers.

i. Consider the mean-variance frontier portfolio with expected return 12%. Explain why asset A receives positive weight in this portfolio.

ii. Which of assets B and C receives greater weight in the portfolio referred to in (i)? Explain.

iii. Now consider the mean-variance frontier portfolio with expected return 7%. Which of assets B and C receives greater weight in this portfolio? Explain.

(d) Briefly explain the notion of "sampling distribution" for an estimator. How does this notion matter for the ex-ante assessment of the impact of estimation risk on portfolio performance?

2. (a) Suppose you can invest in two stock indices: a domestic index and a global one, where the global index is invested with equal weights in your domestic index and in a portfolio of foreign stock indices (you presumably live in a large country, which may explain why your domestic index makes up for a large part of the global index). Note that you can only get exposure to foreign stock indices via the global index but cannot directly invest in them. The domestic index offers an expected return in excess of your domestic riskfree rate equal to μeD = 11%, with a volatility σD = 15%. The portfolio of foreign indices that enters the composition of the global index earns an expected excess return of μeF = 13% (expressed in your local currency and above your domestic riskfree rate), while the volatility of this portfolio is σF = 20%. The correlation between the returns on your domestic index and the portfolio of foreign indices is ρ = 0.6.

i. Compute the expected excess return on the global index (μeG) and its volatility (σG).

ii. Compute the covariance between the global index and your domestic index.

iii. Suppose you run a regression of domestic excess returns on global excess returns ReDt = α +βReGt + εt. What estimates for α and β would you find? What residual variance σ2(ε) would you obtain?

iv. Looking just at the risky part of your portfolio, what optimal weights (ωG, ωD) should you put on the global and domestic indices, assuming you have mean-variance preferences? Answer this question using standard results from mean-variance optimization theory (see formula for the inverse of a 2-by-2 matrix).

Hint: if all your calculations so far are right, you should find that

ωD = α/(α(1-β)+ μeG(σ2(ε)/σ2G))

v. At the optimal weights (ωG, ωD), what fraction of the risky part of your portfolio is de facto invested in the domestic index?

vi. How does the squared Sharpe ratio of the optimal portfolio compare with the squared Sharpe ratio of the global index? Answer this question without computing any Sharpe ratio.

(b) What empirical findings are referred to as value and size effects?

(c) "It could be the case that unconditional tests reject the CAPM even though the CAPM holds conditionally". Explain and discuss this statement, in relation to empirical findings on the value effect.

3. (a) Explain the construction of "market-implied" expected excess returns (also referred to as "market-neutral" expected excess returns) that enter the prior in the Black-Litterman approach to asset allocation.

(b) In practice, "market-implied" expected excess returns typically differ from the sample means of excess returns. Provide several interpretations and explanations for this finding.

(c) Explain the notion of "predictive distribution" in the context of Bayesian portfolio choice.

(d) Summarize the main intuitions offered by He and Lit-Lerman - in an article that was discussed in class - regarding the composition of the optimal portfolios implied by the Black-Litterman procedure, in the absence of portfolio constraints.

4. (a) Suppose you have historical data at monthly frequency on the returns (converted into your local currency) generated by a set of N international stocks.

i. Explain how you would estimate a characteristic-based factor model featuring country- and industry-specific factors based on these data.

ii. Explain how you could use this model to estimate the covariance matrix of the N stock returns.

(b) Ledoit and Wolf argue that a good estimator of the covariance matrix of returns consists in shrinking the sample co-variance matrix towards the covariance matrix implied by the estimation of a factor model. Explain and discuss this result.

(c) Consider a large number N of risky assets whose returns in excess of a constant riskfree rate Rf can be described by the following linear factor model:

Rite = μie + k=1ΣKβikfkt + εit, for i = 1, ...., N,

where K < N and E(fkt) = E(εit) = 0.

i. Let Pk denote the well-diversified mimicking portfolio for factor k. What are the properties of this portfolio?

ii. Let μpke = E(Rpk,te) denote the (constant) expected excess rate of return on the well-diversified mimicking portfolio for factor k. Show that

Rite = αi + k=1ΣKβikRpk,te + εit,

Where αi =μie - k=1ΣKβikμpke.

iii. What is the interpretation of αi?

iv. Consider a portfolio Q of the N risky assets with time-varying weights. Let ωQi,t denote the fraction of portfolio Q invested in asset i in period t. Derive the beta of portfolio Q on factor k in period t, denoted by βQk,t.

V. Let RQte denote the excess return of portfolio Q over the riskfree rate. Show that

E[RQte] i=1ΣNE[ωQi,t] αi + k=1ΣKcov(βQk,t, Rpk,te) + k=1ΣKE[βQk,t] μpke.

vi. Interpret all the terms in the previous decomposition, and discuss the relevance of this decomposition in the context of fund performance evaluation.

5. (a) Suppose two stocks A and B are traded, along with an index X that consists of a portfolio with weight 25% in stock A and 75% in stock B.

i. Consider an active manager investing in stocks A and B whose performance is evaluated against the index. Assume for now that the manager's portfolio is equally weighted across the two stocks. What are his/her active weights?

ii. The beta of stock A against the index is 1.3. What is the beta of the manager's portfolio (βp) against the index? Hint: what is the beta of stock B?

iii. For given βp, the manager's active return is computed from realized excess returns as Rept - βPReXt. How can one compute the active return just based on the knowledge of active weights and residual returns, where the residual return on stock i ∈ {A, B} is defined as θit = Rite - βiReXt?

iv. Suppose the residual returns on stocks A and B are uncorrelated. The residual volatility on both stocks is 10%. The manager's estimates of alphas are -3.5% and 3.5% for stocks A and B, respectively. What are the optimal active weights, given a tracking error volatility constraint of 7%? Hint: you can find the optimal active weights by considering a related unconstrained linear mean-variance active portfolio choice problem.

v. Redo the previous question assuming that by mandate the manager is restricted to take long positions in stocks.

(b) There are two types of fund managers, good and bad. You believe only 40% of them are good. The realized investment performance of a manager is classified as very good, mediocre or poor. The table below gives the likelihood of a given level of performance for each type of manager.

|

|

Good manager

|

Bad manager

|

|

Very good performance

|

60%

|

25%

|

|

Mediocre performance

|

30%

|

25%

|

|

Poor performance

|

10%

|

50%

|

A fund manager is recommended to you on the ground that his track record shows very good performance. What is your own assessment of the probability that he is really good rather than bad and lucky?

(c) There are two types of investors: passive investors who just invest in the market index, and a crowd of investors (including hedge funds and other "active" investors) who hold portfolios that typically differ from the market portfolio. Consider the wealth-weighted average performance of each of the two groups, computed based on the returns on their risky holdings. A priori, which of the two groups will show the best performance? Justify your answer.

(d) In his Presidential Address to the 2011 American Finance Association, John Cochrane argued: "There is no more alpha. There is just beta you understand and beta you don't understand". Discuss this statement.

6. (a) Suppose you live for two periods. You are born with wealth W0, invest over two periods, and consume all your wealth (W2) at the end of the second period. Your investment opportunity set consists of an aggregate stock index and a one-period riskfree rate Rf at which you can save or borrow. Let R1 and R2 denote the stock market returns over periods 1 and 2, respectively. We also define rf = log(1 + Rf) the log riskfree rate over one period, ri = log(1 + Ri) the log stock return in period i = 1,2, and excess log returns rie = ri - rf. Assume that the utility derived from consuming out of terminal wealth is given by

u(W2) = W21-γ/1-γ, γ > 1.

Suppose you are a buy-and-hold investor and let w denote the fraction of your initial wealth that you invest in the stock market until the end of period 2.

i. For a given choice of ω, how much do you consume at the end of your life? Your answer should be expressed as a function of r1, r2, rf, ω and W0.

ii. Your objective is to maximize your expected utility. Show that the key determinant of your portfolio allocation decision is the distribution of r1e + r2e.

iii. Suppose that r1e and r2e are known to be independently and identically distributed, with rie ˜ N(μe, σ2) for i = 1,2. How does your optimal portfolio allocation differ from the one that you would choose if you were only investing over one period? Justify your answer.

iv. Redo the previous question, now assuming that r1e˜ N(μ-e , σ2) and r2e = k(μ-e - r1e) + ε2, where k, μ-e > 0 are known positive parameters and ε2 ˜ N(0, σ2).

v. Do you think the assumption of negative return autocorrelation is a good assumption?

vi. Now assume that you can rebalance your portfolio after the first period, i.e., you choose a weight ω1 at the beginning of the first period, and a weight w2 at the beginning of the second period. Explain the logic driving the choice of ω1 in this dynamic portfolio optimization problem. Consider both the case where excess log stock returns are iid over time, and the case where they are not.

(b) Some researchers have claimed that the aggregate price-dividend ratio (P/D ratio) can be used to predict future aggregate stock market returns.

i. Summarize the empirical evidence that supports this claim. How has the VAR methodology been used to forecast future stock returns by exploiting the predictive power of the P/D ratio?

ii. (4 marks) In theory, what could explain the fact that the P/D ratio contains information about future market returns?

iii. What are the implications of return predictability for long-term asset allocation?

Useful formula: inverse of a two-by-two matrix

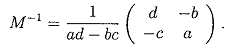

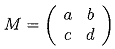

Consider a matrix  with ad - bc ≠ 0. Then

with ad - bc ≠ 0. Then