Reference no: EM131318196

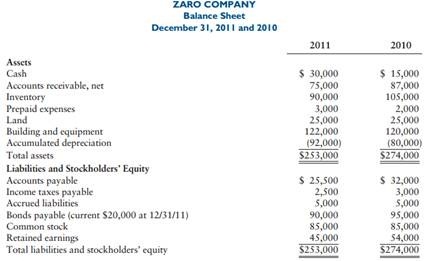

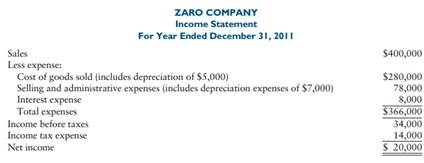

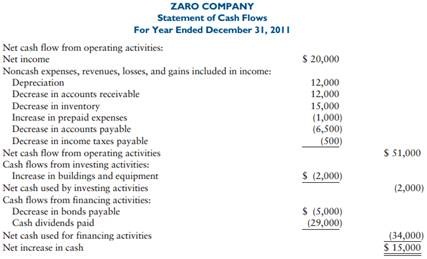

Zaro Company's balance sheets for December 31, 2011 and 2010, income statement for the year ended December 31, 2011, and the statement of cash flows for the year ended December 31, 2011, follow:

The president of Zaro Company cannot understand how the company was able to pay cash dividends that were greater than net income and at the same time increase the cash balance. He notes that business was down slightly in 2011.

Required

a. Comment on the statement of cash flows.

b. Compute the following liquidity ratios for 2011:

1. Current ratio

2. Acid-test ratio

3. Operating cash flow/current maturities of long-term debt and current notes payable

4. Cash ratio

c. Compute the following debt ratios for 2011:

1. Times interest earned

2. Debt ratio

d. Compute the following profitability ratios for 2011:

1. Return on assets (using average assets)

2. Return on common equity (using average common equity)

e. Give your opinion as to the liquidity of Zaro.

f. Give your opinion as to the debt position of Zaro.

g. Give your opinion as to the profitability of Zaro.

h. Explain to the president how Zaro was able to pay cash dividends that were greater than net income and at the same time increase the cash balance.

|

Determine the diameter of the tower

: The gas enters the tower with an average molecular weight of 30.1 and the liquid stream, leaving the bottom of the tower, has an average molecular weight of 180, a specific gravity of 0.81 and a viscosity of 3.9×10-3 Pa.s

|

|

Result of the change in exchange rates

: The exchange rate for dollars to pounds was1£ = 2 U.S. dollars. This year the exchange rate is 1£ = 2.18 U.S. dollars. The inventory in Britain is still valued at 240,000 pounds. What is the gain or loss in inventory value in U.S. dollars as a res..

|

|

What economic argument can be made for social sustainability

: What economic arguments can be made for and against environmental sustainability initiatives? What economic arguments can be made for and against social sustainability initiatives?

|

|

Create an erd that represents the entities and attributes

: Create an ERD that represents the entities, attributes, the relationships between entities, and the cardinality and optionality of each relationship that are described by this business rule

|

|

Compute the current ratio and acid test ratio

: Comment on the statement of cash flows.- Compute the Current ratio, Acid-test ratio, Operating cash flow/current maturities of long-term debt and current notes payable and Cash ratio.

|

|

What if you use the geometric average growth rate

: If the stock currently sells for $60, what is your best estimate of the company's cost of equity capital using the arithmetic average growth rate in dividends? What if you use the geometric average growth rate?

|

|

Explain the purpose and philosophical approach

: Discuss the purpose and philosophical approach. Discuss the underlying assumptions. If referring to a research reporting article, present the methodology. Relate the resource to the body of resources you have consulted in this course.

|

|

What is the internal rate of return if the initial cost

: Miller Brothers is considering a project that will produce cash inflows of $32,500, $38,470, $40,805, and $41,268 a year for the next four years, respectively. What is the internal rate of return if the initial cost of the project is $184,600?

|

|

Centervales disaster management plan

: Develop a PowerPoint presentation that outlines your suggested path to updating Centervale's disaster management plan and ensure you support your arguments with examples and scholarly references.

|