Reference no: EM131144177

Assignment 1: Handout

1. This lists the costs included for the acquisition of land. First is the purchase price, which is obviously included in the cost of the land. The reasons for including the other costs are not so obvious. For example, removing a building looks more like an expense.

Requirements

R1. State why the costs listed in the chapter are included as part of the cost of the land.

R2. After the land is ready for use, will these costs be capitalized or expensed?

2. Advanced Automotive pays $140,000 for a group purchase of land, building, and equipment. At the time of your acquisition, the land has a market value of $75,000, the building $60,000, and the equipment $15,000.

Requirement

R1. Journalize the lump-sum purchase of the 3 assets for a total cost of $140,000. You sign a note payable for this amount.

3. At the beginning of the year, Logan Services purchased a used airplane for $65,000,000.Logan Services expects the plane to remain useful for 4 years (6 million miles) and to have a residual value of $5,000,000. The company expects the plane to be flown 1.3 million miles the first year.

Requirements

R1. Compute Logan Services' first-year depreciation on the plane using the following methods:

a. Straight-line,

b. Units-of-production,

c. Double-declining-balance.

R2. Show the airplane's book value at the end of the first year under the straight-line method.

4. At the beginning of 2011, Texas Aero purchased a used airplane at a cost of $59,000,000. Texas Aero expects the plane to remain useful for 5 years (6 million miles) and to have a residual value of $5,000,000. Texas Aero expects the plane to be flown 1.4 million miles the first year and 1.3 million miles the second year.

Requirements

R1. Compute second-year (2012) depreciation on the plane using the following methods:

a. Straight-line,

b. Units-of-production,

c. Double-declining-balance.

R2. Calculate the balance in Accumulated depreciation at the end of the second-year using the Straight-line method of depreciation.

5. This exercise uses the Logan Services data from problem #3. Logan Services is deciding which depreciation method to use for income tax purposes.

Requirements

R1. Which depreciation method offers the tax advantage for the first year? Describe the nature of the tax advantage.

R2. How much extra depreciation will Logan Services get to deduct for the first year as compared with the straight-line method?

6. On February 28, 2011, Solar Energy Consulting purchased a Xerox copy machine for $23,100. Solar Energy Consulting expects the machine to last for 3 years and to have a residual value of $1,500.

Requirement

R1. Compute depreciation on the machine for the year ended December 31, 2011, using the straight-line method.

7. Assume that Smith's Auto Sales paid $50,000 for equipment with a 10-year life and zero expected residual value. After using the equipment for 4 years, the company determines that the asset will remain useful for only 3 more years.

Requirements

R1. Record depreciation on the equipment for year 5 by the straight-line method.

R2. What is accumulated depreciation at the end of year 5?

8. ABC Catering Service purchased equipment on January 1, 2010, for $58,500. ABC Catering Service expected the equipment to last for 6 years and to have a residual value of $4,500. Suppose ABC Catering Service sold the equipment for $43,000 on December 31, 2012, after using the equipment for three full years. Assume depreciation for 2012 has been recorded.

Requirement

R1. Journalize the sale of the equipment, assuming straight-line depreciation was used.

9. Micron Precision purchased a computer for $3,100, debiting Computer equipment. During 2010 and 2011, Micron Precision recorded total depreciation of $2,200 on the computer. On January 1, 2012, Micron Precision traded in the computer for a new one, paying $2,900 cash.

Requirement

R1. Journalize Micron Precision's exchange of computers.

10. Arabia Petroleum holds huge reserves of oil and gas assets. Assume that at the end of 2010, Arabia Petroleum's cost of oil and gas reserves totaled $84 billion, representing 7 billion barrels of oil and gas.

Requirements

R1. Which depreciation method does Arabia Petroleum use to compute depletion?

R2. Suppose Arabia Petroleum removed 0.7 billion barrels of oil during 2011. Journalize depletion expense for 2011.

11. When one media company buys another, goodwill is often the most costly asset. Decca Publishing paid $240,000 to acquire Tri Town Daily, a weekly advertising paper. At the time of the acquisition, Tri Town Daily's balance sheet reported total assets of $160,000 and liabilities of $80,000. The fair market value of Tri Town Daily's assets was $120,000.

Requirements

R1. How much goodwill did Decca Publishing purchase as part of the acquisition of Tri Town Daily?

R2. Journalize Decca Publishing's acquisition of Tri Town Daily.

12. Lexington Precision Tools repaired one of its Boeing 737 aircrafts at a cost of $100,000. Lexington Precision Tools erroneously capitalized this cost as part of the cost of the plane.

Requirements

R1. How will this accounting error affect Lexington Precision Tools' net income? Ignore depreciation.

R2. Should the company correct the error or can it ignore the error to report more favorable earnings results?

13. Ayer Furniture Co. purchased land, paying $95,000 cash plus a $270,000 note payable. In addition, Ayer paid delinquent property tax of $2,000, title insurance costing $2,500, and $3,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $550,000. It also paid $52,000 for a fence around the property, $17,000 for a sign near the entrance, and $4,000 for special lighting of the grounds.

Requirements

R1. Determine the cost of the land, land improvements, and building.

R2. Which of these assets will Ayer depreciate?

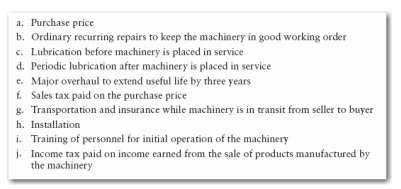

14. Consider the following expenditures:

Requirement

R1. Classify each of the expenditures as a capital expenditure or an expense related to machinery. 15. On January 2, 2011, Ditto Clothing Consignments purchased showroom fixtures for $16,000 cash, expecting the fixtures to remain in service for five years. Ditto has depreciated the fixtures on a double-declining-balance basis, with zero residual value. On August 31, 2012, Ditto sold the

fixtures for $7,600 cash.

Requirement

R1. Record both depreciation for 2012 and sale of the fixtures on August 31, 2012.

16. Cannon Mountain Mining paid $488,500 for the right to extract mineral assets from a 400,000- ton deposit. In addition to the purchase price, Cannon also paid a $500 filing fee, a $1,000 license fee to the state of Nevada, and $90,000 for a geological survey of the property. Because Cannon purchased the rights to the minerals only, it expects the asset to have zero residual value. During

the first year, Cannon removed 20,000 tons of the minerals.

Requirement

R1. Make journal entries to record (a) purchase of the minerals (debit Mineral Asset), (b) payment of fees and other costs, and (c) depletion for the first year.

17. Maynard Printers (MP) manufactures printers. Assume that MP recently paid $400,000 for a patent on a new laser printer. Although it gives legal protection for 20 years, the patent is expected to provide a competitive advantage for only 10 years.

Requirements

R1. Assuming the straight-line method of amortization, make journal entries to record (a) the purchase of the patent and (b) amortization for year 1.

R2. After using the patent for five years, MP learns at an industry trade show that another company is designing a more efficient printer. On the basis of this new information, MP decides, starting with year 6, to amortize the remaining cost of the patent over two remaining years, giving the patent a total useful life of seven years. Record amortization for year 6.

Assignment 2 Handout

Decision Case

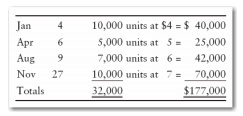

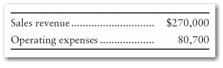

Suppose you are considering investing in two businesses, Shelly's Seashell Enterprises and Jeremy Feigenbaum Systems. The two companies are virtually identical, and both began operations at the beginning of the current year. During the year, each company purchased inventory as follows:

During the first year, both companies sold 25,000 units of inventory. In early January, both companies purchased equipment costing $143,000, with a 10-year estimated useful life and a $20,000 residual value. Shelly uses the inventory and depreciation methods that maximize reported income (FIFO and straight-line). By contrast, Feigenbaum uses the inventory and depreciation methods that minimize income taxes (LIFO and doubledeclining-balance). Both companies' trial balances at December 31 included the following:

Requirements

R1. Prepare both companies' income statements.

R2. Write an investment letter to address the following questions for your clients: Which company appears to be more profitable? Which company has more cash to invest in new projects? Which company would you prefer to invest in? Why?

Financial Statement Case

Refer to the Amazon.com financial statements, including Notes 1 and 3, in the 2009 Amazon.com Financial Statements handout. Answer the following questions.

Requirements

R1. Which depreciation method does Amazon.com use for reporting in the financial statements?

What type of depreciation method does the company probably use for income tax purposes? Why is this method preferable for tax purposes?

R2. Depreciation expense is embedded in the operating expense amounts listed on the income statement. Note 3 gives the amount of depreciation expense. What was the amount of depreciation for 2009? Record Amazon's depreciation expense for 2009.

R3. The statement of cash flows reports the purchases of fixed assets. How much were Amazon's fixed asset purchases during 2009? Journalize the company's purchases of assets for cash, as reflected in the cash flow report.