Reference no: EM131109350

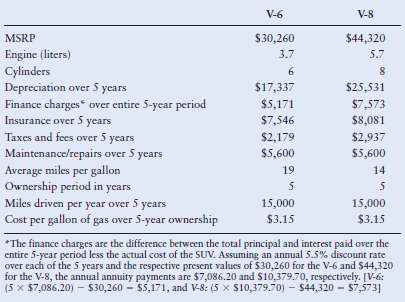

Jimmy Johnson is interested in buying a new Jeep SUV. There are two options available, a V-6 model and a V-8 model. Whichever model he chooses, he plans to drive it for a period of 5 years and then sell it. Assume that the trade-in value of the two vehicles at the end of the 5-year ownership period will be identical. There are definite differences between the two models, and Jimmy needs to make a financial comparison. The manufacturer's suggested retail price (MSRP) of the V-6 and V-8 are $30,260 and $44,320, respectively. Jimmy believes the difference of $14,060 to be the marginal cost difference between the two vehicles.

However, there is much more data available, and you suggest to Jimmy that his analysis may be too simple and will lead him to a poor financial decision. Assume that the prevailing discount rate for both vehicles is 5.5% annually. Other pertinent information on this purchase is shown in the following table:

�

a. Calculate the total "true" cost for each vehicle over the 5-year ownership period.

b. Calculate the total fuel cost for each vehicle over the 5-year ownership period.

c. What is the marginal fuel cost from purchasing the larger V-8 SUV?

d. What is the marginal cost of purchasing the larger and more expensive V-8 SUV?

e. What is the total marginal cost associated with purchasing the V-8 SUV? How does this figure compare with the $14,060 that Jimmycalculated?

|

Topic of intercultural communication and leadership

: Go to the library or use Google Books to look up a book on the topic of intercultural communication and leadership (e.g., Collard & Normore, 2009; Jones, 2000; Moodian, 2008). What does it suggest about the multicultural communication of effect..

|

|

Is intelligent design theory scientific

: You are being protected in a secluded hotel from ACLU lawyers and right-wing demonstration groups. Here is your question: is intelligent design theory scientific

|

|

What are bad debts in dollars currently

: What are bad debts in dollars currently and under the proposed change? Calculate the cost of the marginal bad debts to the firm.

|

|

Calculate the cost of the marginal investment

: Calculate the cost of the marginal investment in accounts receivable. Should the firm implement the proposed change? What other information would be helpful in your analysis?

|

|

Calculate the total true cost for each vehicle

: Calculate the total "true" cost for each vehicle over the 5-year ownership period. Calculate the total fuel cost for each vehicle over the 5-year ownership period. What is the marginal fuel cost from purchasing the larger V-8 SUV?

|

|

How many students are expected to attend graduation

: A random sample of starting salaries for an engineer are: $40,000, $40,000, $48,000, $55,000 and $67,000. Find the following and show all work. Include equations, a table or EXCEL work, to show how you found your solution.

|

|

Describing the decrease in the number of customer

: Jordan, the sales manager of a local car rental service, wants to write a report describing the decrease in the number of customer complaints. He is trying to decide between using a bar chart or a line graph to supplement his discussion in the rep..

|

|

Electronic mail from a team member

: Lisa Robinson is a sales manager at a bank. She recently received an electronic mail from a team member, John Hill, requesting leave during Christmas. Though the mail was formulated well, she felt like Hill was shouting at her. Which of the follow..

|

|

Death compassion and feelings

: Reflect on Death's compassion and his feelings in the paragraph which begins, "As is often he case with humans, when i read about them in..."

|