Reference no: EM13200420

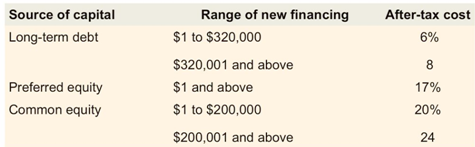

WACC, MCC, and IOS Cartwell Products has compiled the data shown in the following table for the current costs of its three sources of capital-long-term debt, preferred equity, and common equity-for various ranges of new financing.

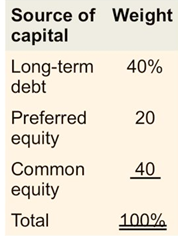

The company's optimal capital structure, which is used to calculate the weighted average cost of capital, is shown in the following table.

a. Determine the break points and ranges of new financing associated with each source of capital. At what financing levels will Cartwell's weighted average cost of capital change?

b. Calculate the weighted average cost of capital for each range of total new financing found in a. (Hint: There are three ranges.)

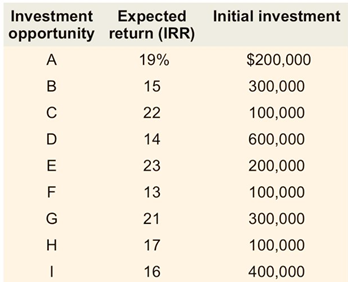

c. Using the results of b along with the following information on the available investment opportunities, draw the firm's marginal cost of capital (MCC) schedule and investment opportunities schedule (IOS).

d. Which, if any, of the available investments do you recommend that the firmselect? Explain your answer.

e. Now calculate the overall cost of capital for Cartwell Products. Which projects should the firm select? Does your answer differ from your answer topart d? If so, explain why.

|

Write and solve an equation to represent the cost of x fish

: Ronald is setting up an aquarium in his new office. At one pet store fish cost $2 and an aquarium costs $40. At another pet store, fish cost $3 and an aquarium costs $36. Write and solve an equation to represent the cost of x fish and an aquarium ..

|

|

Find probability of outcome must be inclusive

: Sum of all possible outcomes must equal 1 Outcomes must be mutually exclusive Probability of each outcome must be between 0 and 1 inclusive

|

|

Construct a frequency distribution

: Construct a frequency distribution.

|

|

Find the rate at which the distance from home plate

: For the baseball diamond shown in the figure below, suppose the player is running from first to second at a speed of 29 feet per second. Find the rate at which the distance from home plate is changing when the player is 27 feet from second base. (..

|

|

Calculate the overall cost of capital for cartwell products

: Calculate the overall cost of capital for Cartwell Products. Which projects should the firm select? Does your answer differ from your answer topart d? If so, explain why.

|

|

How many students failed the test

: In a large class, 80 students took a test. When the test papers were rated, it was found that 10% of the students had papers, 23% had B papers, 30% had C papers, 15% had D papers, and the rest failed. How many students failed the test?

|

|

State the singers are equally likely to pick any song

: You attend a Karaoke night and hope to hear you favorite song. There are 300 different songs in the karaoke (and your favorite is among the 300). Assuming the singers are equally likely to pick any song and no song is repeated

|

|

How many revolutions per minute would the cd make

: A compact disc can have an angular speed up to 3142 radians per minute. At this angular speed, how many revolutions per minute would the CD make? How long would it take the CD to make 10,000 revolutions?

|

|

How much was invested at each rate

: You invested $19000 in two accounts paying 7% and 8% annual ineterest respectively. If the total interest earned for the year was $1350, how much was invested at each rate?

|