Reference no: EM13180517

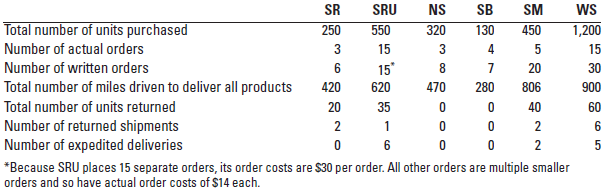

Customer profitability and ethics. Snark Corporation manufactures a product called the snark, which it sells to merchandising firms such as Snark Republic (SR), Snarks-R-Us (SRU), Neiman Snark-us (NS), Snark Buy (SB), Snark-Mart (SM), and Wal-Snark (WS). The list price of a snark is $50, and the full manufacturing costs are $35. Salespeople receive a commission on sales, but the commission is based on number of orders taken, not on sales revenue generated or number of units sold. Salespeople receive a commission of $25 per order (in addition to regular salary). Snark Corporation makes products based on anticipated demand. Snark Corporation carries an inventory of snarks so rush orders do not result in any extra manufacturing costs over and above the $35 per snark. Snark Corporation ships finished product to the customer at no additional charge to the customer for either regular or expedited delivery. Snark incurs significantly higher costs for expedited deliveries than for regular deliveries. Customers occasionally return shipments to Snark, and these returns are subtracted from gross revenue. The customers are not charged a restocking fee for returns Budgeted (expected) customer-level cost driver rates are as follows:

Order taking (excluding sales commission)..................$30 per order

Product handling..................................................$2 per unit

Delivery.............................................................$0.50 per mile driven

Expedited (rush) delivery........................................$325 per shipment

Restocking.........................................................$100 per returned shipment

Visits to customers................................................$150 per customer

Because salespeople are paid $25 per order, they often break up large orders into multiple smaller orders. This practice reduces the actual order taking cost by $16 per smaller order (from $30 per order to $14 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department. All other actual costs are the same as budgeted costs.

Information about Snark's clients follows:

�

Required

1. Classify each of the customer-level operating costs as a customer output-unit-level, customer batch- level, or customer-sustaining cost.

2. Using the preceding information, calculate the expected customer-level operating income for the six customers of Snark Corporation. Use the number of written orders at $30 each to calculate expected order costs.

3. Recalculate the customer-level operating income using the number of written orders but at their actual $14 cost per order instead of $30 (except for SRU, whose actual cost is $30 per order). How will Snark Corporation evaluate customer-level operating cost performance this period?

4. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don't forget to also adjust sales commissions.

5. How is the behavior of the salespeople affecting the profit of Snark Corporation? Is their behavior ethical? What could Snark Corporation do to change the behavior of the sales people?

|

Standard error of the slope in the original regression

: Prove that if Wi* = \(\lambda1+\lambda2Wi\) then the new intercept b1* = \(\lambda1+\lambda2b1\) where b1 is the intercept of the original regression of W on H. Explain how the standard error of the slope coefficient in (h) is..

|

|

Identification method for inventory valuation

: Compute depreciation for 20X3 - 20X7 by using the following methods: straight line, units of output, and double-declining-balance.

|

|

Explain why barium must be disposed of properly

: Describe why barium must be disposed of properly. What are the health effects of excess barium in drinking water? What is the maximum allowable concentration of barium in public water systems?

|

|

State how many moles of acetic acid

: A buffer solutions contains .120 M acetic acid and 0.150 M sodium acetate. How many moles of acetic acid and of sodium acetate are present in 50.0 ml of solution ? = 0.0075 moles.

|

|

Calculate the customer-level operating income

: Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don't forget to also adjust sales commissions.

|

|

Define the effect of decrease in capital

: Consider a country where the velocity of money is constant. Real GDP grows by 3% per year, the money stock grows by 4% per year, and the nominal interest rate is 3%.Using the approximate Fisher Equation what is the real interest rate in the economy..

|

|

Compute the number of moles of sodium carbonate

: Calculate the number of moles and the mass of sodium carbonate present in the mixture. (Formula weight of sodium carbonate is 106g/mol)

|

|

Heat may not appear on the reagent table with the reagent

: List the letter that corresponds to the reagent from the reagent table you need to carry out the following synthesis in 5 steps or less. Heat may not appear on the reagent table with the reagent

|

|

Find the length and width

: The length of a rectangular computer part is twice th width The area is 242 yd. Find the length and width.

|