Reference no: EM131123007

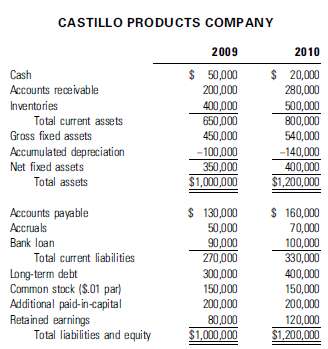

Cindy and Robert (Rob) Castillo founded the Castillo Products Company in 2008. The company manufactures components for personal decision assistant products and for other handheld electronic products. Year 2009 proved to be a test of the Castillo Products Company's ability to survive. However, sales increased rapidly in 2010, and the firm reported a net income after taxes of $75,000. Depreciation expenses were $40,000 in 2010. Following are the Castillo Products Company's balance sheets for 2009 and 2010.

A. Calculate Castillo's cash flow from operating activities for 2010.

B. Calculate Castillo's cash flow from investing activities for 2010.

C. Calculate Castillo's cash flow from financing activities for 2010.

D. Prepare a formal statement of cash flows for 2010 and identify the major cash inflows and outflows that were generated by the Castillo Products Company.

E. Use your calculation results from Parts A and B to determine whether Castillo was building or burning cash during 2010 and indicate the dollar amount of the cash build or burn.

F. If Castillo had a net cash burn from operating and investing activities in 2010, divide the amount of burn by 12 to calculate an average monthly burn amount.

If the 2011 monthly cash burn continues at the 2010 rate, indicate how long in months it will be before the firm runs out of cash if there are no changes in financingactivities.

|

A network topology design for abc

: For this project, you will design the layout of users, domains, trusted domains, anonymous users etc. for a start-up open-source software company, ABC. The company should have an internal CVS server (only internal developers can access it), an anonym..

|

|

A bias for industry from current drm

: Evaluate the issue of whether or not the current DRM solutions are biased toward industry over the consumer. Support your evaluation with literature from both academic and industry sources.

|

|

Micropayment systems

: Micropayments are a payment scheme that emphasise the ability to make payments in small amounts. Several micropayment schemes have been suggested in this Week’s materials, including Millicent, PayWord and MicroMint, among others. For additional infor..

|

|

Calculate each income statement item

: Calculate each income statement item for 2009 as a percent of the 2009 sales level. Make the same calculations for 2010. Determine which cost or expense items varied directly with sales for the two-year period.

|

|

Calculate castillo cash flow from financing activities

: Calculate Castillo's cash flow from operating activities for 2010. Calculate Castillo's cash flow from investing activities for 2010. Calculate Castillo's cash flow from financing activities for 2010.

|

|

Estimate the survival or ebdat breakeven amount

: Estimate the survival or EBDAT breakeven amount in terms of survival revenues necessary for the SubRay Corporation to break even next year. Assume that the product selling price is $50 per unit. Calculate the EBDAT breakeven point in terms of the num..

|

|

Calculate the dollar amount of sales revenue expected

: (a) Calculate the dollar amount of sales revenue expected in each month (i.e., April, May, and June) and for the second quarter of the year. (b) Prepare a cost of production schedule for April, May, and June.

|

|

Calculate the dollar amount of sales revenue expected

: Calculate the dollar amount of sales revenue expected in each month (i.e., January, February, and March) and for the first quarter of the year. Prepare a cost of production schedule for January, February, and March. Prepare an inventories schedule fo..

|

|

Describe three financial performance measures that d light

: Describe three financial performance measures that D.light’s venture investors might use to examine whether D.light is measuring up financially as it achieves its “lives touched” goals.

|