Reference no: EM13844137

A. build a graph showing how inflation-adjusted investment of $1 in residential real estate changed in 1972-2014 and include it in your deliverable. Note that Fisher equation relates nominal return to real (inflation-adjusted) return:

In other words, estimate real return every year, compound it, and build a graph. Note that CPI in data file stands for Consumer Price Index and, therefore, the change in this index is the annual rate of inflation.

B. Comment on relationship between real estate prices and inflation. Does residential real estate offer protection against inflation? Quantify your answer. You may take a closer look at numbers in period of high inflation in the United States. Also, report pairwise correlations for various asset classes in 1975-2014.

C. Does investment in real estate investment trusts proxy for investment in residential real estate? In other words, can they be viewed as a substitute to investment in residential housing? You need to report pairwise correlations and cumulative returns over the 1975-2014 periodto support your answer.

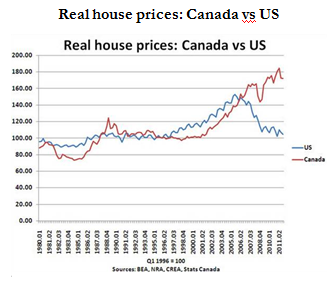

D. The United States and Canada's housing data in Figure 1 is widely cited to rationalize expectations of a price correction in the Canadian housing market. Two arguments can be put forward to support expectation of price correction in Canada. Try to reproduce these arguments

|

Explain the us health care reimbursement and billing system

: Describe international standard diagnosis classification use in the US health care reimbursement and billing system.

|

|

Describe and analyze an information system

: Describe and analyze an information system within a business or organization. It should include with recommendations or suggestions for possible improvements.

|

|

What is zombie corps debt-equity ratio

: Zombie Corp. has a profit margin of 5.7 percent, total asset turnover of 1.5, and ROE of 20.24 percent. What is this firm's debt-equity ratio?

|

|

Sam is interested in buying two types of goods

: Microsoft Word - Problem Set 2 Questions 1.Sam is interested in buying two types of goods, x and y. He can either use all his income to buy 3 units of x and 9 units of y, or 9 units of x and 3 units of y. If he spends all his income on x, how many u..

|

|

Build a graph showing how inflation-adjusted investment

: build a graph showing how inflation-adjusted investment of $1 in residential real estate changed in 1972-2014 and include it in your deliverable. Note that Fisher equation relates nominal return to real

|

|

What is current weighted average cost of capital of america

: What is the current weighted average cost of capital (WACC) of American Exploration?

|

|

Consider the given probabilities

: 1. Consider the given probabilities: P(A) = 0.25, P(B|A) = 0.34, P(C|A∩B) = 0.62. Fill in the blanks. P(A∩B) = (Give your answer to three decimal places.) P(B'|A) = (Give your answer to two decimal places.)

|

|

Does the company have a social responsibility message

: Why did you choose this company? Does the company have a social responsibility message, if so what is it? How has the company demonstrated or promoted this message? Is this a broad philanthropic approach or have they aligned with specific partners

|

|

Determine if profits earned by ford motors company

: DETERMINE IF Profits earned by Ford Motors Company in 2007, on automobile production in Ireland, was included in 2007 by GDP IN USA in 2007

|