Reference no: EM13747544 , Length: word count:2300

James Brooks, the newly appointed financial analyst of the Steel Tube division of Manchester Cones & Tubes Plc, shut his office door and walked over to his desk. He had just 24 hours to re-examine the accountant's profit projections and come up with a recommendation on the proposed new computer numerically controlled (CNC) milling machine.

At the meeting he had just left, the managing director made it quite clear: 'If the project can't pay for itself in the first three years, it's not worth bothering with.' James was unhappy with the accountant's analysis, which showed that the project was a loss maker. But as the MD said, 'Unless you can convince me by this time tomorrow that spending £240,000 on this capital project makes economic sense, you can forget the whole idea.'

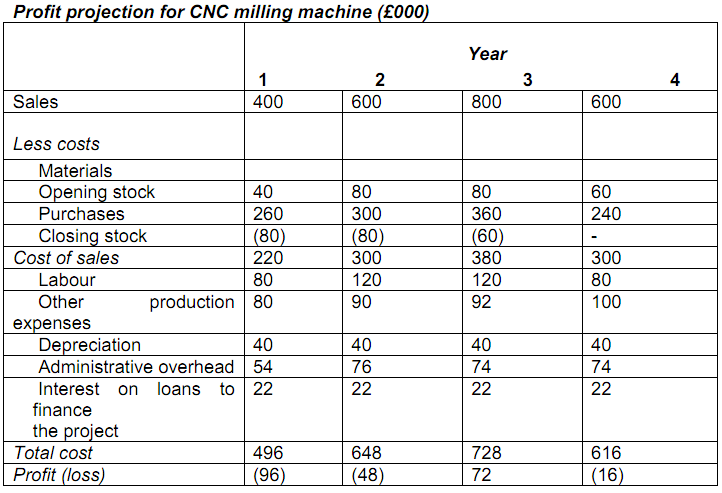

His first task was to re-examine the accountant's profitability forecast (given below) in the light of the following facts that emerged from the meeting:

1. Given the rapid developments in the market, it was unrealistic to assume that the product had more than a four-year life. The machinery would have no other use and could not raise more than £20,000 in scrap metal at the end of the project.

2. The opening stock in Year 1 would be acquired at the same time as the machine. All other stock movement would occur at the year-ends.

3. This type of machine was depreciated over six years on a straight-line basis.

4. Within the 'other production expenses' were apportioned fixed overheads equal to 20 percent of labour costs. As far as could be seen, none of these overheads were incurred as a result of the proposal.

5. The administration charge was an apportionment of central fixed overheads Profit projection for CNC milling machine (£000)

Later that day, James met the production manager, who explained that if the new machine was installed, it would have sufficient capacity to enable an existing machine to be sold immediately for £20,000 and to create annual cash benefits of £18,000. However, the accountant had told him that, with the machine currently standing in the books at £50,000, the company simply could not afford to write off the asset against this year's slender profits. ‘We would do better to keep it operating for another four years, when its scrap value will produce about £8,000,' he said.

James then raised the proposal with the marketing director. It was not long before two new pieces of information emerged:

(a) To stand a realistic chance of hitting the sales forecast for the proposal, marketing would require £40,000 for additional advertising and sales promotion at the start of the project and a further £8,000 a year for the remainder of the project's life. The sales forecast and advertising effort had been devised in consultation with marketing consultants whose bill for £18,000 had just arrived that morning.

(b) The marketing director was very concerned about the impact on other products within the product range. If the investment went ahead, it would lead to a reduction in sales value of a competing product of around £60,000 a year. With net profit margins of around 10 per cent and gross margins (after direct costs) of 25 per cent on these sales, this is probably the "kiss of death" for the CNC proposal,' James reflected.

The Steel Tube division was a profitable business operating within an attractive market. The investment, which employed new technology, had recently been identified as part of the group's core activities. The chief engineer felt that once they had got to grips with the new technology it should deliver improved product quality, and greater flexibility, enabling shorter production runs and other benefits.

The latest accounts for the division showed a 16 per cent return on assets, but the MD talked about a three-year payback requirement. His phone call to the finance director at head office, to whom this proposal would eventually be sent, was distinctly unhelpful: 'We have, in the past, found that whenever we lay down a hurdle rate for divisional capital projects, it merely encourages unduly optimistic estimates from divisional executives eager to promote their pet proposals. So now we give no guidelines on this matter.'

James decided to use 10 per cent as the required rate of return for the project (WACC). He went home that evening with a very full briefcase and a number of unresolved questions:

Q1. How much of the information which he had gathered was really relevant to the decision?

Q2. What was the best approach to assessing the economic worth of the proposal? The company used payback, but he felt that discounted cash flow techniques (IRR and NPV) had some merit.

Q3. How should the strategic factors be assessed?

Other information concerning the new project is as follows:

Manchester Cones & Tubes Plc pays Corporation Tax at 30 per cent and annual writing- down allowances (capital allowance) of 25 per cent on the reducing balance may be claimed. The existing machine has a nil value for tax purposes and tax is payable in the same year as the cash flows to which it relates. The impact of changes in working capital is to be ignored.

Required

Prepare the case, with recommendations, to be presented by James at tomorrow's meeting.

Your report should not be more than 2000 words.