Reference no: EM13381279

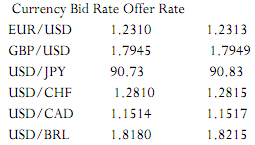

1. A Japanese exporter to Brazil would like to sell its BRL300m receivables in the spot market against Yen. The exporter's CFO calls the trading desk at Banco Itau to ask for a quote. The trader on the other line sees the following spot rates on its screen.

a) What rate should the trader quote to the CFO?

a. 49.55 b. 49.60 c. 49.81 d. 49.96 e. None of the above

b) How much JPY will the CFO receive in exchange for BRL300m?

2. Suppose nominal three year risk free interest rates in the US and Mexico are expected to be 3.5% and 10% per annum respectively. Real interest rates in the Eurozone are 1.5% and the current EUR/USD spot rate is EUR/USD 1.3340. If the current USD/MXP spot rate is USD/MXP12.00, and the International Fisher Effect holds, then relative purchasing power parity suggests that the exchange rate in three years will be approximately _________. (10pts) [Round your results to the second decimal]

a. 10.88

b. 13.69

c. 14.41

d. None of the above

3. P&G is a US based MNC and has operations in Turkey. P&G expects 120,000,000 TRL cash flows in 6 months, however due to significant volatility; cash flows are expected to fluctuate as much as 20%. In other words P&G can get TRL120m, TRL96m or TRL144m depending on the economic conditions. Based on their expectations, P&G treasurers choose to sell TRL96m forward at TRL1.90and buy TRL48m put option at TRL1.90 both with six month maturities. The cost of the put option is $0.02. Assume that the spot exchange rate turns out to be TRL2.10/$ at the expiration and cash flows materialize as TRL144,000,000. What will the net USD cash-flows of P&G and what will be the cost of acquiring one US dollar? Assume that P&G's cost of capital is 10%. [To calculate the net USD cash flow round your results to integer; to calculate the cost of acquiring one USD round your results to fourth decimal] (20pts)

a. 50,526,316 and TRL1.9000/$

b. 25,263,158 and TRL1.9200/$

c. 74,829,474 and TRL1.924/$

d. 74,781,474 and TRL1.9256

e. None of the above

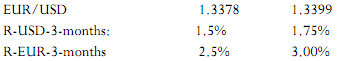

4. Use the following spot and interest rates to answer the following question:

If the dealer has 0.1% profit policy, what rate he/she would quote to a client who wants to buy USD 3 months forward? (10pts)

a. 1.3183

b. 1.3170

c. 1.3328

d. 1.3315

e. None of the above

5. A US importer is concerned about the appreciation of EUR against USD due to EUR payables of EUR100,000,000 in three months. To hedge the position, importer decides to use futures markets. Currently CME (Chicago Mercantile Exchange) EUR contracts (125,000 each) with closest maturity are traded at USD1.3500 per EUR. Futures contract will expire one week after the due date of payables.

Suppose the importer takes a futures position equal to 50% of its cash position at USD1.3500. Also Company treasurer buys an OTC (over the counter) call option on EUR for EUR40,000,000 notional with a strike price of EUR/USD 1.3500 at 2% premium and leaves EUR10,000,000

portion of the exposure uncovered. At the time the option is purchased, the spot rate was USD1.3778. On the day the Futures contract is liquidated, Futures price is 1.3100 per EUR and the EUR/USD spot rate is 1.3150.

Calculate the effective amount of USD the company will pay for its 100m EUR payable? Assume that importer's cost of capital is 10%.

6. Vale, a Brazilian multinational corporation borrows EUR100,000,000 from a European bank at a 6%. At the time of the loan issue EUR/BRL rate was BRL2.24 per EUR. When the loan was repaid, the exchange rate was EUR/BRL2.19. What was the effective BRL cost of euro loan for Vale?

7. A U.S. firm with no subsidiaries presently has sales to Brazil amounting to BRL200 million, while its Brazilian Real -denominated expenses amount to BRL100 million. If it shifts its material orders from its Brazilian suppliers to U.S. suppliers, it could reduce BRL-denominated expenses by BRL20 million and increase dollar-denominated expenses by $15 million. This strategy would _______ the firm's exposure to changes in the Real's movements against the U.S. dollar.

Regardless of whether the firm shifts expenses, it is likely to perform better when the Real is valued _______ relative to the dollar.